- Saudi Arabia

- /

- Diversified Financial

- /

- SASE:4130

Shareholders in Al-Baha Investment And Development (TADAWUL:4130) have lost 47%, as stock drops 13% this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Al-Baha Investment And Development Company (TADAWUL:4130) shareholders have had that experience, with the share price dropping 60% in three years, versus a market return of about 26%. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

If the past week is anything to go by, investor sentiment for Al-Baha Investment And Development isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Al-Baha Investment And Development

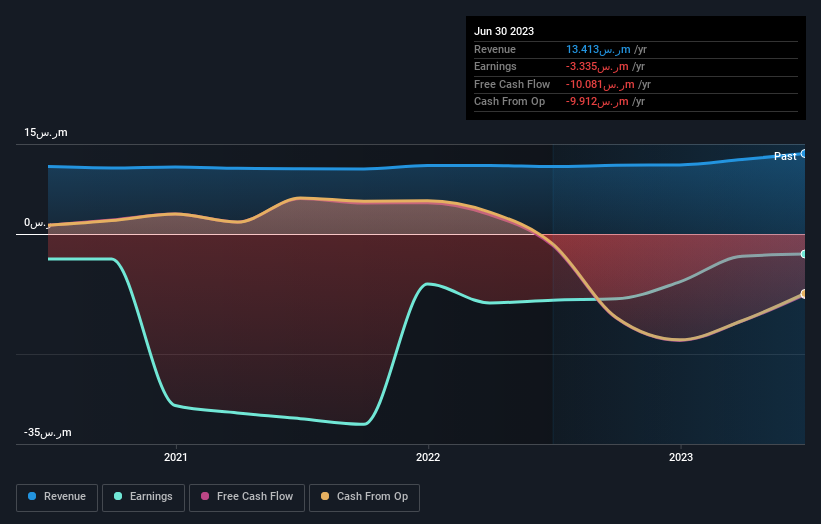

Given that Al-Baha Investment And Development didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Al-Baha Investment And Development grew revenue at 4.7% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 17% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. After all, growing a business isn't easy, and the process will not always be smooth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Al-Baha Investment And Development stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Al-Baha Investment And Development's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Al-Baha Investment And Development hasn't been paying dividends, but its TSR of -47% exceeds its share price return of -60%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 2.9% in the last year, Al-Baha Investment And Development shareholders lost 8.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Al-Baha Investment And Development (3 can't be ignored) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4130

Al-Baha Investment and Development

Manages and leases residential and non-residential real estates in the Kingdom of Saudi Arabia.

Excellent balance sheet low.