Assessing Volvo Cars (OM:VOLCAR B) Valuation Following Recent 68% Share Price Surge

Reviewed by Simply Wall St

Volvo Car AB (publ.) (OM:VOLCAR B) shares have seen a steady climb recently, with the stock advancing about 68% over the past month. Investors are beginning to take notice of its strong performance this year.

See our latest analysis for Volvo Car AB (publ.).

This year, Volvo Car AB (publ.)'s stock has gathered remarkable momentum, highlighted by a 43.51% year-to-date share price return and a robust 68% climb in the last month alone. Strong performance and upbeat sentiment are beginning to drive a recovery narrative, even as the company continues to bounce back from a challenging multi-year stretch.

If Volvo’s recent surge has you rethinking your portfolio, now is a great time to explore what’s happening across the sector and discover See the full list for free.

But with such a rapid rally and the share price now above analyst targets, the key question becomes whether Volvo Car is still undervalued or if the market is already factoring in all the expected gains from this point. Is there truly a buying opportunity, or have the recent gains simply priced in future growth?

Most Popular Narrative: 43.9% Overvalued

According to the most widely followed narrative, Volvo Car AB (publ.)’s last close at SEK34.02 far exceeds its calculated fair value of SEK23.63, suggesting the recent surge puts the stock well ahead of what analysts project over the medium term. This perspective sets the stage for a debate: are current market expectations just running too hot?

Ongoing geopolitical instability and regulatory uncertainty around emissions standards necessitate costly compliance investments and supply chain adaptations. These factors could further strain net margins and delay earnings improvement. Elevated investment needs for electrification, new technologies, and capacity expansions are suppressing free cash flow and delaying the timeline to return to sustainable cash generation, heightening risks to earnings and capital allocation.

Curious why this narrative sees danger signs despite huge projected earnings growth? The secret is that various aggressive financial forecasts drive this calculation, such as climbing margins and a valuation multiple that is anything but average. The real shocker lies in how razor-thin the projected runway is for profits to catch up with today’s lofty price. Can these bold targets be met? Find out what’s powering the math behind the current fair value.

Result: Fair Value of $23.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if local EV production scales rapidly or if sustained cost reductions are achieved, the current cautious outlook for Volvo Car AB could quickly change.

Find out about the key risks to this Volvo Car AB (publ.) narrative.

Another View: Discounted Cash Flow Model

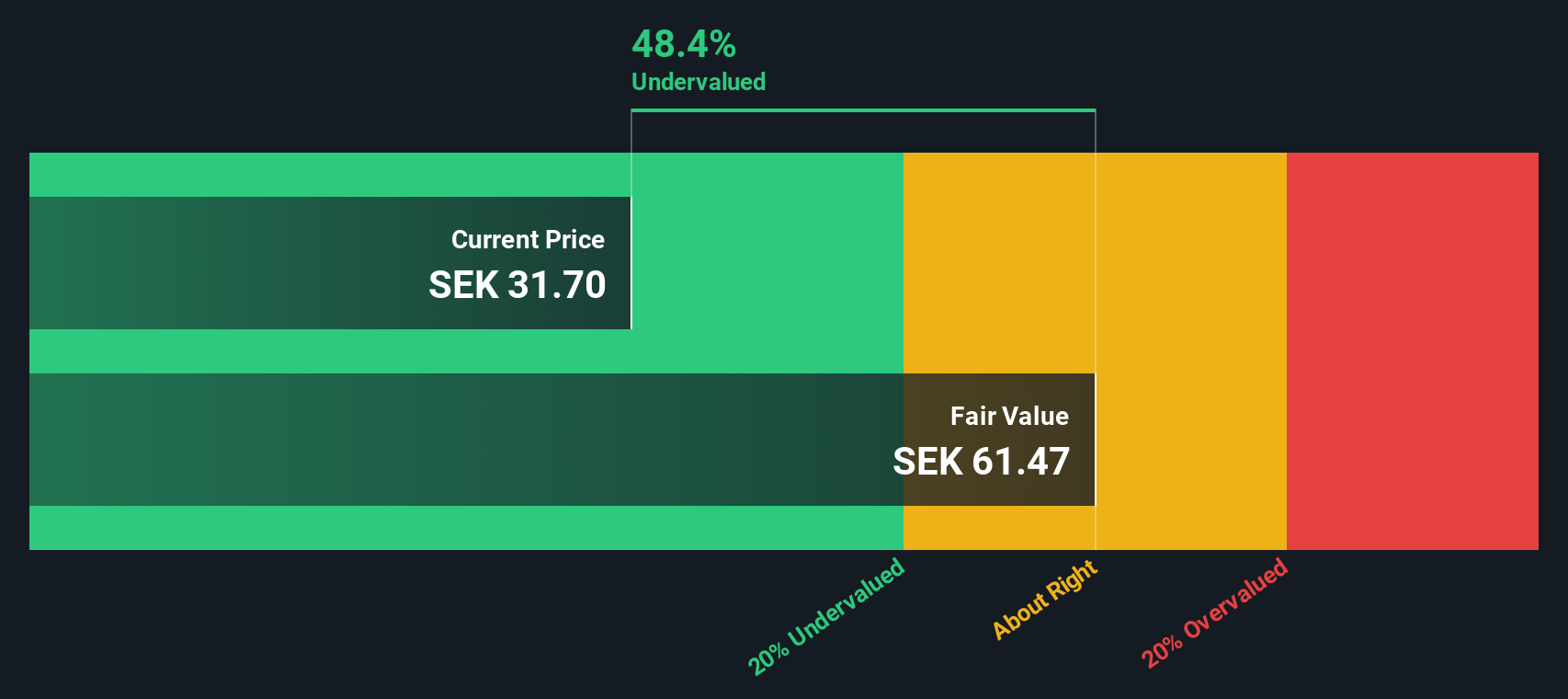

Taking a different approach, our SWS DCF model suggests that Volvo Car AB (publ.) is actually trading well below its fair value. The current price is 41.2% under our estimate. This view raises important questions: does the market see risk the model cannot, or is there hidden value yet to be unlocked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Volvo Car AB (publ.) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Volvo Car AB (publ.) Narrative

If these findings do not match your personal take or you prefer to dig into the numbers on your own, you can shape your perspective with the data at hand in just a few minutes. Do it your way

A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to take your portfolio to the next level? Use these powerful screeners to uncover unique opportunities and stay ahead of the latest trends before everyone else.

- Grab the chance to target steady income by checking out these 16 dividend stocks with yields > 3%, which offers yields above 3% for your peace of mind.

- Jump on the latest breakthroughs in automated healthcare with these 32 healthcare AI stocks, connecting you to innovators transforming patient outcomes.

- Capitalize on tomorrow’s blockchain boom by using these 82 cryptocurrency and blockchain stocks, which is packed with bold companies in cryptocurrency and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives