- Sweden

- /

- Capital Markets

- /

- OM:NAIG B

Here's Why We're Wary Of Buying Nordic Asia Investment Group 1987's (STO:NAIG B) For Its Upcoming Dividend

Readers hoping to buy Nordic Asia Investment Group 1987 AB (publ) (STO:NAIG B) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Thus, you can purchase Nordic Asia Investment Group 1987's shares before the 31st of May in order to receive the dividend, which the company will pay on the 7th of June.

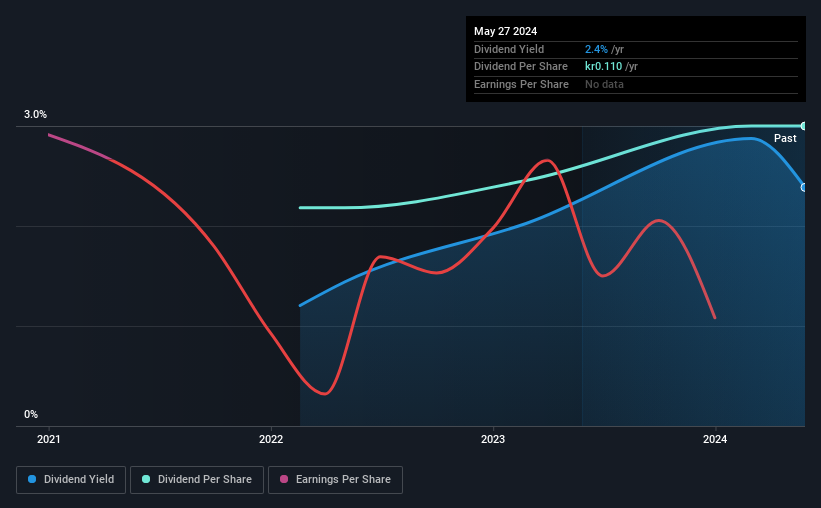

The company's upcoming dividend is kr00.11 a share, following on from the last 12 months, when the company distributed a total of kr0.11 per share to shareholders. Last year's total dividend payments show that Nordic Asia Investment Group 1987 has a trailing yield of 2.4% on the current share price of kr04.61. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Nordic Asia Investment Group 1987

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Nordic Asia Investment Group 1987 reported a loss last year, so it's not great to see that it has continued paying a dividend.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Nordic Asia Investment Group 1987 was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last three years, making us wonder if the dividend is sustainable at all.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Nordic Asia Investment Group 1987 has delivered 17% dividend growth per year on average over the past two years.

Get our latest analysis on Nordic Asia Investment Group 1987's balance sheet health here.

The Bottom Line

Is Nordic Asia Investment Group 1987 an attractive dividend stock, or better left on the shelf? It's hard to get past the idea of Nordic Asia Investment Group 1987 paying a dividend despite reporting a loss over the past year - especially when the general trend in its earnings also looks to be negative. Nordic Asia Investment Group 1987 doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

With that being said, if you're still considering Nordic Asia Investment Group 1987 as an investment, you'll find it beneficial to know what risks this stock is facing. To help with this, we've discovered 4 warning signs for Nordic Asia Investment Group 1987 (3 shouldn't be ignored!) that you ought to be aware of before buying the shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Asia Investment Group 1987 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NAIG B

Nordic Asia Investment Group 1987

A principal investment firm specializes in long term strategic equity investment and growth investments in Chinese companies that are exposed to the Chinese internal consumer market.

Excellent balance sheet moderate.