- Sweden

- /

- Auto Components

- /

- OM:BULTEN

Further Upside For Bulten AB (publ) (STO:BULTEN) Shares Could Introduce Price Risks After 26% Bounce

Bulten AB (publ) (STO:BULTEN) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

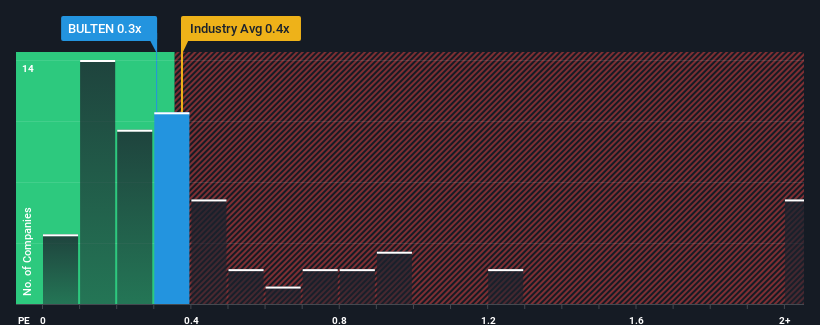

Even after such a large jump in price, it's still not a stretch to say that Bulten's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Auto Components industry in Sweden, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Bulten

How Bulten Has Been Performing

With revenue growth that's superior to most other companies of late, Bulten has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bulten will help you uncover what's on the horizon.How Is Bulten's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bulten's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. The strong recent performance means it was also able to grow revenue by 90% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.3% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.3%, which is noticeably less attractive.

In light of this, it's curious that Bulten's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Bulten's P/S Mean For Investors?

Bulten appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bulten currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Bulten that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bulten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BULTEN

Bulten

Manufactures and distributes fasteners in Sweden, Poland, Germany, the United Kingdom, rest of Europe, the United States, China, and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives