- Sweden

- /

- Electrical

- /

- OM:META

Strong week for Metacon (STO:META) shareholders doesn't alleviate pain of five-year loss

Metacon AB (publ) (STO:META) shareholders will doubtless be very grateful to see the share price up 62% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. In fact, the share price has tumbled down a mountain to land 85% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the stock has risen 20% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Given that Metacon didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Metacon saw its revenue increase by 42% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 13% each year, in the same time period. It could be that the stock was over-hyped before. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

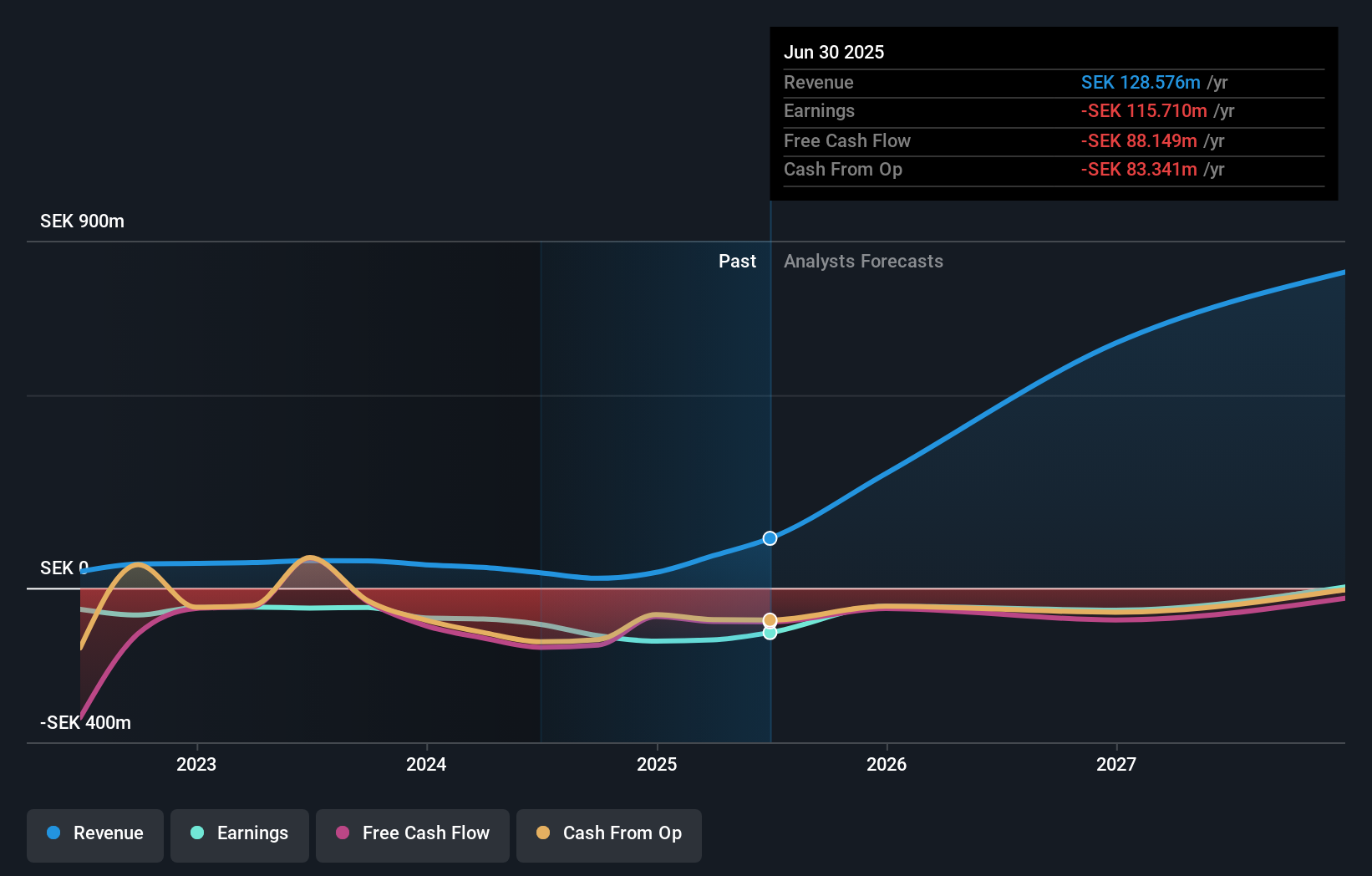

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Metacon stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Metacon shareholders are down 8.7% for the year. Unfortunately, that's worse than the broader market decline of 2.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Metacon you should be aware of, and 2 of them are potentially serious.

Of course Metacon may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:META

Metacon

Develops, manufactures, and sells energy systems to produce fossil-free green hydrogen in Sweden and Greece.

High growth potential with slight risk.

Market Insights

Community Narratives