- Sweden

- /

- Electrical

- /

- NGM:NIUTEC

Niutech Group AB's (NGM:NIUTEC) Price Is Right But Growth Is Lacking After Shares Rocket 30%

Niutech Group AB (NGM:NIUTEC) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 93% share price decline over the last year.

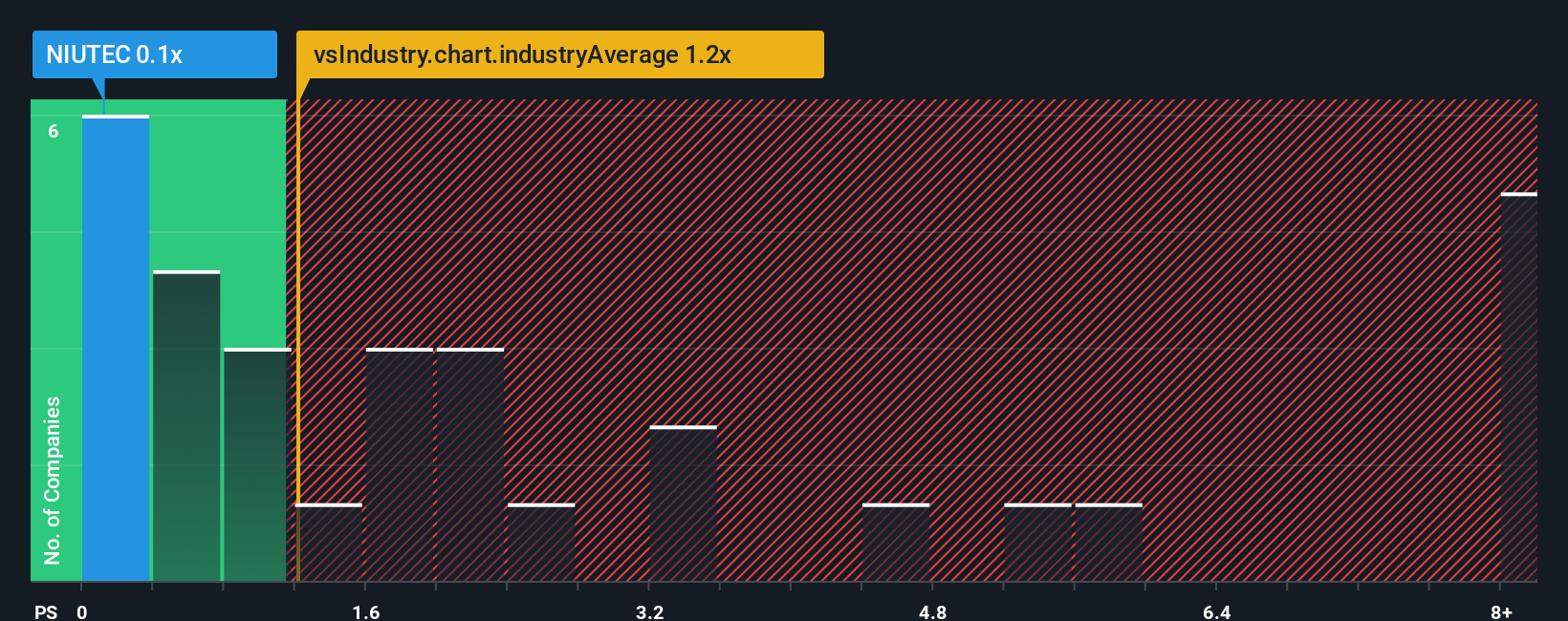

Although its price has surged higher, Niutech Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Electrical industry in Sweden have P/S ratios greater than 1.8x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Niutech Group

What Does Niutech Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Niutech Group's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Niutech Group.Is There Any Revenue Growth Forecasted For Niutech Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Niutech Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 165% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 41% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 14% growth, that's a disappointing outcome.

With this information, we are not surprised that Niutech Group is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Niutech Group's P/S Mean For Investors?

Niutech Group's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Niutech Group's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Plus, you should also learn about these 5 warning signs we've spotted with Niutech Group (including 4 which make us uncomfortable).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Niutech Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:NIUTEC

Niutech Group

Engages in the installation of solar cell systems and electric car chargers in Sweden.

Undervalued with moderate risk.

Market Insights

Community Narratives