- Saudi Arabia

- /

- Chemicals

- /

- SASE:2210

Loss-making Nama Chemicals (TADAWUL:2210) sheds a further ر.س77m, taking total shareholder losses to 49% over 3 years

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term Nama Chemicals Company (TADAWUL:2210) shareholders have had that experience, with the share price dropping 49% in three years, versus a market decline of about 3.7%. And the ride hasn't got any smoother in recent times over the last year, with the price 26% lower in that time. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days. Of course, this share price action may well have been influenced by the 9.3% decline in the broader market, throughout the period.

Since Nama Chemicals has shed ر.س77m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Nama Chemicals

Given that Nama Chemicals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Nama Chemicals' revenue dropped 5.1% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 14%, annualized. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

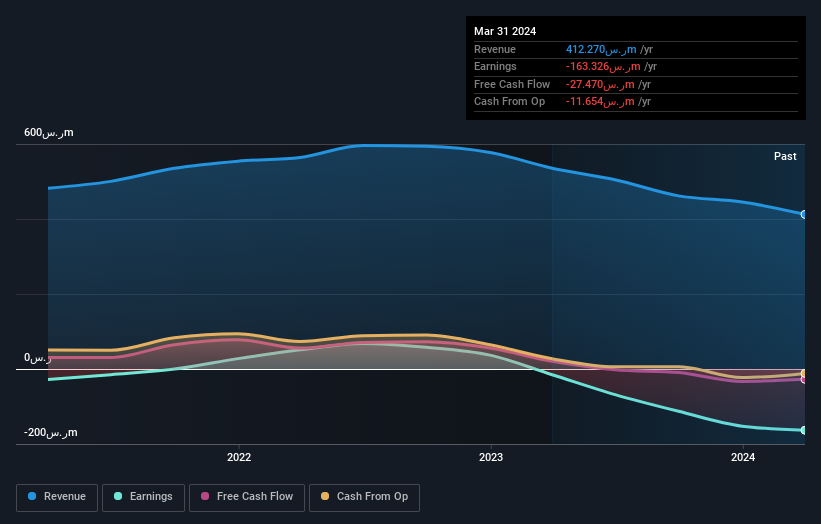

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 7.4% in the twelve months, Nama Chemicals shareholders did even worse, losing 26%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Nama Chemicals is showing 2 warning signs in our investment analysis , you should know about...

Of course Nama Chemicals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nama Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2210

Nama Chemicals

NAMA Chemicals Company, together with its subsidiaries, owns, operates, and manages industrial projects in the petrochemical and chemical sectors in Saudi Arabia, the Gulf countries, Asia, Africa, Europe, and other territories.

Very low with worrying balance sheet.