- Israel

- /

- Electronic Equipment and Components

- /

- TASE:TLSY

Alef Education Holding And 2 Other Undiscovered Gems In Middle East Markets

Reviewed by Simply Wall St

In the midst of geopolitical tensions and uncertainties surrounding potential Federal Reserve rate cuts, most Gulf bourses have experienced a downturn, with key indices like Qatar's benchmark index slipping amid cautious investor sentiment. Despite these challenges, the Middle East market still holds potential for discovering undervalued stocks that can thrive in such volatile environments; identifying companies with strong fundamentals and growth prospects becomes crucial for investors seeking opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 13.06% | 3.14% | ★★★★★★ |

| Terminal X Online | 17.70% | 12.39% | 35.35% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | -32.50% | -4.61% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Alef Education Holding (ADX:ALEFEDT)

Simply Wall St Value Rating: ★★★★★★

Overview: Alef Education Holding plc, along with its subsidiary, offers AI-driven educational solutions across the UAE, Indonesia, the US, and Saudi Arabia with a market capitalization of AED7.21 billion.

Operations: Alef Education Holding generates revenue primarily from Education Solutions, amounting to AED662.50 million, and Support and Services, contributing AED99.63 million. The company's market capitalization stands at AED7.21 billion.

Alef Education Holding, a small but promising player in the education sector, showcases robust financial health with no debt and high-quality earnings. Over the past year, revenue grew to AED 357.28 million from AED 354.16 million, while net income increased to AED 232.26 million from AED 226.16 million. Despite trading at a good value—17% below its estimated fair value—its earnings growth of 3.9% lagged behind the industry average of 6.6%. With consistent dividend payouts and projected revenue growth of up to 4%, Alef seems poised for steady performance driven by its seasonal billing cycle in education services.

- Take a closer look at Alef Education Holding's potential here in our health report.

Gain insights into Alef Education Holding's past trends and performance with our Past report.

Al Hassan Ghazi Ibrahim Shaker (SASE:1214)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Hassan Ghazi Ibrahim Shaker Company operates in Saudi Arabia and Jordan, focusing on the trading, wholesale, and maintenance of spare parts, electronic equipment, household equipment, and air-conditioners, with a market cap of SAR1.59 billion.

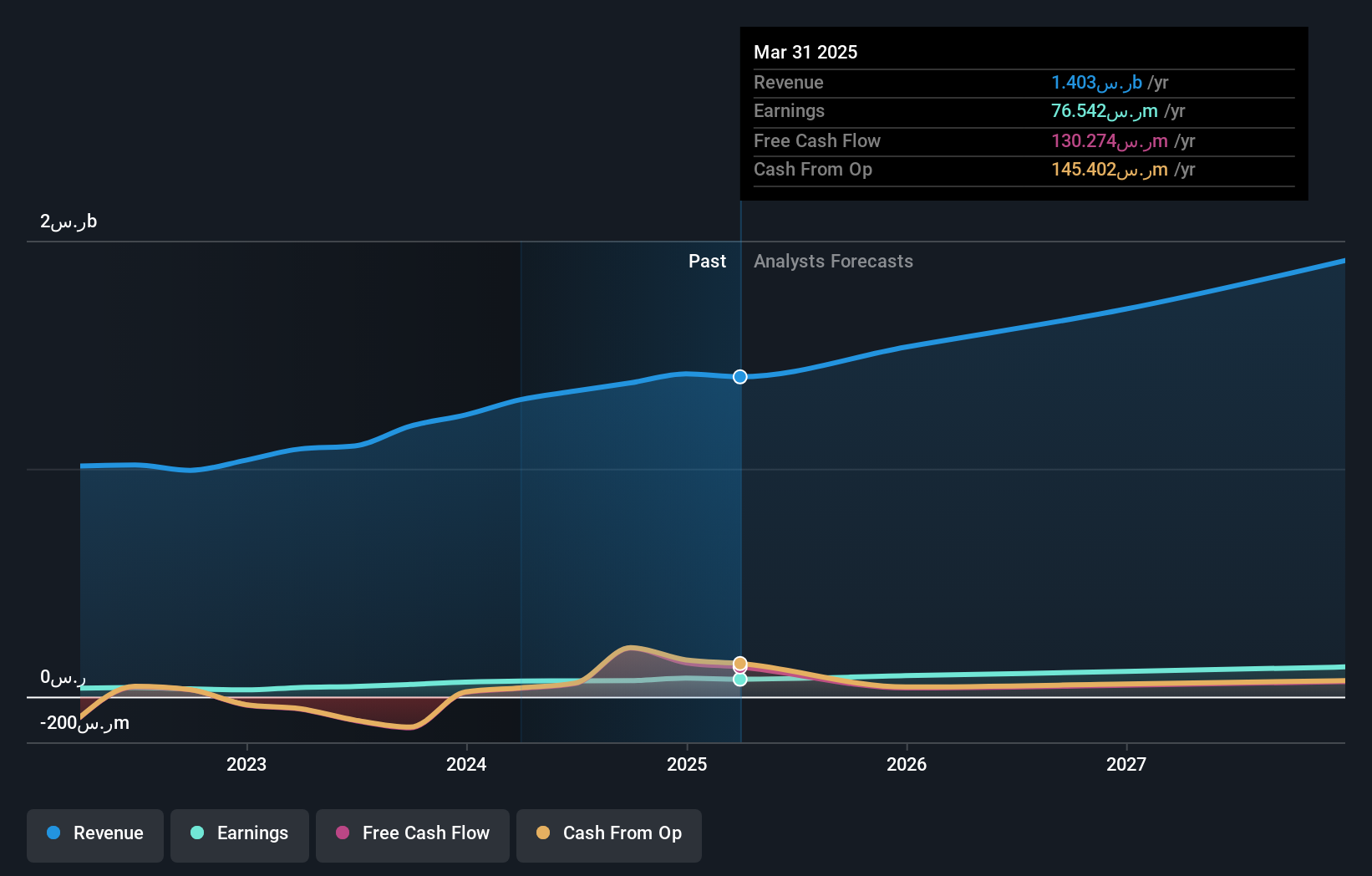

Operations: The company's primary revenue streams are derived from Heating, Ventilation and Air-Conditioning Solutions (HVAC), contributing SAR1.07 billion, and Home Appliances, generating SAR353.79 million. The net profit margin shows an interesting trend, reflecting the company's ability to manage costs effectively relative to its revenue generation in these segments.

Shaker, a notable player in the Middle East's appliance distribution sector, has shown resilience with earnings growing 39.6% annually over five years. The company's net debt to equity ratio stands at a satisfactory 31.2%, having improved from 59.4% five years ago, indicating prudent financial management. Recent results highlight sales of SAR 368.77 million for Q2 2025, up from SAR 345.14 million last year, and net income at SAR 19.9 million compared to SAR 16.45 million previously, reflecting steady growth amidst industry challenges and competitive pressures in the Trade Distributors sector where Shaker's earnings grew by only 15.1%.

- Click to explore a detailed breakdown of our findings in Al Hassan Ghazi Ibrahim Shaker's health report.

Learn about Al Hassan Ghazi Ibrahim Shaker's historical performance.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★★

Overview: Telsys Ltd. is engaged in the marketing and distribution of electronic components within Israel, with a market capitalization of approximately ₪2.03 billion.

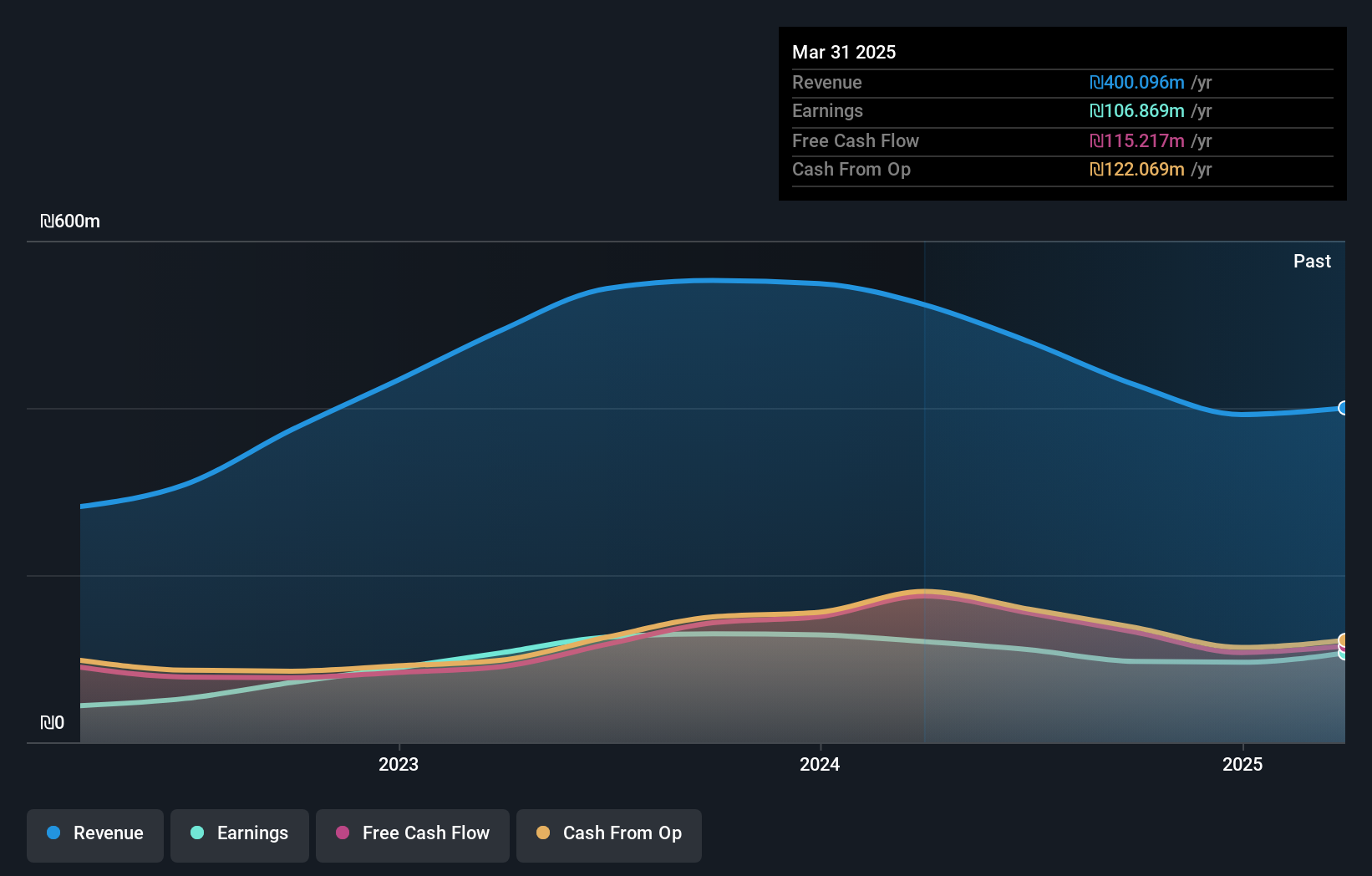

Operations: Telsys generates revenue primarily from two segments: SOM Sector and Distribution, with revenues of ₪276.83 million and ₪128.70 million, respectively.

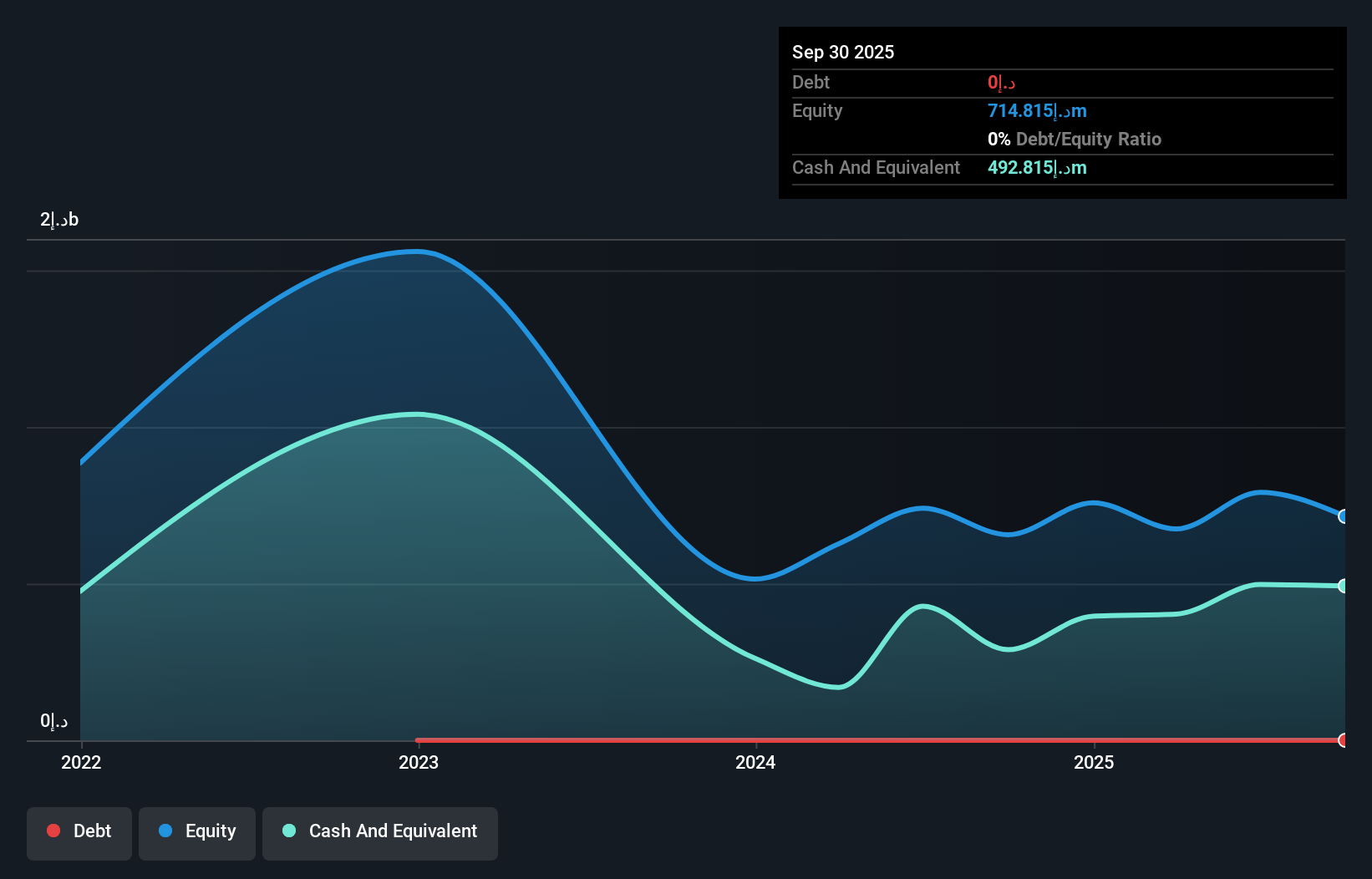

Telsys, a relatively smaller player in the electronics sector, has seen its net income rise to ILS 32.23 million from ILS 21.04 million year-on-year, highlighting a robust performance despite facing negative earnings growth of -11.3% over the past year compared to the industry average of 10.3%. The company's debt situation appears favorable with a reduction in its debt-to-equity ratio from 16.7% to 8% over five years, and it holds more cash than total debt, ensuring financial stability. Recent earnings per share increased to ILS 3.56 from ILS 2.33, reflecting improved profitability and high-quality earnings amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Telsys.

Review our historical performance report to gain insights into Telsys''s past performance.

Taking Advantage

- Unlock our comprehensive list of 219 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telsys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TLSY

Telsys

Telsys Ltd. markets and distributes electronic components and open tools in Israel.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives