As global markets continue to reach record highs, with the Russell 2000 Index hitting unprecedented levels, investor sentiment is buoyed by domestic policy developments and geopolitical events. Despite challenges such as tariff concerns and a manufacturing slump, the strength of consumer spending has provided a solid foundation for small-cap stocks to thrive. In this dynamic environment, identifying hidden opportunities requires a keen eye for companies that exhibit strong fundamentals and resilience in the face of economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

CTT Systems (OM:CTT)

Simply Wall St Value Rating: ★★★★★★

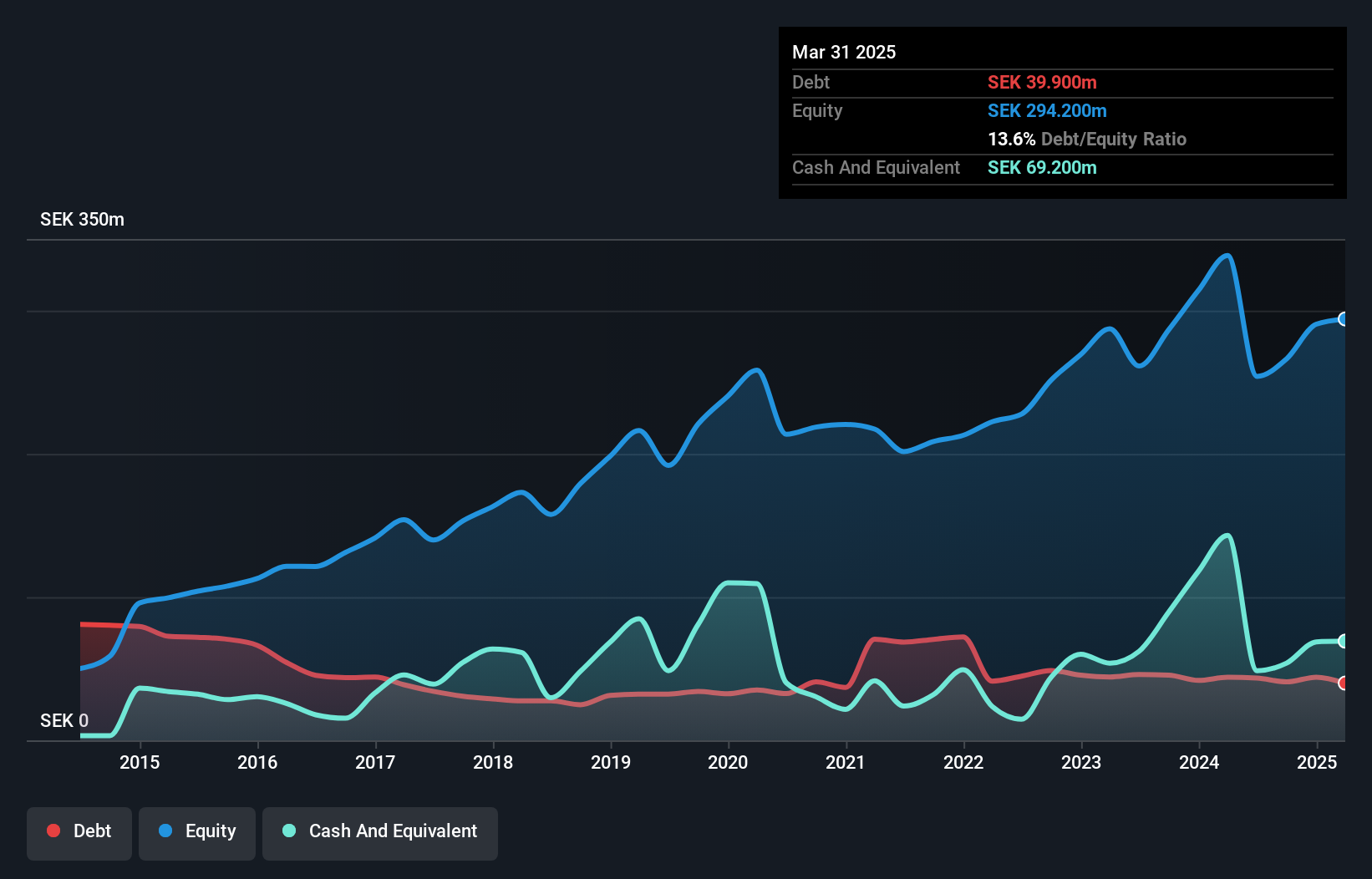

Overview: CTT Systems AB (publ) specializes in designing, manufacturing, and selling humidity control systems for aircraft across Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.52 billion.

Operations: The company generates its revenue primarily from the Aerospace & Defense segment, amounting to SEK301.40 million.

CTT Systems, a player in the Aerospace & Defense sector, showcases a mixed bag of performance metrics. Over the past five years, earnings have grown by 11% annually, although recent growth of 3.5% lagged behind industry peers at 17.3%. The company is trading at an attractive valuation, being 18.5% below its estimated fair value and boasts high-quality earnings with interest payments well covered by EBIT at a multiple of 70.6x. Despite reducing debt to equity from 15.4 to 15.3 over five years, recent quarterly sales dropped to SEK 57.7 million from SEK 74 million last year amidst adjusted guidance for lower net sales expectations between SEK 137 million and SEK 147 million for late-2024.

- Click to explore a detailed breakdown of our findings in CTT Systems' health report.

Evaluate CTT Systems' historical performance by accessing our past performance report.

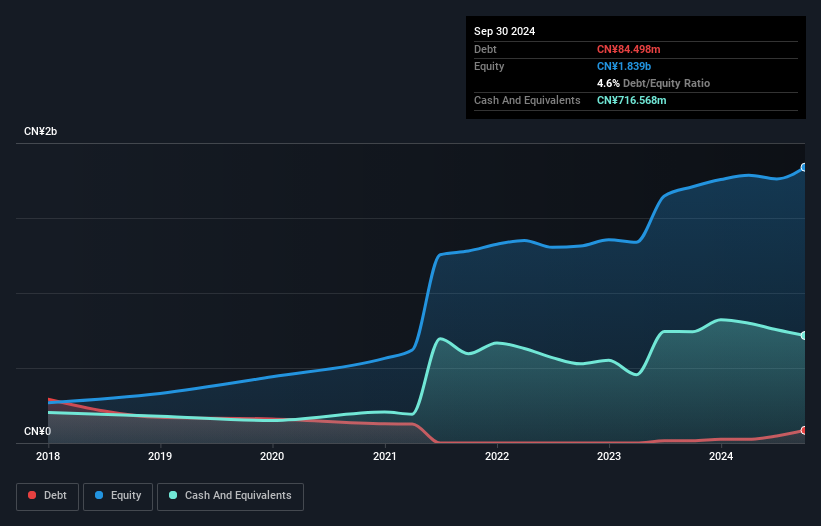

Shandong Link Science and TechnologyLtd (SZSE:001207)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Link Science and Technology Co., Ltd. operates in the technology sector with a market capitalization of CN¥4.06 billion.

Operations: The company's revenue streams are not specified in the provided text, and no detailed cost breakdowns or financial performance metrics such as gross profit margin or net profit margin are available.

Shandong Link Science and Technology, a small player in the chemicals industry, is trading at 34% below its estimated fair value. With earnings growth of 66.9% over the past year, it outpaces an industry that saw a -5% change. The company has reduced its debt to equity ratio significantly from 39.4% to 4.6% over five years, indicating improved financial health. Recent earnings for nine months ending September 2024 showed net income of CNY 199.76 million compared to CNY 113.57 million previously, while basic earnings per share rose from CNY 0.6 to CNY 1, highlighting robust performance amidst strategic changes in governance structure.

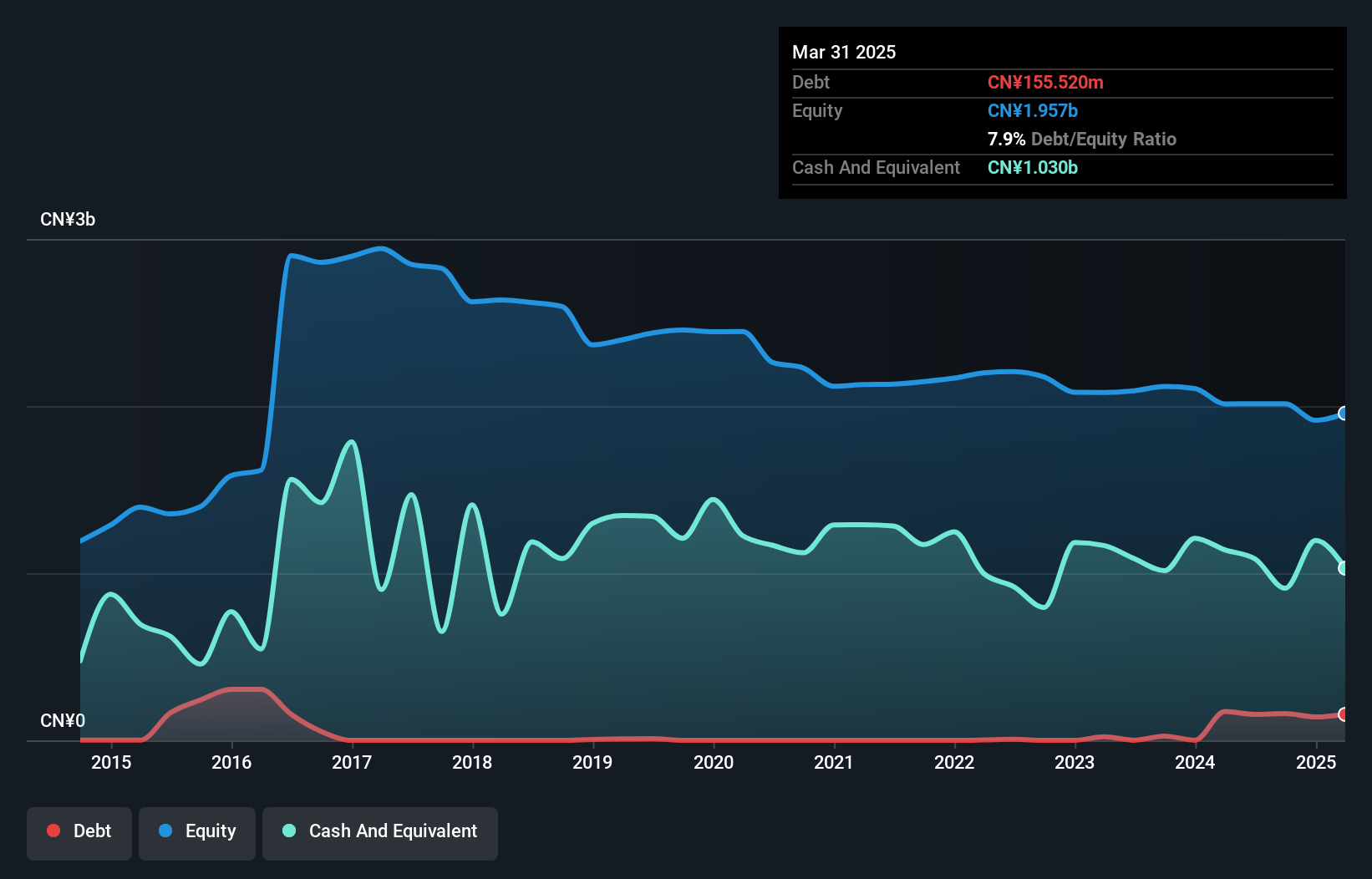

Toread Holdings Group (SZSE:300005)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toread Holdings Group Co., Ltd. focuses on the research, development, operation, and sales of outdoor products in China and has a market cap of CN¥6.89 billion.

Operations: Toread generates revenue primarily from the sales of outdoor products. The company's cost structure includes expenses related to research, development, and operations. Gross profit margin trends show fluctuations over recent periods, reflecting changes in production costs and pricing strategies.

Toread Holdings Group, a small player in the leisure industry, has shown impressive financial strides. Earnings surged by 21.8% over the past year, significantly outpacing the industry's -0.7%. The company reported a net income of CN¥101.75 million for the nine months ending September 2024, up from CN¥46.08 million in the previous year, reflecting its robust performance despite market volatility. A notable one-off gain of CN¥22.7 million also bolstered results this year to September 30th, adding complexity to its earnings profile but highlighting potential resilience and adaptability within its operations.

Where To Now?

- Click here to access our complete index of 4641 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toread Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300005

Toread Holdings Group

Engages in the research, development, operation, and sales of outdoor products in China.

Excellent balance sheet with acceptable track record.