The Swedish stock market has shown resilience amid mixed global economic signals, with small-cap stocks drawing increased interest from investors. As the broader market sentiment fluctuates, discerning investors are on the lookout for fundamentally strong companies that can weather economic uncertainties and offer potential growth. When evaluating stocks in this environment, it is crucial to focus on robust financial health, sustainable business models, and competitive advantages. In this article, we explore three undiscovered gems in Sweden that exemplify these qualities.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.47% | 15.07% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.31% | 29.94% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Rederiaktiebolaget Gotland | NA | -14.29% | 18.06% | ★★★★★★ |

| Karnell Group | 44.29% | 22.04% | 39.45% | ★★★★★☆ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Betsson (OM:BETS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Betsson AB (publ) operates an online gaming business across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK17.49 billion.

Operations: Betsson AB (publ) generates revenue primarily from its Casinos & Resorts segment, amounting to €1.01 billion. The company has a market cap of SEK17.49 billion.

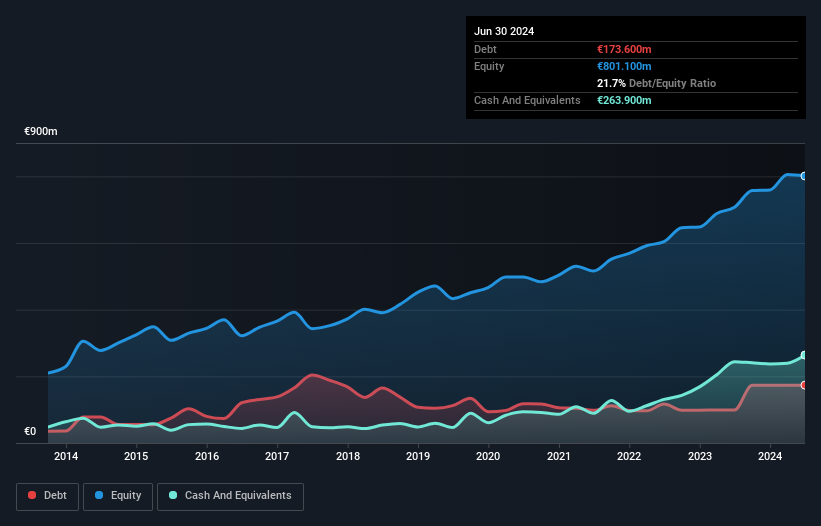

Betsson has shown strong financial health, with its debt to equity ratio decreasing from 25.9% to 21.7% over the past five years and interest payments well covered by EBIT at 16.5x. The company reported EUR 271.5 million in sales for Q2 2024, up from EUR 236.8 million a year ago, though net income dipped slightly to EUR 45.5 million from EUR 50.2 million last year. Betsson's recent expansion into Peru and dividend increases highlight its strategic growth and shareholder focus.

- Click to explore a detailed breakdown of our findings in Betsson's health report.

Review our historical performance report to gain insights into Betsson's's past performance.

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of SEK15.61 billion.

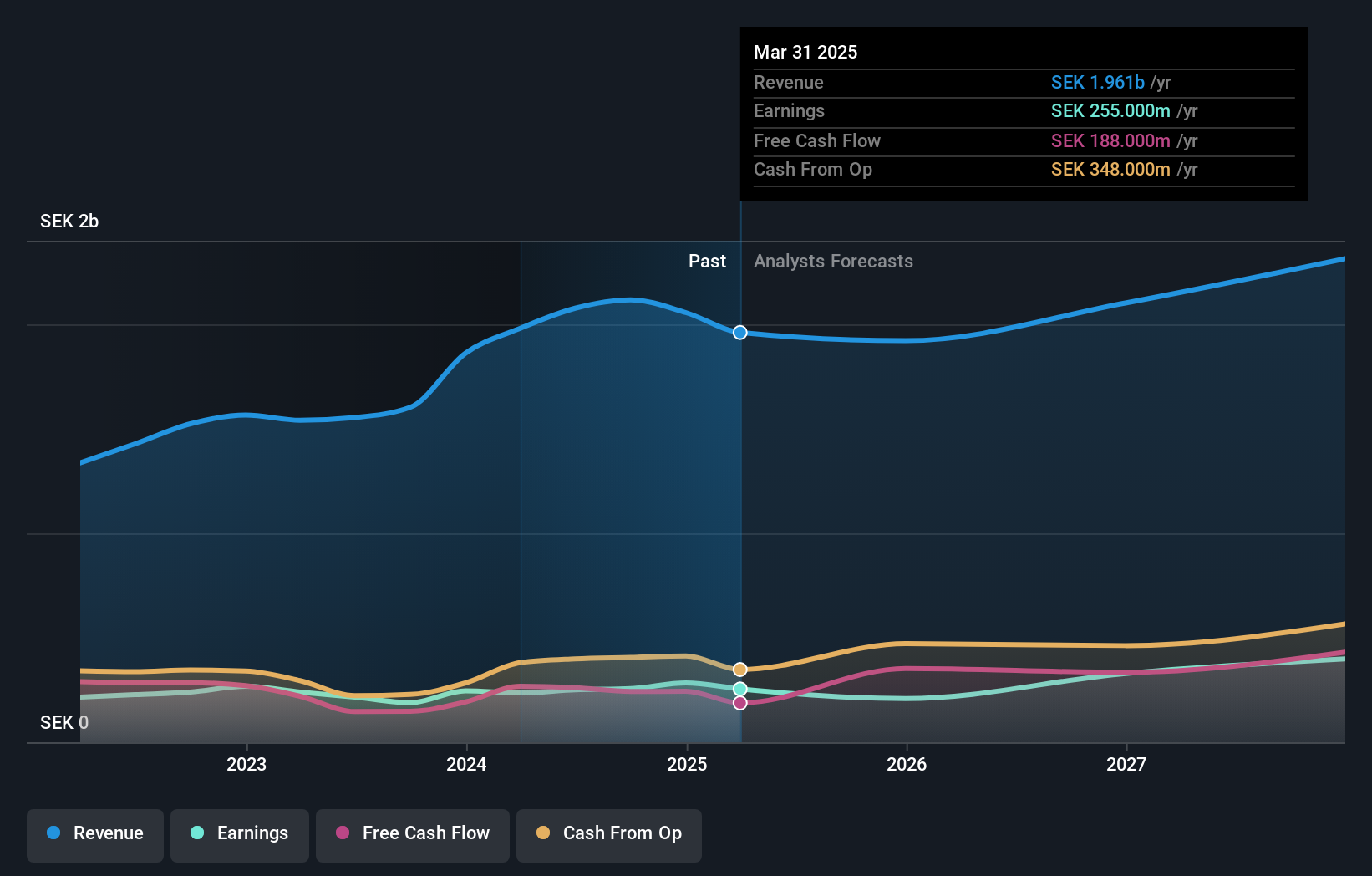

Operations: Biotage AB (publ) generates revenue primarily from its Healthcare Software segment, which contributed SEK 2.08 billion. The company has a market cap of SEK 15.61 billion.

Biotage, a Swedish life sciences firm, has shown robust performance with earnings growing 16.2% over the past year, outpacing the industry's -13%. Trading at 39.3% below its estimated fair value, Biotage's debt to equity ratio has improved significantly from 19.2% to 4% in five years. Recent earnings reports for Q2 show sales of SEK 504 million and net income of SEK 48 million compared to SEK 409 million and SEK 34 million last year respectively.

- Click here and access our complete health analysis report to understand the dynamics of Biotage.

Examine Biotage's past performance report to understand how it has performed in the past.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★★★★

Overview: VBG Group AB (publ) is a company that develops, manufactures, markets, and sells various industrial products across multiple regions including Sweden, Germany, the Nordic countries, Europe, North America, Brazil, Australia/New Zealand, China and internationally with a market cap of SEK10.78 billion.

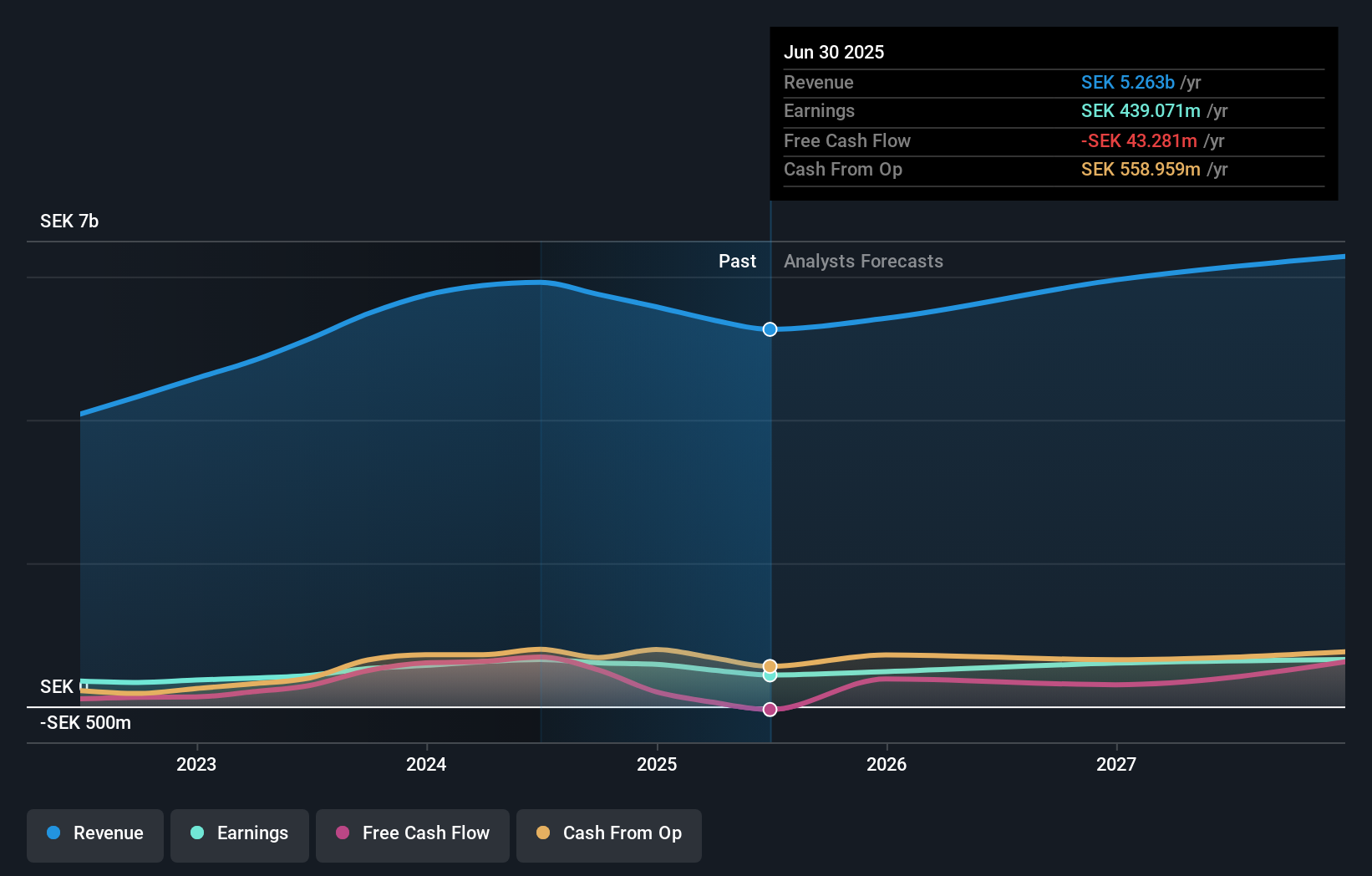

Operations: VBG Group AB (publ) generates revenue primarily from three segments: Mobile Thermal Solutions (SEK 3.33 billion), Truck & Trailer Equipment (SEK 1.62 billion), and RINGFEDER Power Transmission (SEK 962.30 million).

VBG Group has shown robust growth, with earnings rising 50.3% over the past year, significantly outpacing the Machinery industry’s 0.9%. The company’s debt to equity ratio improved from 34.2% to 16.5% in five years, and its EBIT covers interest payments by a substantial margin of 31.2x. Recently, VBG reported Q2 sales of SEK 1,494 million and net income of SEK 168 million while announcing plans for a new CAD108 million production facility in Toronto to streamline operations and support future growth.

- Dive into the specifics of VBG Group here with our thorough health report.

Evaluate VBG Group's historical performance by accessing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 53 companies within our Swedish Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VBG B

VBG Group

Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, North America, Brazil, Australia/New Zealand, China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.