EDF Nuclear Deal and Raised Sales Outlook Could Be a Game Changer for Alfa Laval (OM:ALFA)

Reviewed by Sasha Jovanovic

- EDF recently announced it has extended its long-term partnership with Alfa Laval to deploy advanced heat exchanger technology for six new EPR2 nuclear reactors in France, supported by a standardized, modular approach to streamline construction and efficiency.

- This development, together with Alfa Laval's raised 2025 sales growth guidance and solid quarterly earnings, underscores growing momentum in low-carbon energy infrastructure and industrial collaborations.

- We'll explore how the expanded EDF collaboration could shape Alfa Laval’s investment narrative in the context of energy transition demand.

Find companies with promising cash flow potential yet trading below their fair value.

Alfa Laval Investment Narrative Recap

To be a shareholder in Alfa Laval, you need to believe in the company's ability to capitalize on the accelerating energy transition, especially through its core expertise in heat transfer and sustainable technologies. The extended EDF partnership gives Alfa Laval visibility in long-cycle nuclear projects, supporting growth in low-carbon energy; however, overexposure to cyclical end-markets remains the biggest risk, while order flow from energy transition projects is the near-term catalyst. Overall, the EDF news reinforces momentum but does not materially change the risk profile.

Among recent announcements, Alfa Laval’s October guidance revision stands out: the company lifted its average annual sales growth target for 2025 to 7 percent, up from 5 percent previously. This aligns with the EDF deal’s potential to feed the order pipeline from nuclear energy infrastructure, which, if sustained, could help offset concerns about volatility in marine, oil, and gas end-markets and underpins more ambitious growth assumptions.

In contrast, investors should watch closely for signs that project conversion delays or slowdowns in clean energy adoption could...

Read the full narrative on Alfa Laval (it's free!)

Alfa Laval is projected to achieve SEK77.3 billion in revenue and SEK9.6 billion in earnings by 2028. This outlook requires a 4.5% annual revenue growth rate and a SEK1.6 billion earnings increase from the current SEK8.0 billion.

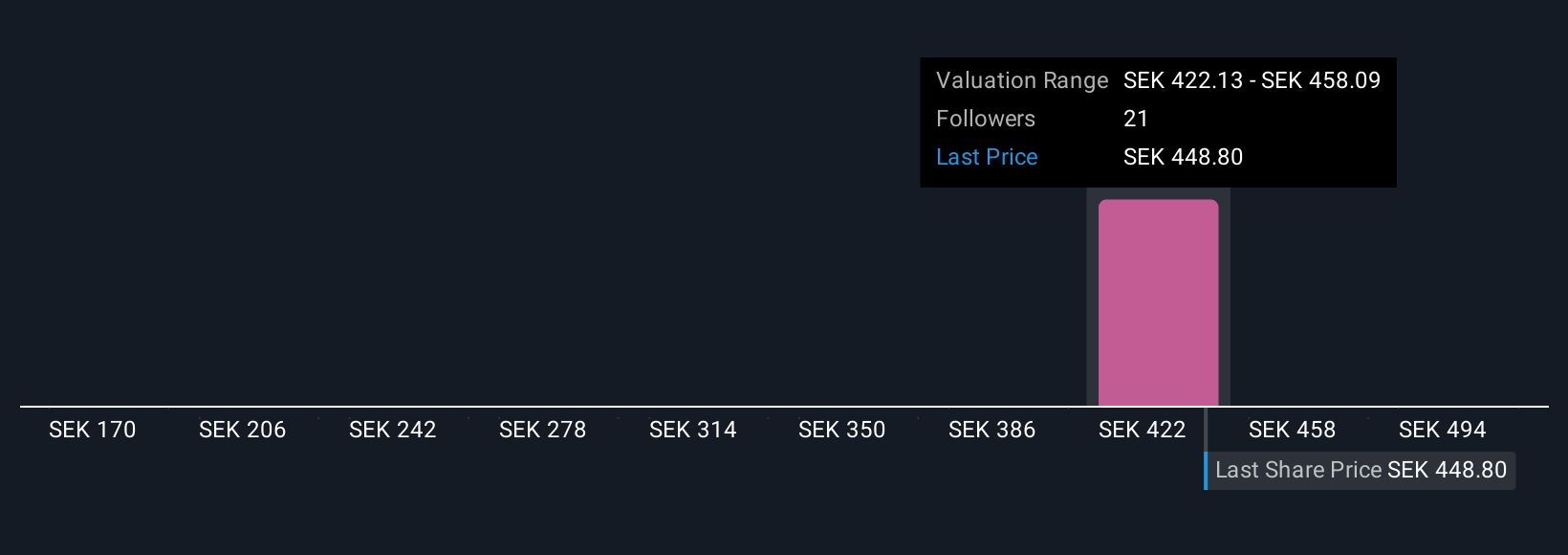

Uncover how Alfa Laval's forecasts yield a SEK465.93 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors estimate Alfa Laval’s fair value spans from SEK390 to SEK530, based on four separate analyses. While optimism around energy efficiency and decarbonization drives many outlooks, keep in mind long-cycle project delays can still challenge near-term revenue growth.

Explore 4 other fair value estimates on Alfa Laval - why the stock might be worth 12% less than the current price!

Build Your Own Alfa Laval Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alfa Laval research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alfa Laval research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alfa Laval's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALFA

Alfa Laval

Provides heat transfer, separation, and fluid handling products and solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives