Stock Analysis

- Saudi Arabia

- /

- Basic Materials

- /

- SASE:2360

Saudi Vitrified Clay Pipe (TADAWUL:2360) delivers shareholders 6.0% CAGR over 3 years, surging 10% in the last week alone

Low-cost index funds make it easy to achieve average market returns. But in any diversified portfolio of stocks, you'll see some that fall short of the average. That's what has happened with the Saudi Vitrified Clay Pipe Company (TADAWUL:2360) share price. It's up 17% over three years, but that is below the market return. Zooming in, the stock is up a respectable 5.8% in the last year.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Saudi Vitrified Clay Pipe

Saudi Vitrified Clay Pipe wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Saudi Vitrified Clay Pipe actually saw its revenue drop by 24% per year over three years. The falling revenue is arguably somewhat reflected in the lacklustre return of 6% per year over three years, which falls short of the market return. As a general rule we don't like it when a loss-making company isn't even growing revenue.

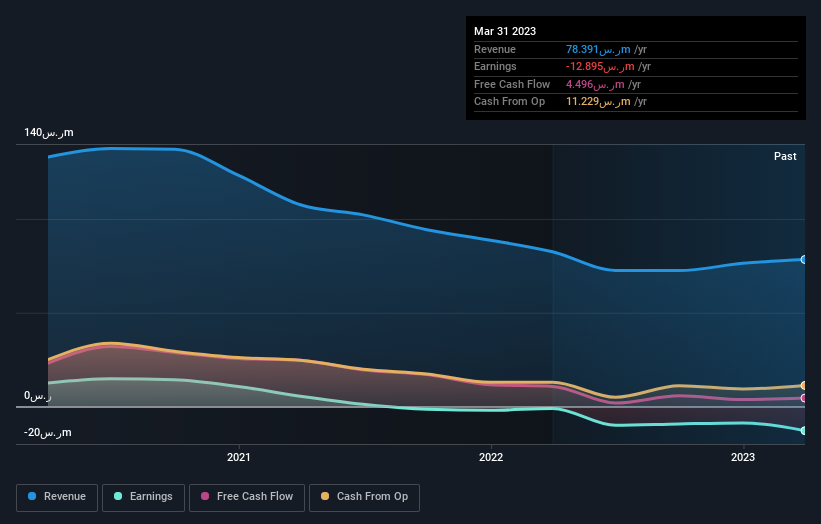

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Saudi Vitrified Clay Pipe shareholders have received a total shareholder return of 5.8% over the last year. That gain is better than the annual TSR over five years, which is 1.8%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Saudi Vitrified Clay Pipe you should be aware of.

But note: Saudi Vitrified Clay Pipe may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Saudi Vitrified Clay Pipe is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2360

Saudi Vitrified Clay Pipe

Saudi Vitrified Clay Pipe Company manufactures and sells vitrified clay pipes and fittings in Saudi Arabia and internationally.

Flawless balance sheet and overvalued.