The 18% return delivered to engcon's (STO:ENGCON B) shareholders actually lagged YoY earnings growth

It hasn't been the best quarter for engcon AB (publ) (STO:ENGCON B) shareholders, since the share price has fallen 15% in that time. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. To wit, it had solidly beat the market, up 17%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for engcon

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

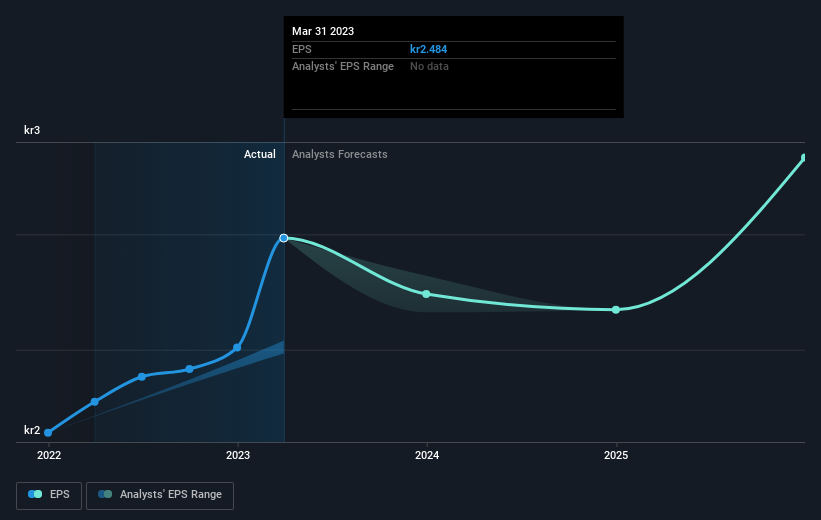

engcon was able to grow EPS by 40% in the last twelve months. It's fair to say that the share price gain of 17% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about engcon as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on engcon's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

engcon shareholders should be happy with the total gain of 18% over the last twelve months, including dividends. We regret to report that the share price is down 15% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - engcon has 1 warning sign we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ENGCON B

engcon

Engages in the design, production, and sale of excavator tools in Sweden, Denmark, Norway, Finland, rest of Europe, North and South America, Japan, South Korea, Australia, New Zealand, and internationally.

Exceptional growth potential with excellent balance sheet.