- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4192

Al-Saif Stores for Development & Investment Company's (TADAWUL:4192) top holders are insiders and they are likely disappointed by the recent 8.4% drop

Key Insights

- Al-Saif Stores for Development & Investment's significant insider ownership suggests inherent interests in company's expansion

- Suleiman bin Muhammad Saleh Alsaif owns 63% of the company

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

To get a sense of who is truly in control of Al-Saif Stores for Development & Investment Company (TADAWUL:4192), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are individual insiders with 71% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And following last week's 8.4% decline in share price, insiders suffered the most losses.

Let's delve deeper into each type of owner of Al-Saif Stores for Development & Investment, beginning with the chart below.

See our latest analysis for Al-Saif Stores for Development & Investment

What Does The Lack Of Institutional Ownership Tell Us About Al-Saif Stores for Development & Investment?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

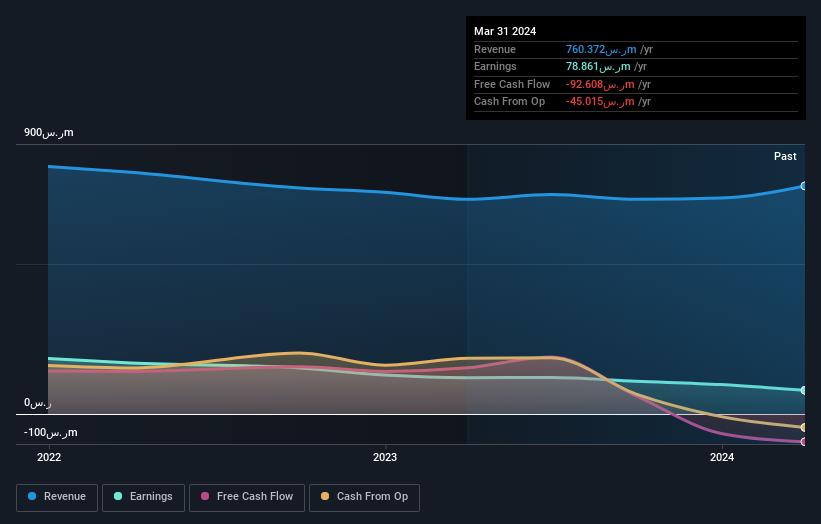

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. Al-Saif Stores for Development & Investment's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in Al-Saif Stores for Development & Investment. Looking at our data, we can see that the largest shareholder is Suleiman bin Muhammad Saleh Alsaif with 63% of shares outstanding. This essentially means that they have extensive influence, if not outright control, over the future of the corporation. In comparison, the second and third largest shareholders hold about 2.1% and 1.4% of the stock. Two of the top three shareholders happen to be Head of Marketing and Vice Chairman, respectively. That is, insiders feature higher up in the heirarchy of the company's top shareholders.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Al-Saif Stores for Development & Investment

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own the majority of Al-Saif Stores for Development & Investment Company. This means they can collectively make decisions for the company. Given it has a market cap of ر.س3.0b, that means they have ر.س2.1b worth of shares. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 29% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Al-Saif Stores for Development & Investment. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. For instance, we've identified 4 warning signs for Al-Saif Stores for Development & Investment (2 are significant) that you should be aware of.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4192

Al-Saif Stores for Development & Investment

Engages in the wholesale and retail sale of household utensils, electrical appliances, and cleaning supplies in the Kingdom of Saudi Arabia.

Excellent balance sheet slight.