- Sweden

- /

- Medical Equipment

- /

- OM:GETI B

European Stocks That Might Be Trading Below Their Estimated Value In September 2025

Reviewed by Simply Wall St

As of September 2025, the European stock market has experienced mixed performance, with the pan-European STOXX Europe 600 Index slightly down amid global growth concerns and a stronger euro. Despite these challenges, inflation in the eurozone remains close to target, and unemployment rates have shown resilience, creating an environment where investors may find opportunities in stocks that are trading below their estimated value. Identifying such undervalued stocks often involves looking for companies with strong fundamentals that may not yet be reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.60 | SEK85.68 | 49.1% |

| Trifork Group (CPSE:TRIFOR) | DKK88.70 | DKK171.82 | 48.4% |

| Rusta (OM:RUSTA) | SEK64.00 | SEK127.40 | 49.8% |

| Getinge (OM:GETI B) | SEK212.50 | SEK423.41 | 49.8% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €9.80 | €19.40 | 49.5% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.47 | €6.80 | 49% |

| Atea (OB:ATEA) | NOK142.00 | NOK279.70 | 49.2% |

| Aquafil (BIT:ECNL) | €1.962 | €3.85 | 49% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.96 | €3.81 | 48.6% |

| adidas (XTRA:ADS) | €178.80 | €352.27 | 49.2% |

Here's a peek at a few of the choices from the screener.

Getinge (OM:GETI B)

Overview: Getinge AB (publ) is a company that offers products and solutions for operating rooms, intensive-care units, and sterilization departments in Sweden and internationally, with a market cap of approximately SEK57.88 billion.

Operations: Getinge's revenue is primarily derived from its Acute Care Therapies segment at SEK18.80 billion, followed by Surgical Workflows (excluding Life Science) at SEK12.13 billion, and Life Science at SEK4.57 billion.

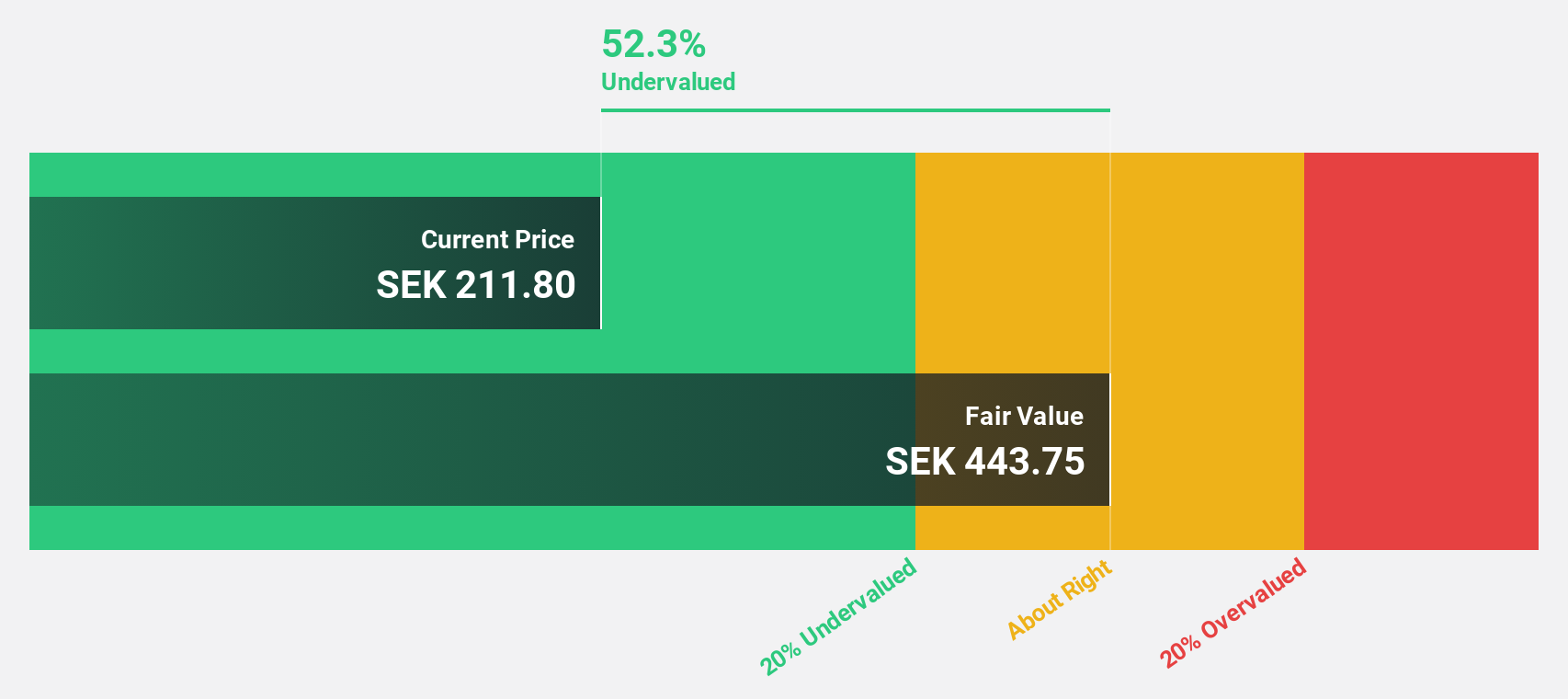

Estimated Discount To Fair Value: 49.8%

Getinge AB is trading at SEK212.5, significantly below its estimated fair value of SEK423.41, indicating it may be undervalued based on cash flows. Despite a recent drop from the OMX Stockholm 30 Index and lower profit margins compared to last year, earnings are forecast to grow by 20% annually over the next three years, outpacing Swedish market growth expectations. However, revenue growth remains modest at 5.2% per year.

- Our earnings growth report unveils the potential for significant increases in Getinge's future results.

- Get an in-depth perspective on Getinge's balance sheet by reading our health report here.

Munters Group (OM:MTRS)

Overview: Munters Group AB (publ) offers climate solutions across the Americas, Europe, the Middle East, Africa, and Asia with a market cap of approximately SEK22.91 billion.

Operations: The company's revenue segments include Air Tech at SEK7.82 billion, Food Tech at SEK3.31 billion, and Data Center Technologies at SEK5.36 billion.

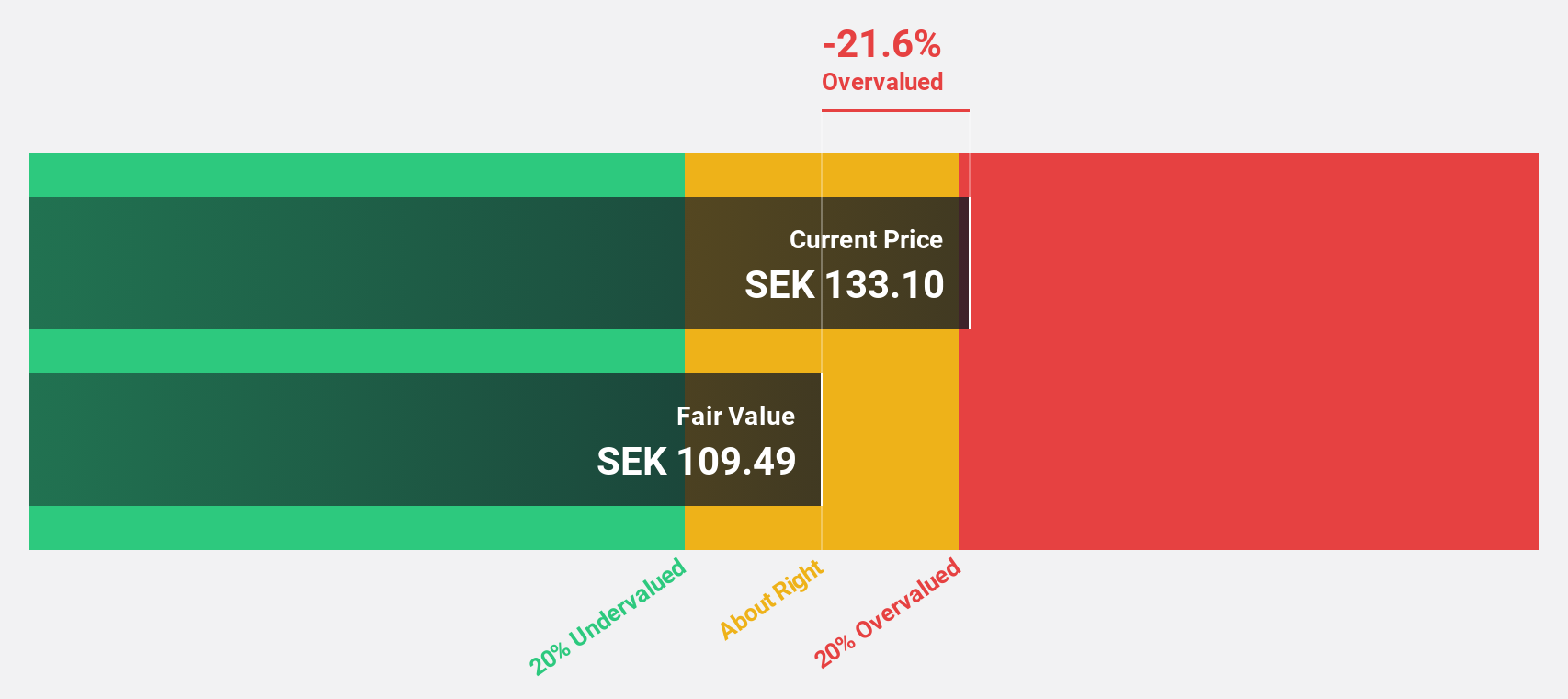

Estimated Discount To Fair Value: 16%

Munters Group AB is trading at SEK125.5, slightly below its fair value estimate of SEK149.44, reflecting a modest undervaluation based on cash flows. Despite recent earnings challenges, with net income dropping to SEK92 million in Q2 2025 from SEK330 million the previous year, the company is projected to achieve significant annual earnings growth of 21.6% over the next three years, surpassing Swedish market expectations while maintaining a high forecasted return on equity of 23.9%.

- Our comprehensive growth report raises the possibility that Munters Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Munters Group.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF1.39 billion, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company's revenue is derived from three main segments: X-Ray Systems (CHF109.40 million), Industrial X-Ray Modules (CHF96.50 million), and Plasma Control Technologies (CHF287.40 million).

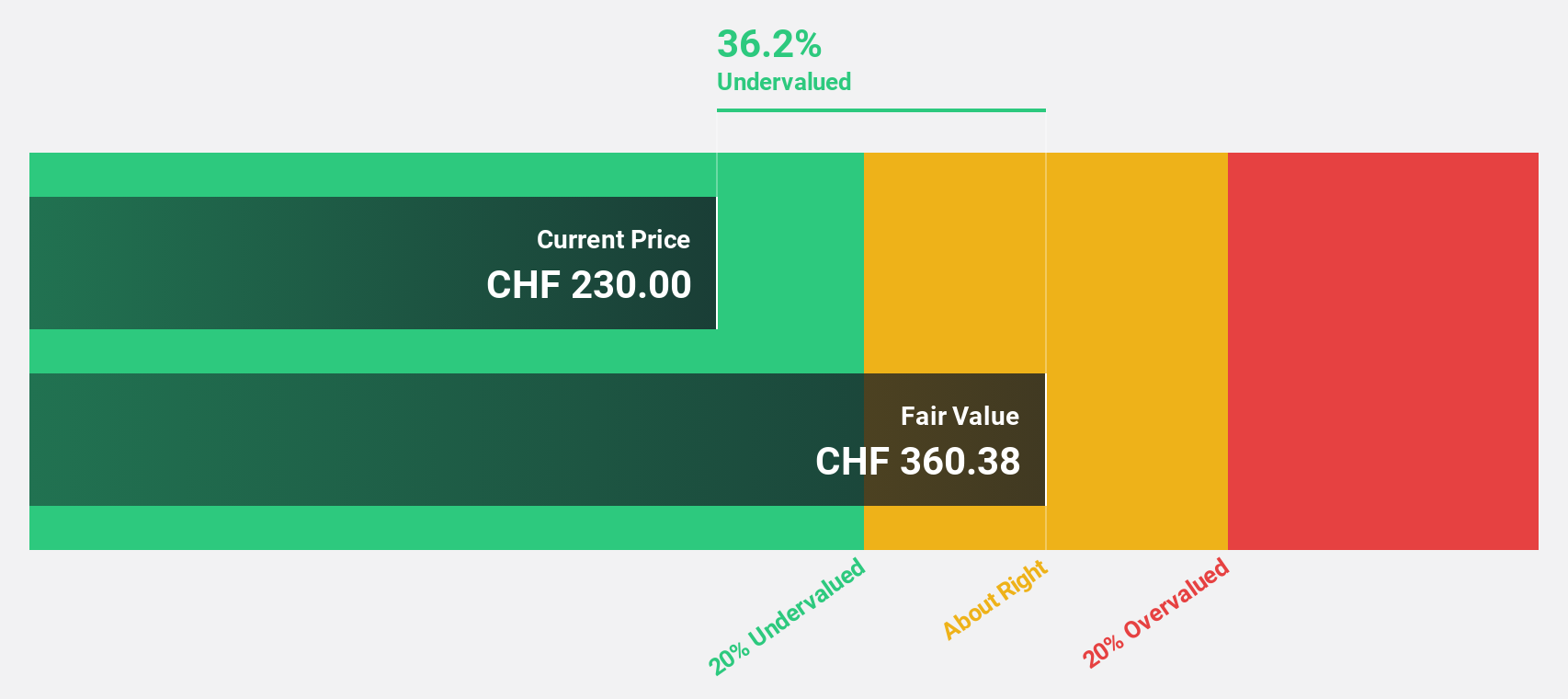

Estimated Discount To Fair Value: 35.4%

Comet Holding AG is trading at CHF178.8, significantly below its estimated fair value of CHF276.62, highlighting an undervaluation based on cash flows. Despite recent earnings guidance being revised downwards for FY25, the company reported a substantial increase in net income to CHF7.86 million for H1 2025 from CHF4.06 million the previous year. With projected annual earnings growth of 35.45% over three years and high return on equity forecasts, Comet's financial outlook remains robust amidst market volatility.

- According our earnings growth report, there's an indication that Comet Holding might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Comet Holding.

Make It Happen

- Access the full spectrum of 215 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GETI B

Getinge

Provides products and solutions for operating rooms, intensive-care units, and sterilization departments in Sweden and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives