- Sweden

- /

- Auto Components

- /

- OM:BULTEN

3 Swedish Dividend Stocks Yielding Up To 5.4%

Reviewed by Simply Wall St

As global markets react to the recent Federal Reserve rate cut, European indices have shown mixed results, with cautious optimism prevailing among investors. In this environment, Swedish dividend stocks offer a compelling opportunity for those seeking steady income streams amidst market fluctuations. When evaluating dividend stocks in such a dynamic market, it's crucial to consider companies with strong fundamentals and consistent payout histories.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.89% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.81% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.81% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.42% | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.40% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.81% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.47% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.70% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.01% | ★★★★☆☆ |

| SSAB (OM:SSAB A) | 9.85% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related services for various industries, including automotive and consumer electronics, across multiple countries with a market cap of SEK 1.41 billion.

Operations: Bulten AB (publ) generates SEK 5.95 billion in revenue from its fasteners and related services across various industries.

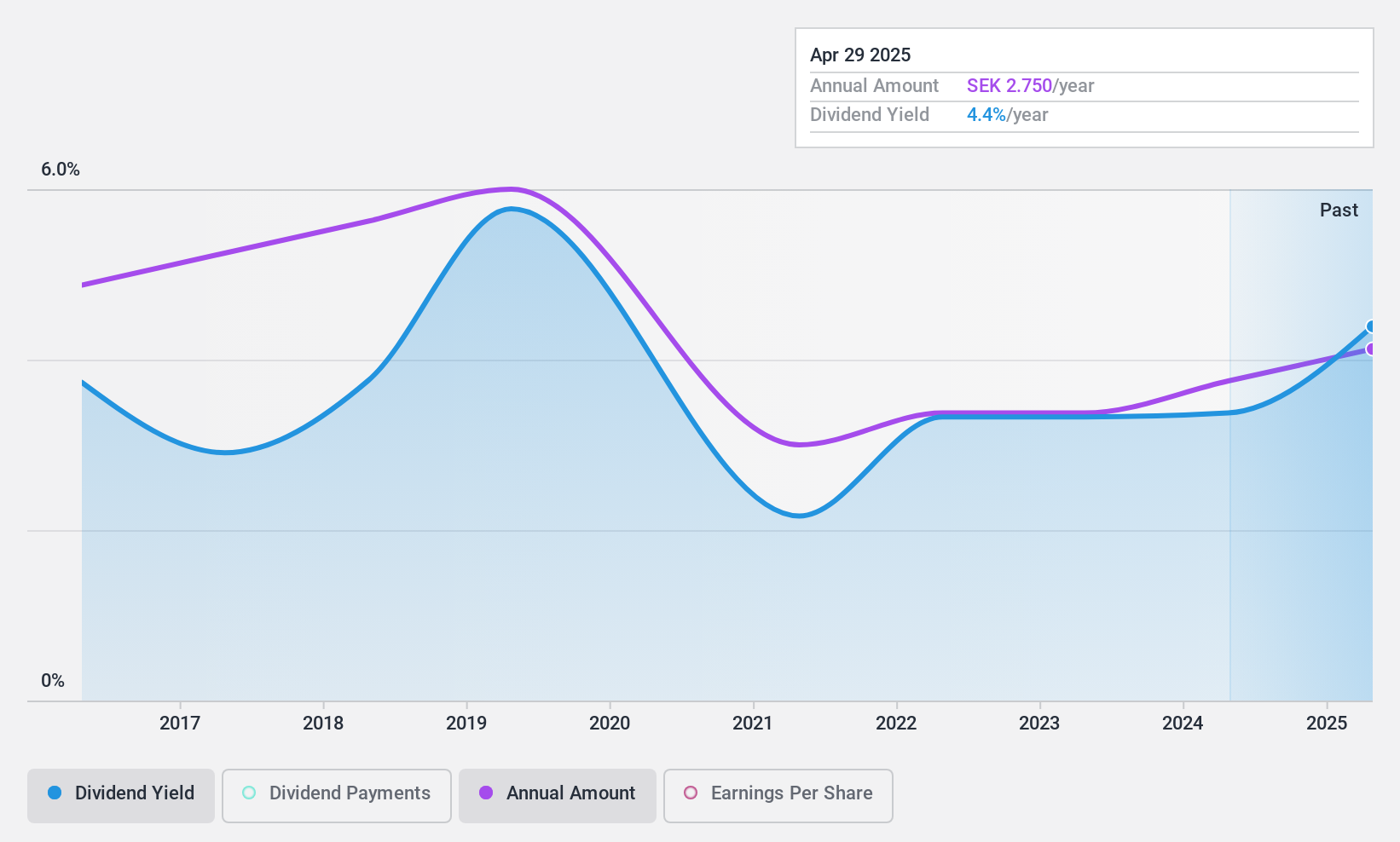

Dividend Yield: 3.7%

Bulten's dividend yield of 3.73% is lower than the top 25% of Swedish dividend payers, but its payout ratio of 57% indicates dividends are covered by earnings. Despite a history of volatile dividends, recent payments have increased over the past decade. The company's net profit margin has decreased to 1.5%, and while sales rose to SEK 2.99 billion for the first half of 2024, net income fell slightly to SEK 102 million.

- Get an in-depth perspective on Bulten's performance by reading our dividend report here.

- The analysis detailed in our Bulten valuation report hints at an inflated share price compared to its estimated value.

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ) offers corporate, retail, investment, and private banking services and has a market cap of SEK318.57 billion.

Operations: Skandinaviska Enskilda Banken AB (publ) generates revenue from various segments including Life (SEK3.89 billion), Baltic (SEK13.82 billion), Asset Management (SEK3.22 billion), Large Corporates & Financial Institutions (SEK31.90 billion), Private Wealth Management & Family Office (SEK4.56 billion), and Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK25.65 billion).

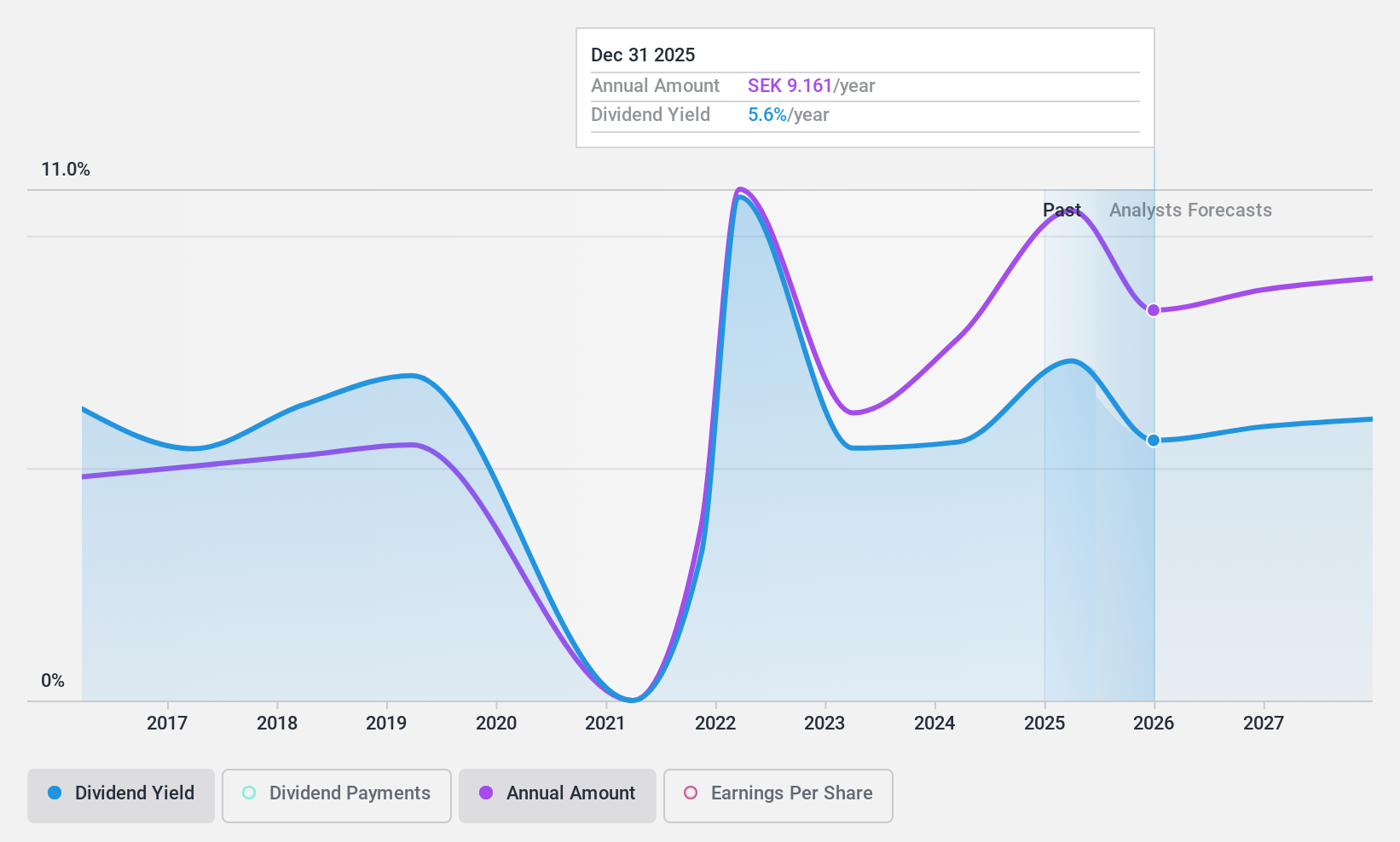

Dividend Yield: 5.5%

Skandinaviska Enskilda Banken's dividend payments have been volatile over the past decade but are well-covered by earnings with a payout ratio of 46.5%. The yield is 5.47%, placing it in the top 25% of Swedish dividend payers. Recent reorganizations aim to enhance operational efficiency and customer focus, while CFO Masih Yazdi's upcoming departure may introduce some uncertainty. Earnings for Q2 2024 were SEK 9,416 million, slightly down from SEK 9,768 million a year ago.

- Click to explore a detailed breakdown of our findings in Skandinaviska Enskilda Banken's dividend report.

- Our expertly prepared valuation report Skandinaviska Enskilda Banken implies its share price may be too high.

Thule Group (OM:THULE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thule Group AB (publ) is a sports and outdoor company operating in Sweden and internationally, with a market cap of SEK31.32 billion.

Operations: Thule Group AB (publ) generates revenue primarily from its Outdoor & Bags segment, which accounts for SEK9.40 billion.

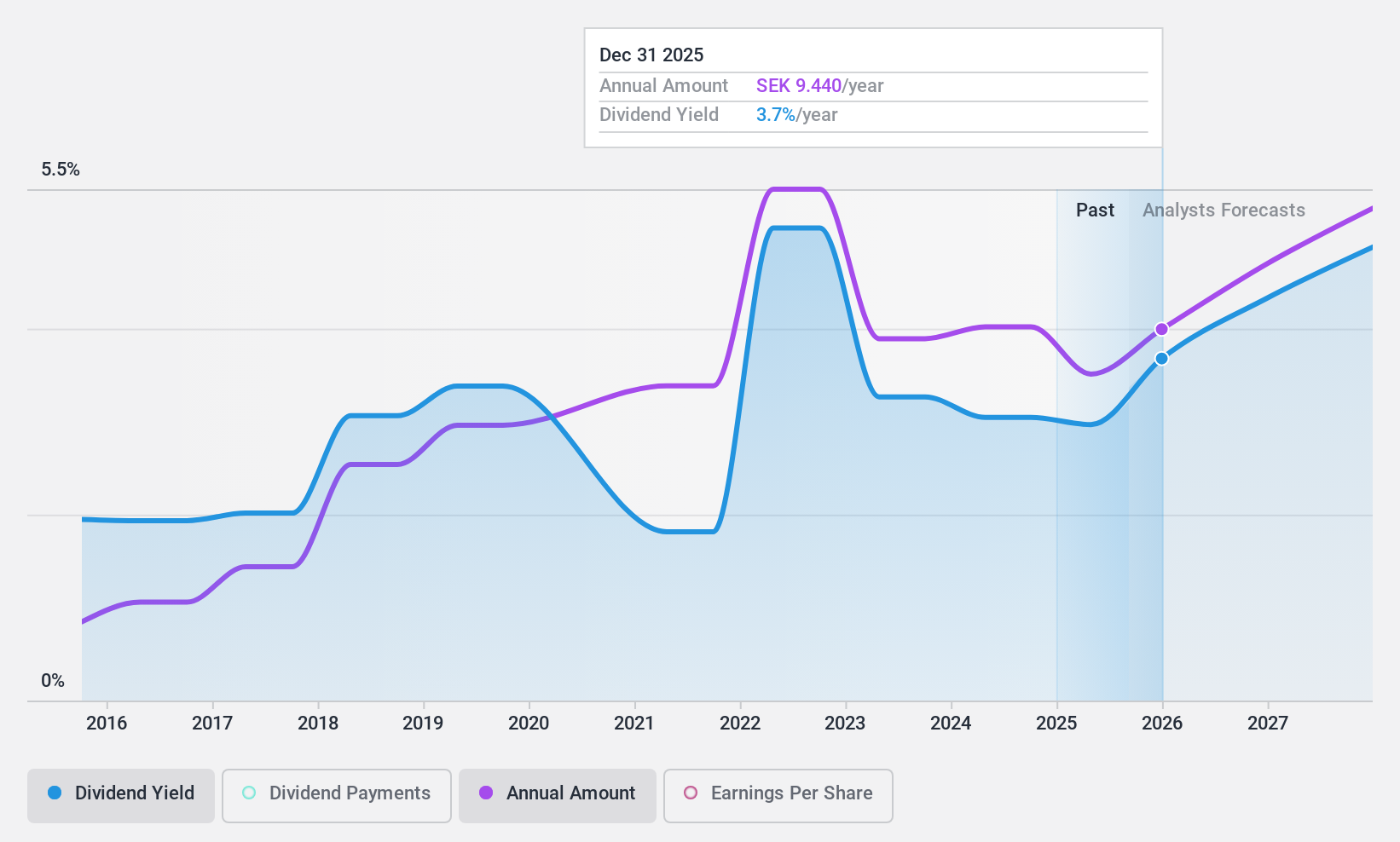

Dividend Yield: 3.2%

Thule Group's dividend payments have been volatile over the past decade, but they are currently covered by earnings with a payout ratio of 87.8% and cash flows at 56.1%. The dividend yield of 3.21% is lower than the top quartile in Sweden. Recent earnings show growth, with Q2 sales at SEK 3.10 billion and net income at SEK 559 million, indicating stable financial performance despite historical dividend instability.

- Click here to discover the nuances of Thule Group with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Thule Group's share price might be too optimistic.

Taking Advantage

- Delve into our full catalog of 21 Top Swedish Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bulten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BULTEN

Bulten

Manufactures and distributes fasteners and related services and solutions for light vehicles, heavy commercial vehicles, automotive suppliers, consumer electronics, and other industries in Sweden, Poland, Germany, the United Kingdom, rest of Europe, the United States, China, Taiwan, and internationally.

Adequate balance sheet average dividend payer.