- Romania

- /

- Other Utilities

- /

- BVB:PE

Premier Energy And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

In the European market, recent fluctuations in major indices like the STOXX Europe 600 reflect a cautious sentiment as investors weigh the impact of steady interest rates from the European Central Bank and mixed economic indicators. With inflation near target levels and a slight uptick in economic growth, attention turns to small-cap stocks that can offer unique opportunities amidst broader market uncertainties. Identifying promising stocks often involves looking for companies with strong fundamentals and potential for growth despite prevailing economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Alantra Partners | NA | -6.09% | -33.39% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Premier Energy (BVB:PE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Premier Energy PLC is an integrated energy and power infrastructure company operating in Romania, Moldova, Hungary, and Serbia with a market capitalization of RON27.50 billion.

Operations: Premier Energy PLC generates revenue primarily through its Moldova Electricity (€506.61 million), Romania Energy Supply (€429.13 million), Natural Gas (€402.62 million), and Romania Renewable Energy (€217.53 million) segments, with a segment adjustment of -€18.74 million affecting overall figures.

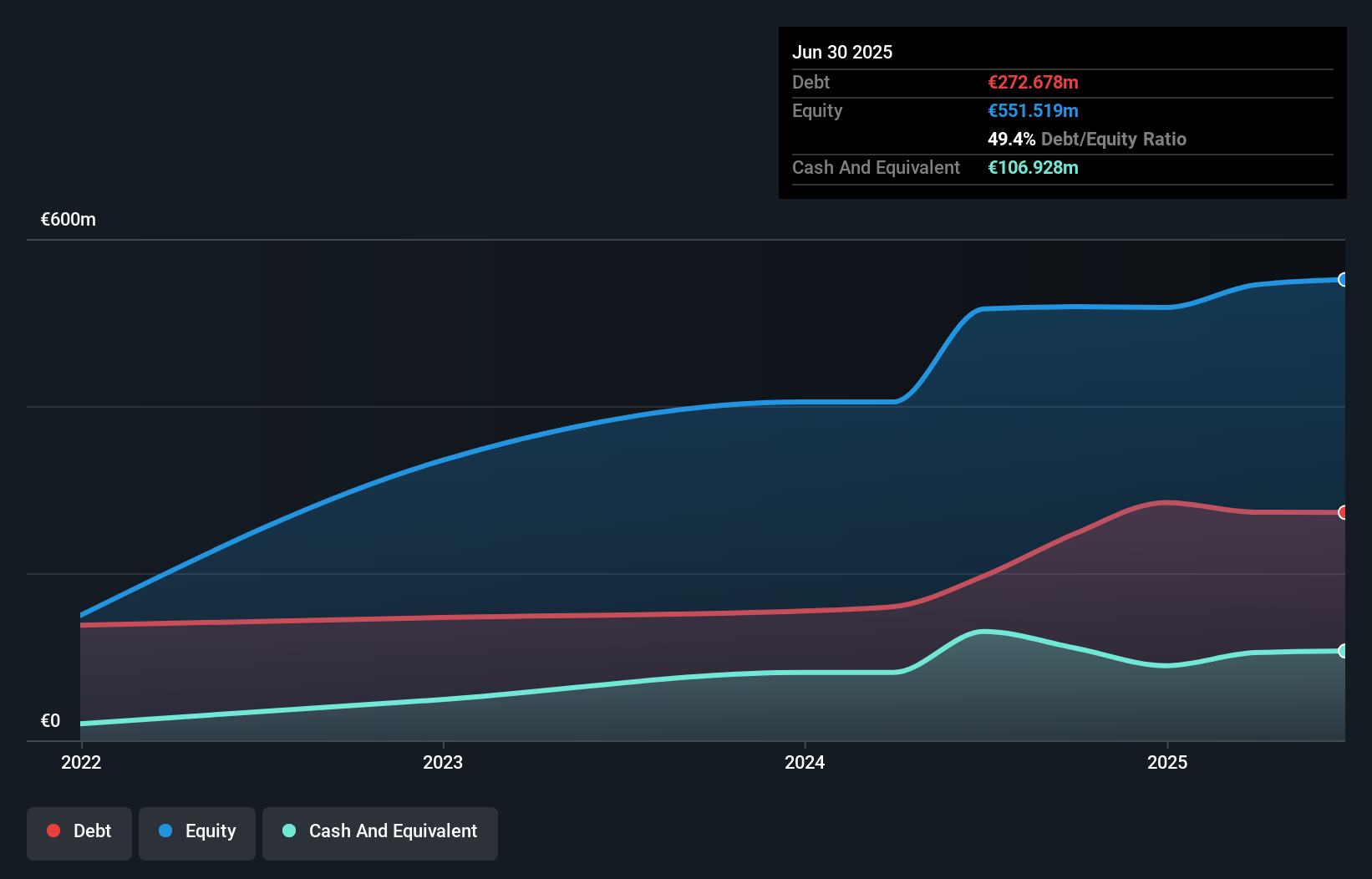

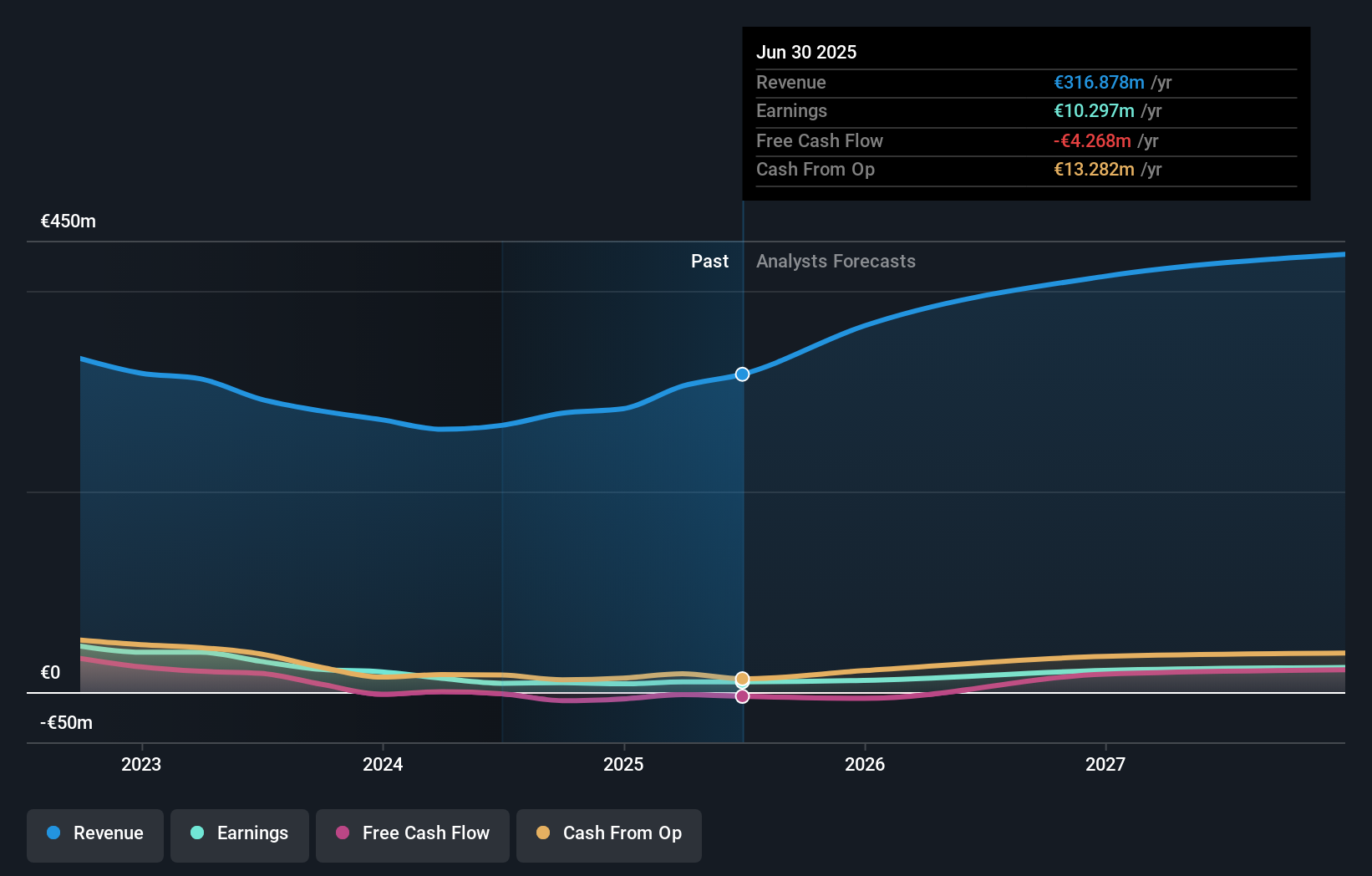

Premier Energy, a small cap in the European market, has shown impressive growth with earnings surging by 51% over the past year. Despite a 15.6% annual decline in earnings over five years, recent results highlight resilience; sales for Q2 reached €350.77 million from last year's €259.02 million, and net income rose to €32.57 million from €26.6 million. Trading at 84% below estimated fair value suggests potential undervaluation while its net debt to equity ratio of 30% is satisfactory, indicating manageable debt levels and well-covered interest payments with EBIT coverage at 6x interest obligations.

- Click here to discover the nuances of Premier Energy with our detailed analytical health report.

Explore historical data to track Premier Energy's performance over time in our Past section.

Koskisen Oyj (HLSE:KOSKI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Koskisen Oyj is a Finnish company engaged in the wood industry, serving markets in Finland, Japan, Germany, Poland, and other European countries with a market capitalization of €227.45 million.

Operations: Koskisen Oyj generates revenue primarily from its Panel Industry and Sawn Timber Industry segments, with sales of €146.06 million and €200.29 million, respectively. The company faces a reduction in total revenue due to eliminations of internal sales amounting to €30.59 million.

Koskisen, a notable player in the forestry sector, is making strides with its recent business expansions. The company's new briquette plant at Jarvela aims to produce 7,500-10,000 tonnes annually of biofuel briquettes from sawmill by-products. This initiative aligns with their strategic investments over the past five years totaling €80 million in enhancing production efficiency and capacity. Recent earnings reports show growth; sales for Q2 2025 reached €89.7 million up from €77.82 million year-on-year, while net income increased to €5.01 million from €4.93 million last year, reflecting robust performance despite industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Koskisen Oyj.

Assess Koskisen Oyj's past performance with our detailed historical performance reports.

Boozt (OM:BOOZT)

Simply Wall St Value Rating: ★★★★★★

Overview: Boozt AB (publ) operates as an online retailer offering a wide range of fashion, apparel, shoes, accessories, kids' products, home goods, sports items, and beauty products with a market capitalization of approximately SEK6.54 billion.

Operations: The company's primary revenue streams are derived from its diverse online sales of fashion, apparel, shoes, accessories, kids' products, home goods, sports items, and beauty products. It has a market capitalization of approximately SEK6.54 billion.

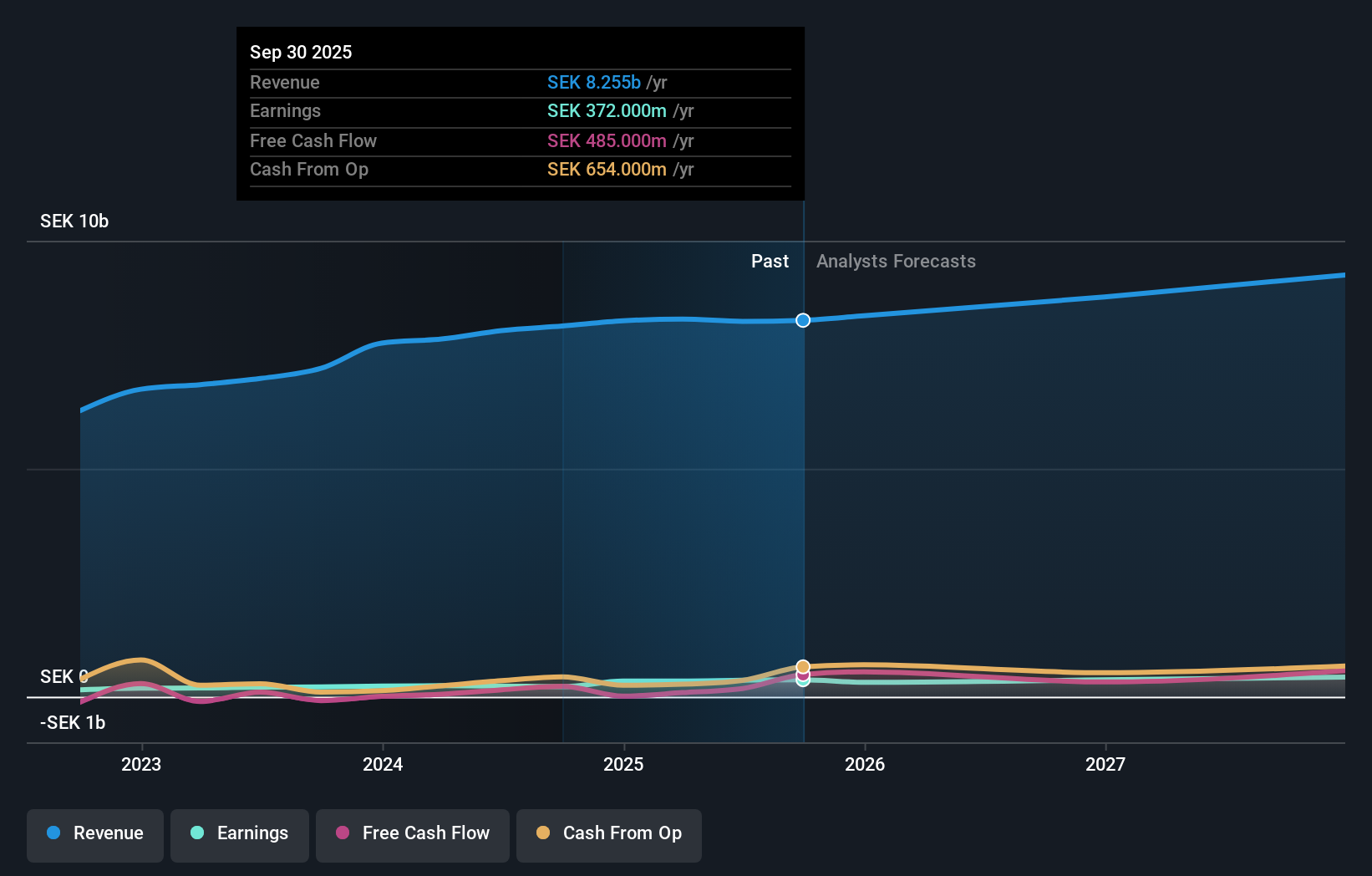

Boozt, a notable player in the Nordic online retail market, has shown impressive financial resilience and strategic growth. Over the past year, earnings surged by 69.9%, significantly outpacing the industry average of 25%. The company also boasts a robust debt position with its debt to equity ratio dropping from 36.2% to just 7.4% over five years, while maintaining more cash than total debt. Recently, Boozt repurchased over 2 million shares for SEK 235 million, reflecting confidence in its valuation at SEK 97.5 per share as analysts foresee revenue growing by about 7% annually despite potential margin contractions.

Turning Ideas Into Actions

- Embark on your investment journey to our 323 European Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:PE

Premier Energy

Operates as an integrated energy and power infrastructure company in Romania, Moldova, Hungary, and Serbia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives