- Saudi Arabia

- /

- IT

- /

- SASE:9558

Insiders with their considerable ownership were the key benefactors as Alqemam for Computer Systems Co. (TADAWUL:9558) touches ر.س382m market cap

Key Insights

- Alqemam for Computer Systems' significant insider ownership suggests inherent interests in company's expansion

- Wasel Abdullah Al Wasel owns 70% of the company

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

A look at the shareholders of Alqemam for Computer Systems Co. (TADAWUL:9558) can tell us which group is most powerful. And the group that holds the biggest piece of the pie are individual insiders with 74% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

As a result, insiders scored the highest last week as the company hit ر.س382m market cap following a 59% gain in the stock.

Let's take a closer look to see what the different types of shareholders can tell us about Alqemam for Computer Systems.

View our latest analysis for Alqemam for Computer Systems

What Does The Lack Of Institutional Ownership Tell Us About Alqemam for Computer Systems?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

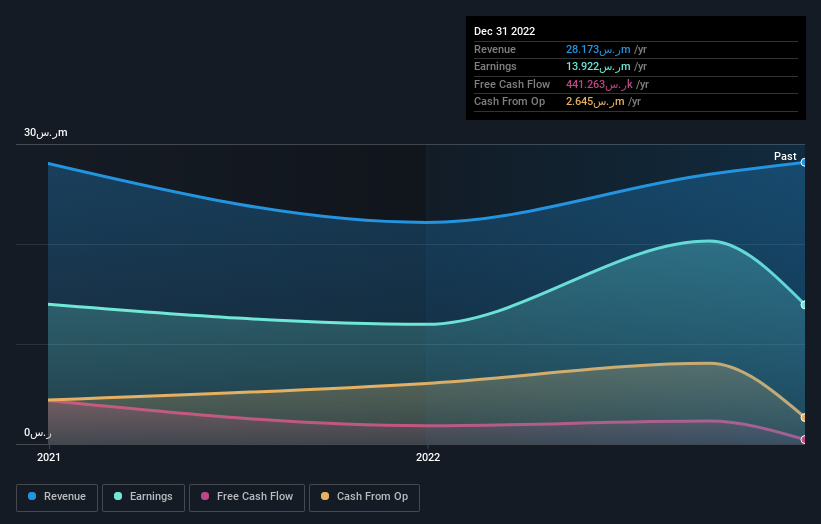

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Alqemam for Computer Systems' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

We note that hedge funds don't have a meaningful investment in Alqemam for Computer Systems. Our data shows that Wasel Abdullah Al Wasel is the largest shareholder with 70% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. Anas Abulrahman Al Qarawi is the second largest shareholder owning 2.4% of common stock, and Fawaz Abdulrahman Al Aqel holds about 1.5% of the company stock.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Alqemam for Computer Systems

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems that insiders own more than half the Alqemam for Computer Systems Co. stock. This gives them a lot of power. Given it has a market cap of ر.س382m, that means they have ر.س283m worth of shares. Most would argue this is a positive, showing strong alignment with shareholders. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 26% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Alqemam for Computer Systems. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Alqemam for Computer Systems you should know about.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9558

Alqemam for Computer Systems

Focuses on system development services in the Kingdom of Saudi Arabia.

Solid track record with excellent balance sheet.