David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Public Joint Stock Company Gazprom (MCX:GAZP) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Gazprom

What Is Gazprom's Net Debt?

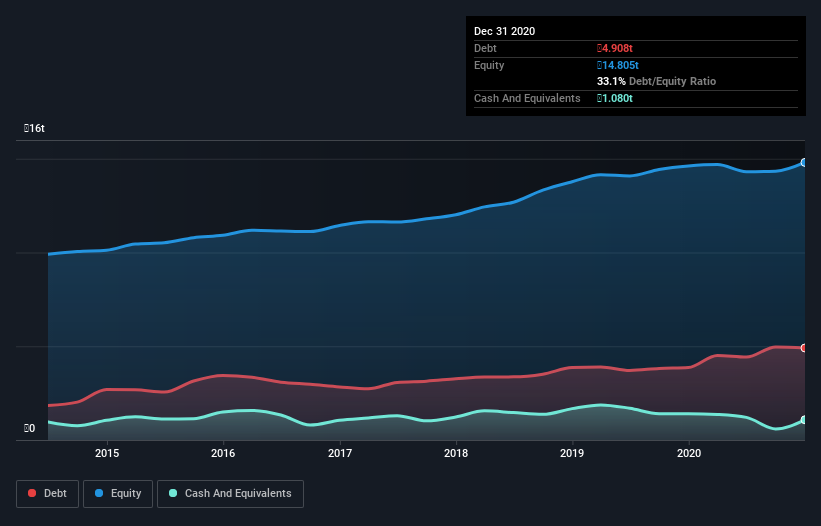

The image below, which you can click on for greater detail, shows that at December 2020 Gazprom had debt of ₽4.91t, up from ₽3.86t in one year. However, it does have ₽1.08t in cash offsetting this, leading to net debt of about ₽3.83t.

How Strong Is Gazprom's Balance Sheet?

According to the last reported balance sheet, Gazprom had liabilities of ₽2.63t due within 12 months, and liabilities of ₽5.92t due beyond 12 months. Offsetting these obligations, it had cash of ₽1.08t as well as receivables valued at ₽1.36t due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₽6.11t.

This deficit is considerable relative to its very significant market capitalization of ₽6.11t, so it does suggest shareholders should keep an eye on Gazprom's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Gazprom's net debt is 2.8 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 43.2 is very high, suggesting that the interest expense on the debt is currently quite low. Shareholders should be aware that Gazprom's EBIT was down 57% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Gazprom can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Gazprom recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Mulling over Gazprom's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Gazprom to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Gazprom you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Gazprom or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:GAZP

Gazprom

Public Joint Stock Company Gazprom, an integrated energy company, engages in the geological exploration, production, processing, storage, transportation, and sale of gas, gas condensates, and oil in Russia and internationally.

Solid track record with excellent balance sheet and pays a dividend.