- Switzerland

- /

- Machinery

- /

- SWX:MIKN

European Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As European markets show signs of recovery, buoyed by the European Central Bank's interest rate cuts and a delay in tariff increases, investors are increasingly looking towards dividend stocks as a source of steady income amid economic uncertainty. In this environment, selecting dividend stocks with strong fundamentals and resilient cash flows can be an effective strategy for those seeking to navigate market volatility while pursuing long-term growth.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.03% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.47% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.72% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.95% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.99% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.25% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.19% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.41% | ★★★★★★ |

Click here to see the full list of 245 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

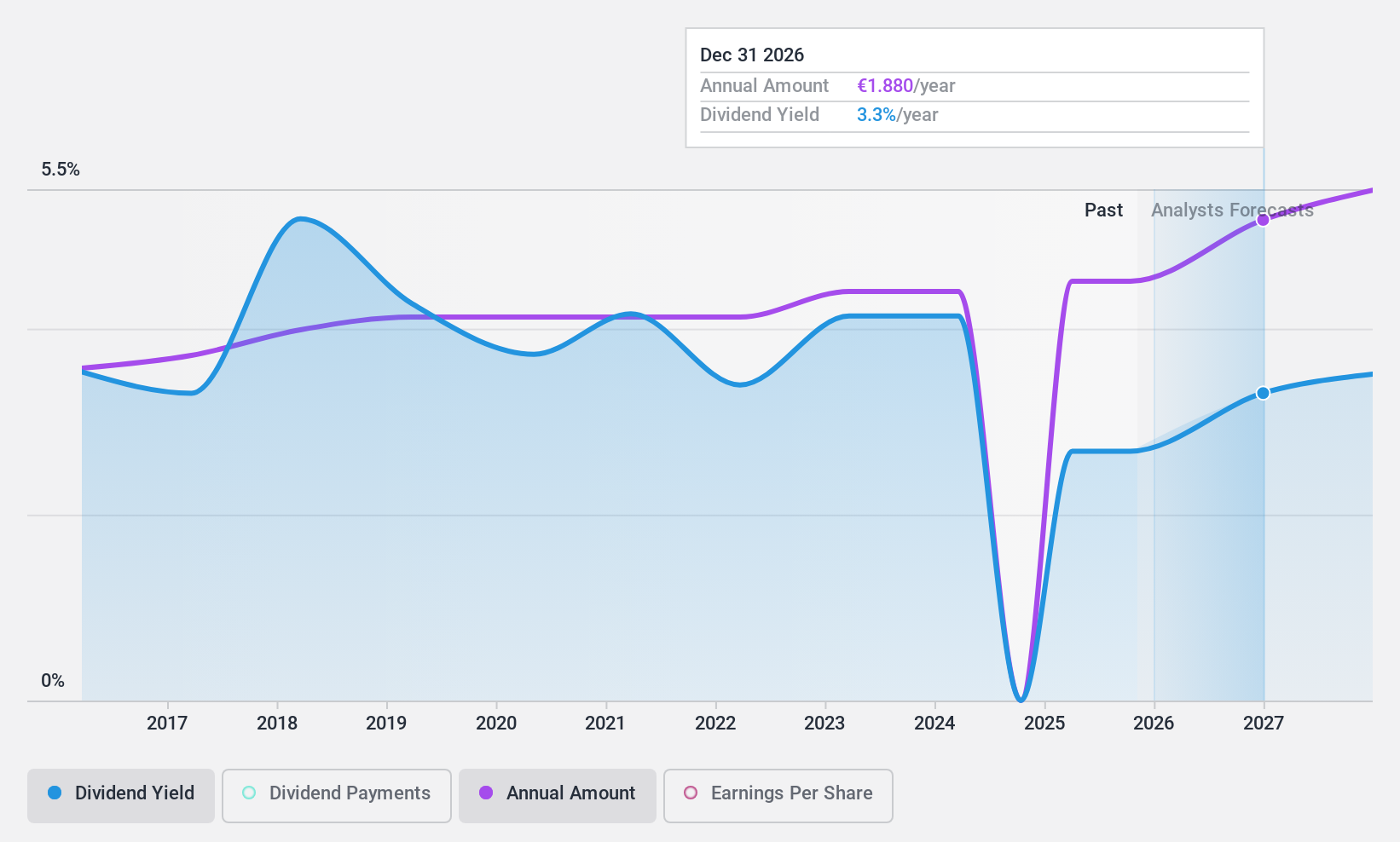

Orion Oyj (HLSE:ORNBV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orion Oyj is a company that develops, manufactures, and markets human and veterinary pharmaceuticals as well as active pharmaceutical ingredients (APIs) across Finland, Scandinavia, Europe, North America, and internationally with a market cap of €7.53 billion.

Operations: Orion Oyj's revenue is derived from its operations in developing, manufacturing, and marketing pharmaceuticals for both humans and animals, as well as active pharmaceutical ingredients (APIs), across various regions including Finland, Scandinavia, Europe, North America, and other international markets.

Dividend Yield: 3.1%

Orion Oyj's dividend payments have been stable and growing over the past decade, but the current cash payout ratio of 129.8% indicates dividends are not well covered by free cash flows. Despite this, earnings grew significantly by 60.2% last year, with Q1 2025 sales reaching €354.6 million and net income at €61.3 million. The company recently announced a dividend increase to €1.64 per share for 2024, paid in two instalments during 2025, reflecting its commitment to returning value to shareholders despite coverage concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Orion Oyj.

- Our valuation report unveils the possibility Orion Oyj's shares may be trading at a discount.

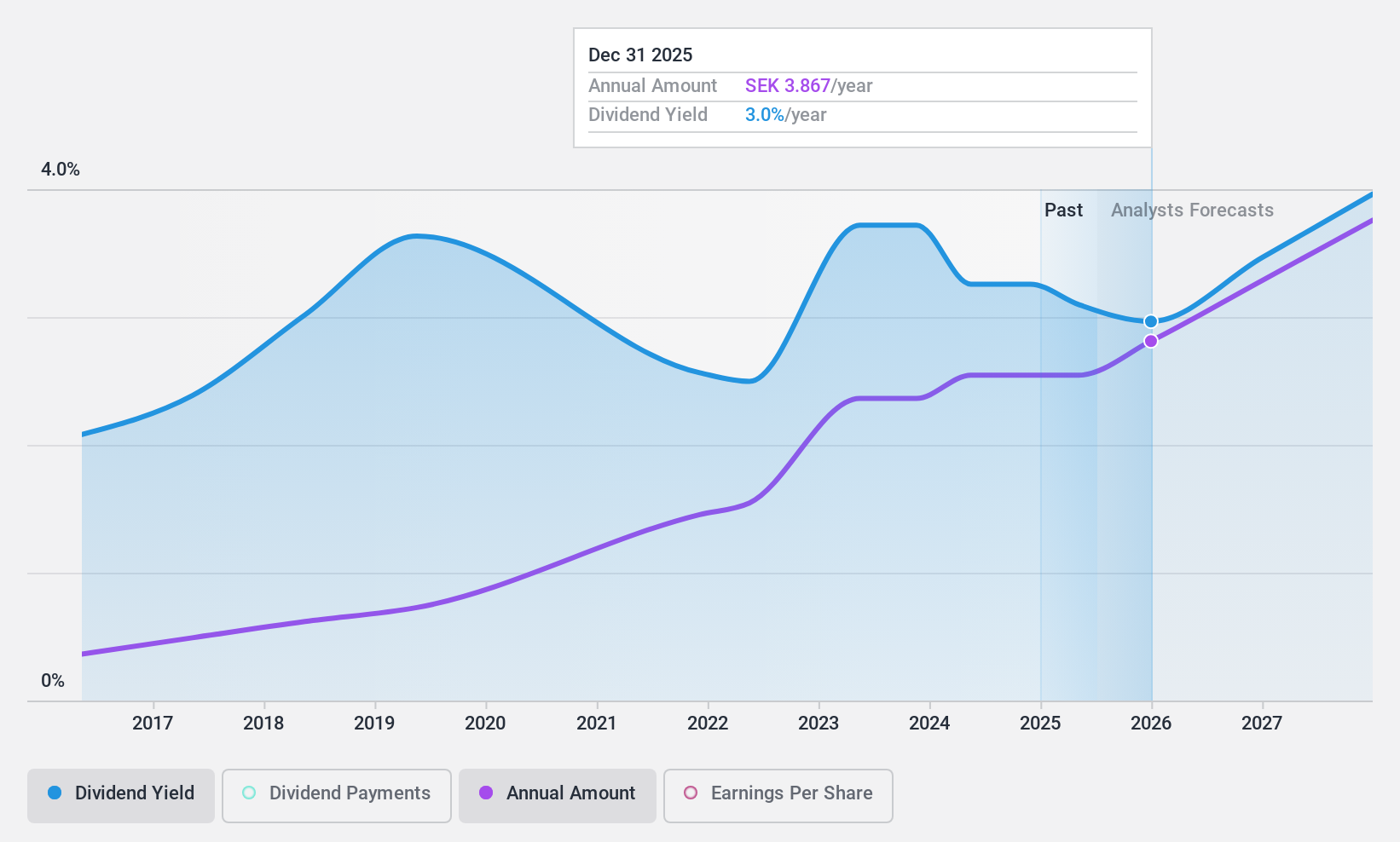

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) operates by designing, acquiring, and developing brands and products across corporate, sports, gifts, and home furnishings sectors in various regions including Sweden, the United States, Central Europe, and internationally with a market cap of SEK14.33 billion.

Operations: New Wave Group AB's revenue segments include corporate, sports, gifts, and home furnishings sectors across Sweden, the United States, Central Europe, and other international markets.

Dividend Yield: 3.2%

New Wave Group's dividend sustainability is supported by a payout ratio of 52.7% and a cash payout ratio of 47.9%, indicating dividends are well covered by earnings and cash flows. However, its dividend history has been volatile over the past decade, with payments not consistently growing. Recent Q1 2025 results showed sales increased to SEK 2.18 billion with net income at SEK 144 million, reflecting solid financial performance amid ongoing dividend challenges.

- Click here to discover the nuances of New Wave Group with our detailed analytical dividend report.

- Our valuation report here indicates New Wave Group may be undervalued.

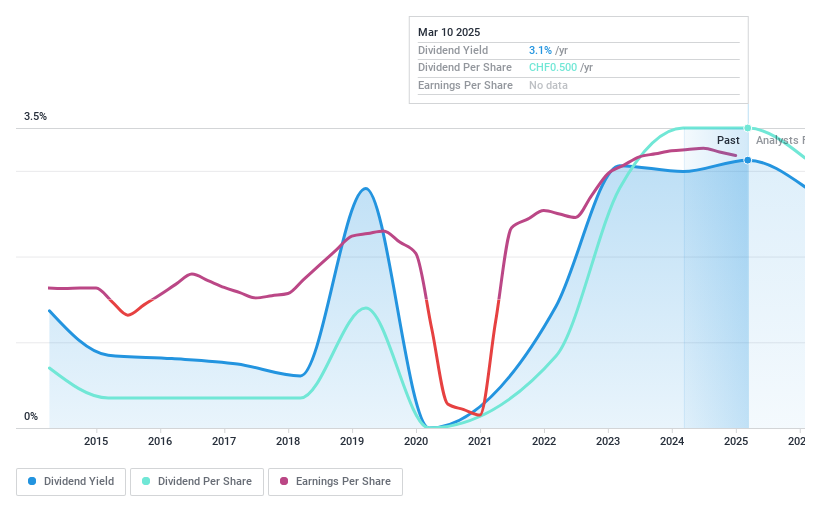

Mikron Holding (SWX:MIKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mikron Holding AG specializes in developing, producing, and marketing automation solutions, machining systems, and cutting tools across Switzerland, Europe, North America, the Asia Pacific, and internationally with a market cap of CHF274.94 million.

Operations: Mikron Holding AG's revenue is primarily derived from its Automation segment, which accounts for CHF233.34 million, and its Machining Solutions segment, contributing CHF140.81 million.

Dividend Yield: 3%

Mikron Holding's dividend of CHF 0.50 per share, approved at the recent AGM, is well covered by earnings and cash flows with a payout ratio of 29.8% and a cash payout ratio of 17.3%. Despite this coverage, its dividend history has been volatile over the past decade without consistent growth. The company's financials show stable sales at CHF 374.06 million for 2024, but net income slightly declined to CHF 27.88 million from the previous year.

- Take a closer look at Mikron Holding's potential here in our dividend report.

- Upon reviewing our latest valuation report, Mikron Holding's share price might be too pessimistic.

Next Steps

- Access the full spectrum of 245 Top European Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MIKN

Mikron Holding

Develops, produces, and markets automation solutions, machining systems, and cutting tools in the Switzerland, Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives