As European inflation nears the central bank's target and key indices like the STOXX Europe 600 Index hit record highs, the Swedish market presents a fertile ground for discovering promising small-cap stocks. In this environment, identifying companies with strong fundamentals and growth potential becomes crucial for investors seeking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) specializes in designing, producing, and selling excavator tools globally, with a market cap of SEK18.00 billion.

Operations: The company generates revenue primarily from the construction machinery and equipment segment, amounting to SEK1.54 billion. Its net profit margin stands at 10.5%.

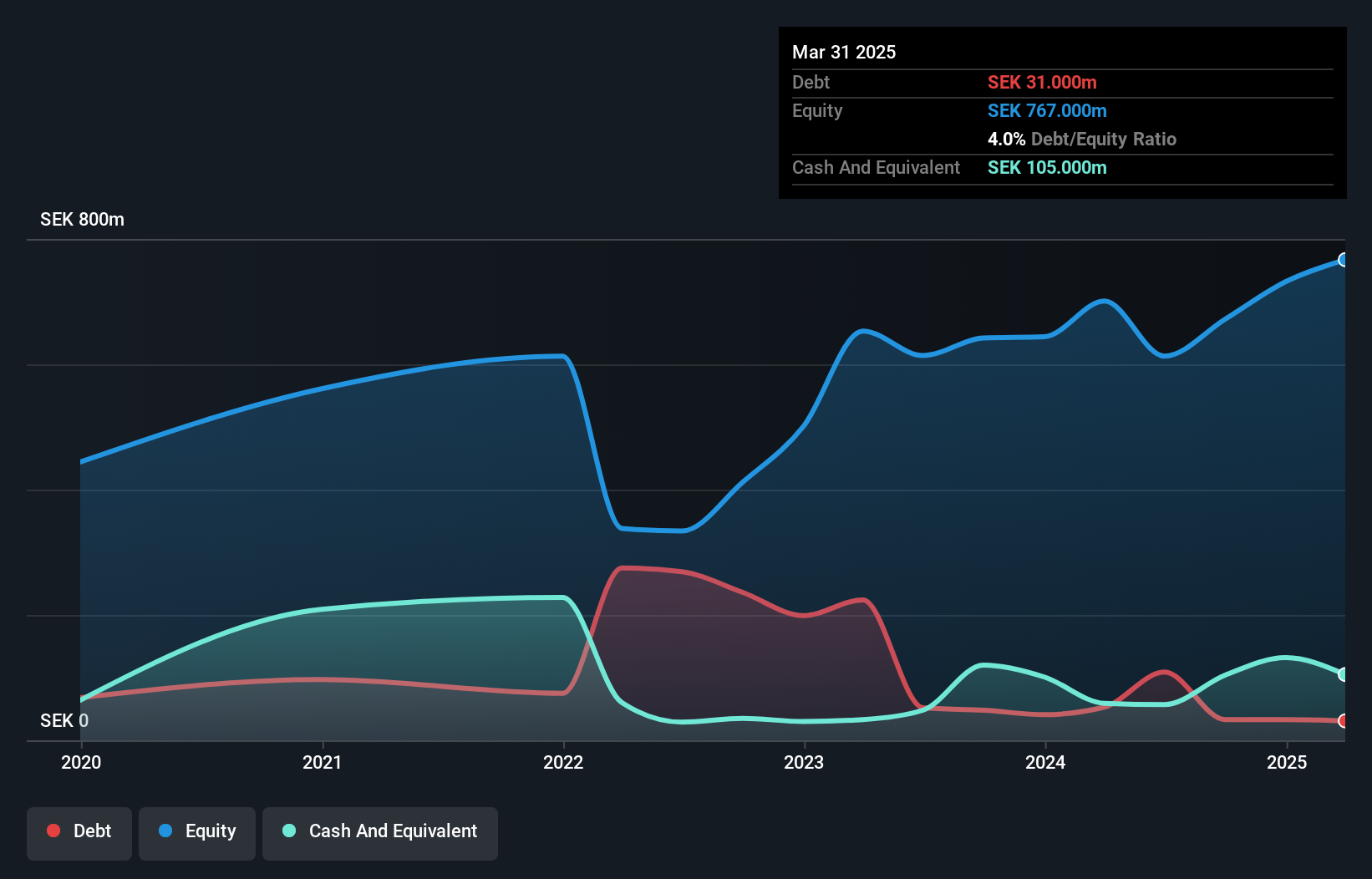

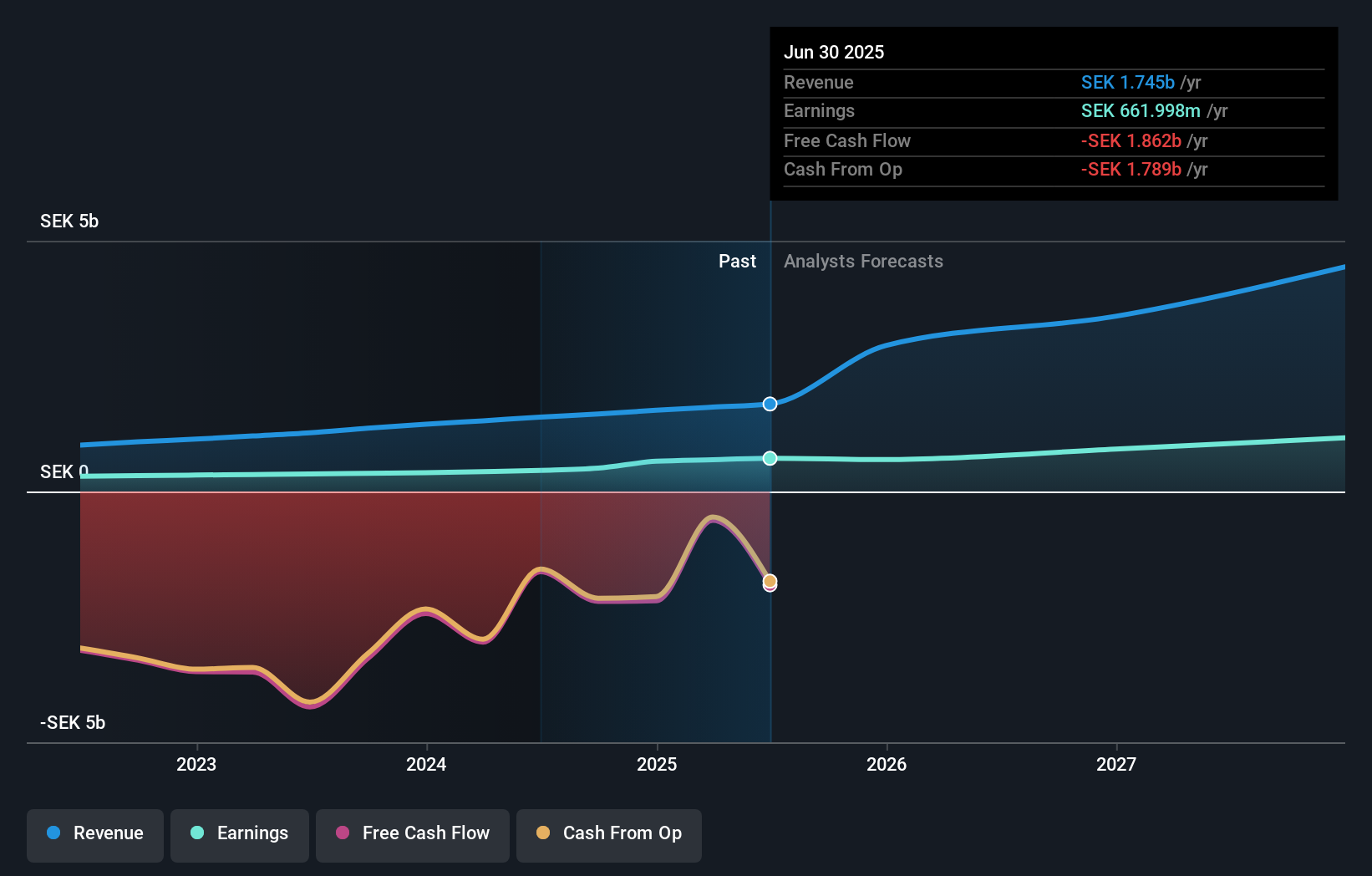

engcon B, a notable player in the machinery sector, has faced challenging times with a 60.6% earnings drop over the past year and net profit margins falling from 18% to 9.9%. Despite this, their EBIT covers interest payments by 20.4x, showcasing financial stability. Recent announcements revealed Q2 sales of SEK 450 million and net income of SEK 55 million. The company also created a new COO role to bolster future growth prospects.

- Dive into the specifics of engcon here with our thorough health report.

Explore historical data to track engcon's performance over time in our Past section.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★★★

Overview: ITAB Shop Concept AB (publ) specializes in designing and providing customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.38 billion.

Operations: ITAB Shop Concept AB (publ) generates revenue through the sale of customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores. The company's market cap stands at SEK5.38 billion.

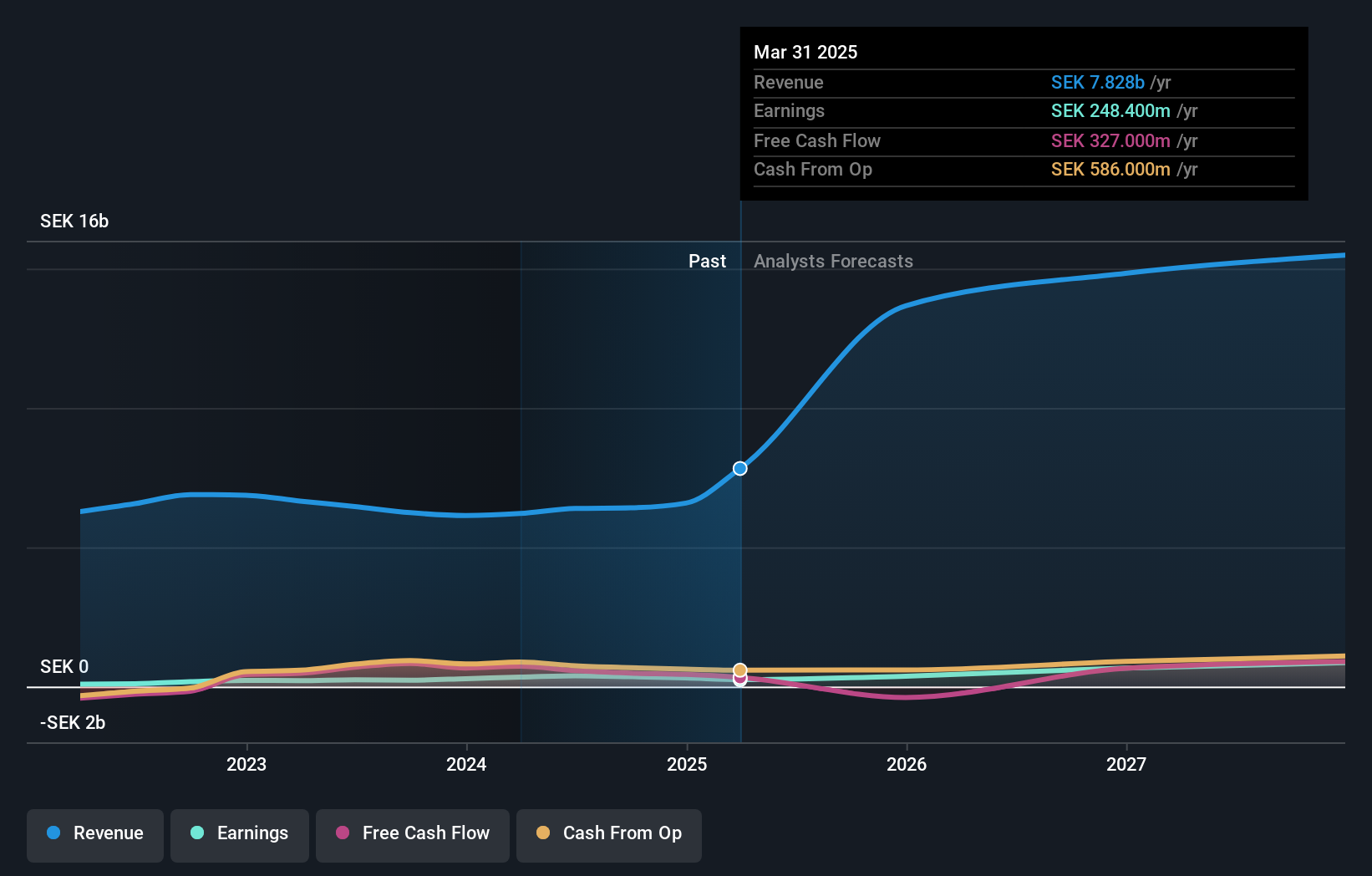

ITAB Shop Concept has shown impressive growth, with earnings increasing by 56.7% over the past year, outpacing the Commercial Services industry. Trading at 22.6% below its estimated fair value, ITAB offers good relative value compared to peers. The company’s debt to equity ratio has significantly improved from 137.6% to 20% in five years, and its interest payments are well covered by EBIT (21x coverage). Recent contracts like a EUR 22 million deal in the UK further bolster its prospects.

- Get an in-depth perspective on ITAB Shop Concept's performance by reading our health report here.

Examine ITAB Shop Concept's past performance report to understand how it has performed in the past.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions through its proprietary IT platform, with a market cap of SEK5.72 billion.

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK 511.24 million), Consumer Lending (SEK 607.24 million), and E-commerce Solutions excluding Credit Cards (SEK 363.28 million).

TF Bank, with total assets of SEK24.1B and equity of SEK2.4B, has shown impressive earnings growth of 21.3% over the past year, outpacing the industry average of 10.4%. Trading at 54% below its estimated fair value, it also has a low allowance for bad loans at 62%, though non-performing loans are high at 10.6%. Recently, TF Bank restructured by creating Rediem Capital AB to focus on acquiring non-performing exposures, aiming for specialized debt restructurer status by January 2025.

- Click to explore a detailed breakdown of our findings in TF Bank's health report.

Gain insights into TF Bank's past trends and performance with our Past report.

Seize The Opportunity

- Explore the 55 names from our Swedish Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ENGCON B

engcon

Engages in the design, production, and sale of excavator tools in Sweden, Denmark, Norway, Finland, rest of Europe, North and South America, Japan, South Korea, Australia, New Zealand, and internationally.

Exceptional growth potential with excellent balance sheet.