It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Sandvik (STO:SAND). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Sandvik

Sandvik's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Sandvik's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

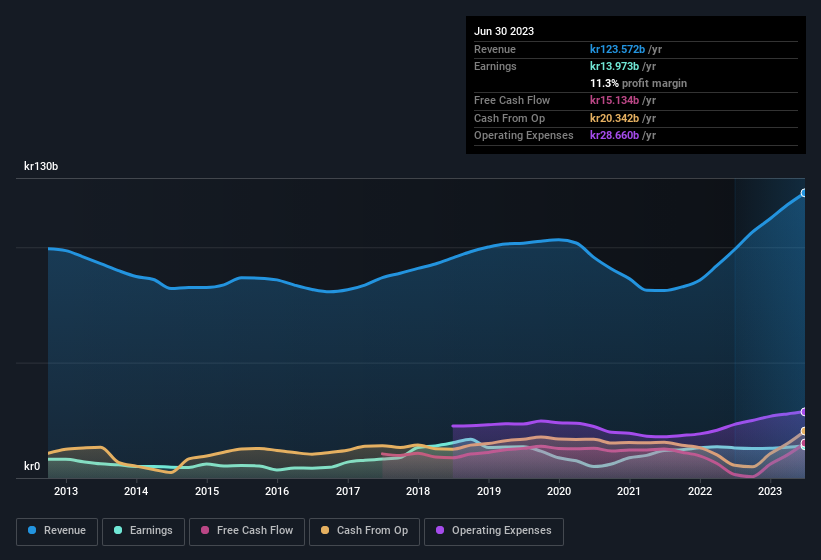

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Sandvik achieved similar EBIT margins to last year, revenue grew by a solid 25% to kr124b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Sandvik's future EPS 100% free.

Are Sandvik Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth kr5.1m) this was overshadowed by a mountain of buying, totalling kr590m in just one year. We find this encouraging because it suggests they are optimistic about Sandvik'sfuture. It is also worth noting that it was Director Helena Stjernholm who made the biggest single purchase, worth kr361m, paying kr214 per share.

The good news, alongside the insider buying, for Sandvik bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at kr815m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Does Sandvik Deserve A Spot On Your Watchlist?

Sandvik's earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Sandvik belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sandvik , and understanding these should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Sandvik isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SAND

Sandvik

An engineering company, provides products and solutions for mining and rock excavation, metal cutting, and materials technology worldwide.

Undervalued with adequate balance sheet and pays a dividend.