Here's Why We Think Sandvik (STO:SAND) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Sandvik (STO:SAND). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Sandvik

How Quickly Is Sandvik Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Sandvik has grown EPS by 6.9% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

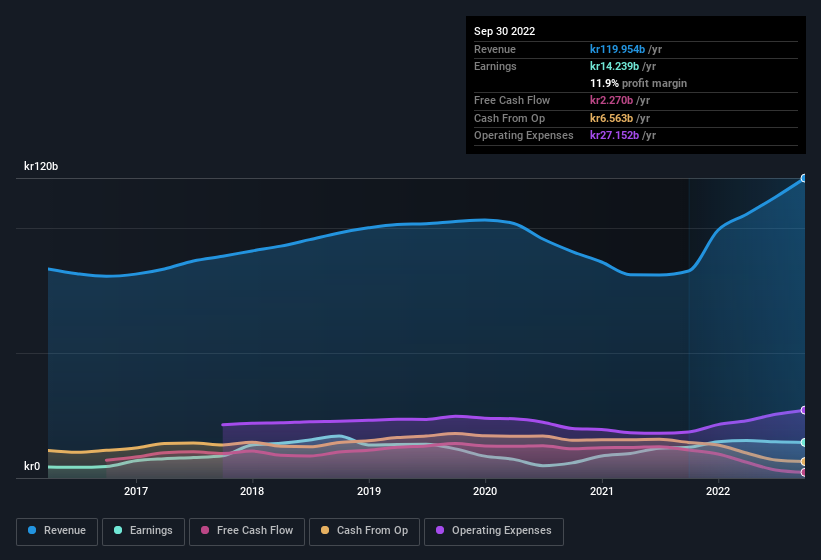

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, Sandvik has done well over the past year, growing revenue by 45% to kr120b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Sandvik's future EPS 100% free.

Are Sandvik Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold kr5.3m worth of shares. But that's far less than the kr208m insiders spent purchasing stock. This adds to the interest in Sandvik because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Director Helena Stjernholm who made the biggest single purchase, worth kr177m, paying kr179 per share.

On top of the insider buying, it's good to see that Sandvik insiders have a valuable investment in the business. Indeed, they hold kr449m worth of its stock. This considerable investment should help drive long-term value in the business. Even though that's only about 0.2% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Sandvik Deserve A Spot On Your Watchlist?

One important encouraging feature of Sandvik is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Still, you should learn about the 3 warning signs we've spotted with Sandvik (including 1 which is a bit unpleasant).

The good news is that Sandvik is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SAND

Sandvik

An engineering company, provides products and solutions for mining and rock excavation, metal cutting, and materials technology worldwide.

Undervalued with adequate balance sheet and pays a dividend.