- Serbia

- /

- Oil and Gas

- /

- BELEX:NIIS

Do Investors Have Good Reason To Be Wary Of Naftna Industrija Srbije a.d.'s (BELEX:NIIS) 5.7% Dividend Yield?

Today we'll take a closer look at Naftna Industrija Srbije a.d. (BELEX:NIIS) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Naftna Industrija Srbije a.d is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . Some simple research can reduce the risk of buying Naftna Industrija Srbije a.d for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Naftna Industrija Srbije a.d paid out 46% of its profit as dividends. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Last year, Naftna Industrija Srbije a.d paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Remember, you can always get a snapshot of Naftna Industrija Srbije a.d's latest financial position, by checking our visualisation of its financial health.

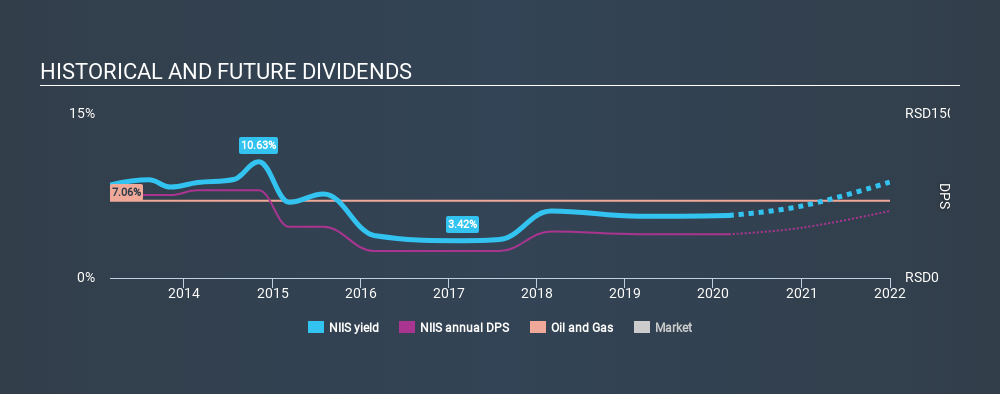

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the data, we can see that Naftna Industrija Srbije a.d has been paying a dividend for the past seven years. It's good to see that Naftna Industrija Srbije a.d has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past seven-year period, the first annual payment was дин75.83 in 2013, compared to дин39.97 last year. The dividend has shrunk at around 8.7% a year during that period. Naftna Industrija Srbije a.d's dividend has been cut sharply at least once, so it hasn't fallen by 8.7% every year, but this is a decent approximation of the long term change.

A shrinking dividend over a seven-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. Over the past five years, it looks as though Naftna Industrija Srbije a.d's EPS have declined at around 22% a year. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

To summarise, shareholders should always check that Naftna Industrija Srbije a.d's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we like Naftna Industrija Srbije a.d's low dividend payout ratio, although we're a bit concerned that it paid out a substantially higher percentage of its free cash flow. Earnings per share are down, and Naftna Industrija Srbije a.d's dividend has been cut at least once in the past, which is disappointing. In summary, Naftna Industrija Srbije a.d has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

See if management have their own wealth at stake, by checking insider shareholdings in Naftna Industrija Srbije a.d stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BELEX:NIIS

Naftna Industrija Srbije a.d

An integrated oil company, engages in the exploration, development, and production of crude oil and gas in Serbia.

Flawless balance sheet slight.