- Saudi Arabia

- /

- Insurance

- /

- SASE:8260

Gulf General Cooperative Insurance (TADAWUL:8260 investor three-year losses grow to 61% as the stock sheds ر.س68m this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Gulf General Cooperative Insurance Company (TADAWUL:8260) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 61% share price collapse, in that time. The falls have accelerated recently, with the share price down 28% in the last three months.

With the stock having lost 16% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Gulf General Cooperative Insurance

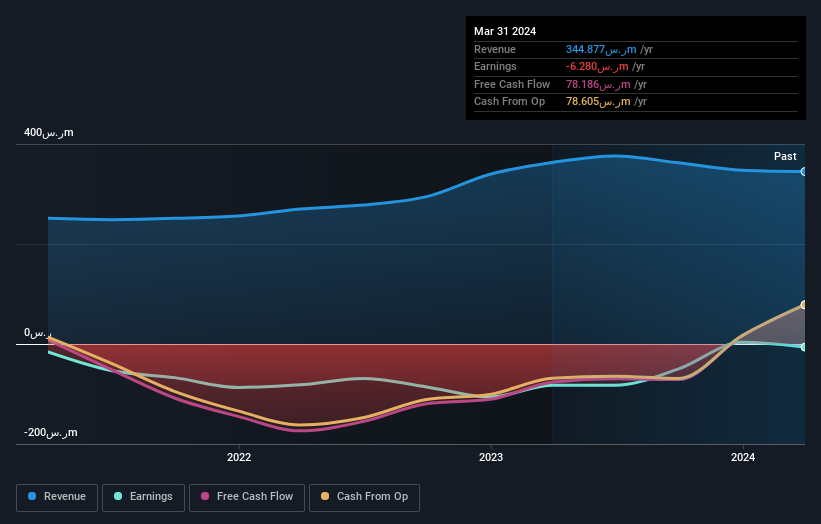

Given that Gulf General Cooperative Insurance didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Gulf General Cooperative Insurance grew revenue at 15% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 17% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. So this is one stock that might be worth investigating further, or even adding to your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Gulf General Cooperative Insurance's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Gulf General Cooperative Insurance shareholders are down 16% for the year. Unfortunately, that's worse than the broader market decline of 5.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Gulf General Cooperative Insurance is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8260

Gulf General Cooperative Insurance

Provides various insurance products for corporates and individuals in the Kingdom of Saudi Arabia.

Excellent balance sheet very low.