Cautious Investors Not Rewarding Trelleborg AB (publ)'s (STO:TREL B) Performance Completely

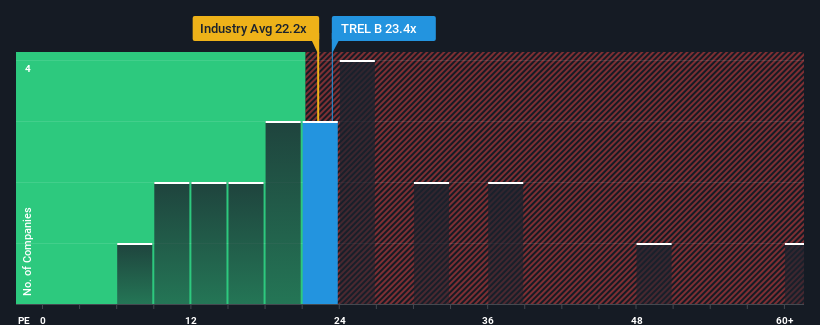

It's not a stretch to say that Trelleborg AB (publ)'s (STO:TREL B) price-to-earnings (or "P/E") ratio of 23.4x right now seems quite "middle-of-the-road" compared to the market in Sweden, where the median P/E ratio is around 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Trelleborg certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Trelleborg

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Trelleborg would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 15% gain to the company's bottom line. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 49% over the next year. With the market only predicted to deliver 23%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Trelleborg's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Trelleborg currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Trelleborg (1 is a bit concerning) you should be aware of.

Of course, you might also be able to find a better stock than Trelleborg. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Trelleborg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TREL B

Trelleborg

Provides engineered polymer solutions for seal, damp, and protect critical applications worldwide.

Flawless balance sheet, undervalued and pays a dividend.