- Saudi Arabia

- /

- Oil and Gas

- /

- SASE:4030

The National Shipping Company of Saudi Arabia's (TADAWUL:4030) Has Performed Well But Fundamentals Look Varied: Is There A Clear Direction For The Stock?

National Shipping Company of Saudi Arabia's (TADAWUL:4030) stock is up by 9.9% over the past three months. Given that the stock prices usually follow long-term business performance, we wonder if the company's mixed financials could have any adverse effect on its current price price movement Particularly, we will be paying attention to National Shipping Company of Saudi Arabia's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for National Shipping Company of Saudi Arabia

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for National Shipping Company of Saudi Arabia is:

17% = ر.س1.8b ÷ ر.س10b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. So, this means that for every SAR1 of its shareholder's investments, the company generates a profit of SAR0.17.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

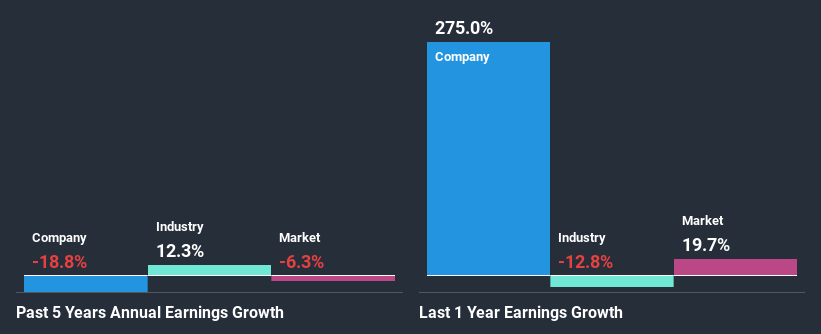

A Side By Side comparison of National Shipping Company of Saudi Arabia's Earnings Growth And 17% ROE

To start with, National Shipping Company of Saudi Arabia's ROE looks acceptable. On comparing with the average industry ROE of 8.5% the company's ROE looks pretty remarkable. As you might expect, the 19% net income decline reported by National Shipping Company of Saudi Arabia is a bit of a surprise. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. These include low earnings retention or poor allocation of capital.

So, as a next step, we compared National Shipping Company of Saudi Arabia's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 17% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if National Shipping Company of Saudi Arabia is trading on a high P/E or a low P/E, relative to its industry.

Is National Shipping Company of Saudi Arabia Efficiently Re-investing Its Profits?

With a three-year median payout ratio as high as 103%,National Shipping Company of Saudi Arabia's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Paying a dividend beyond their means is usually not viable over the long term. You can see the 3 risks we have identified for National Shipping Company of Saudi Arabia by visiting our risks dashboard for free on our platform here.

Moreover, National Shipping Company of Saudi Arabia has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

Overall, we have mixed feelings about National Shipping Company of Saudi Arabia. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of National Shipping Company of Saudi Arabia's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading National Shipping Company of Saudi Arabia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Shipping Company of Saudi Arabia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:4030

National Shipping Company of Saudi Arabia

The National Shipping Company of Saudi Arabia, together with its subsidiaries, purchases, sells, and operates vessels for the transportation of cargo in the Kingdom of Saudi Arabia.

Excellent balance sheet with proven track record.