- Saudi Arabia

- /

- Professional Services

- /

- SASE:1831

August 2024's Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets continue to recover from the August 5 sell-off, investor optimism is bolstered by positive news on inflation and growth, raising hopes for a "soft landing" in the U.S. economy. In this favorable environment, identifying growth companies with high insider ownership can be particularly rewarding, as these stocks often benefit from strong internal confidence and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.7% |

| Yggdrazil Group (SET:YGG) | 12% | 85.5% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| HANA Micron (KOSDAQ:A067310) | 20.2% | 97.4% |

We're going to check out a few of the best picks from our screener tool.

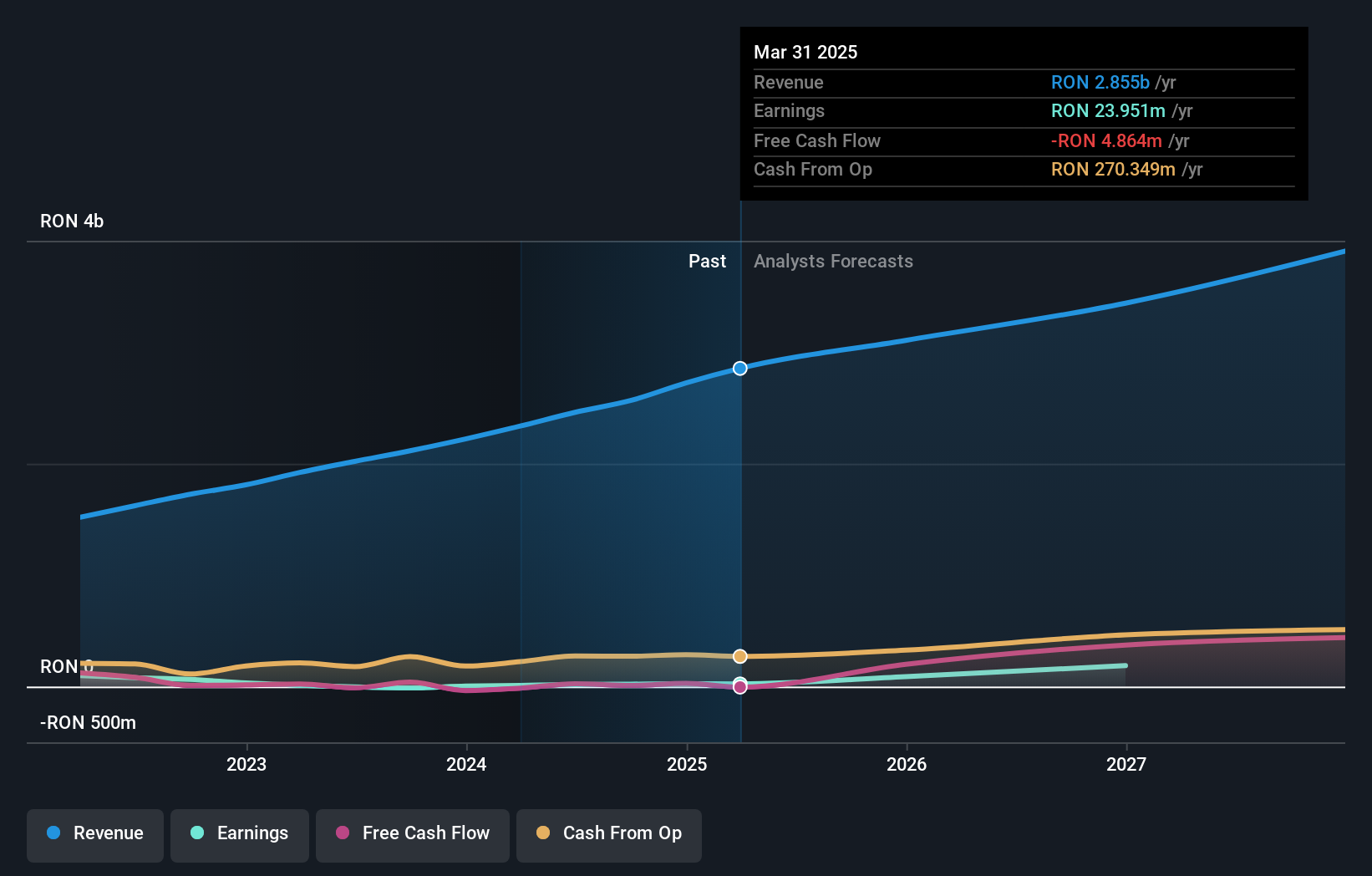

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Med Life S.A., a private healthcare provider with a market cap of RON3.27 billion, offers healthcare services in Bucharest, Cluj, Braila, Timisoara, Iasi, Galati, Ploiesti, Constanta and Targu Mures.

Operations: The company's revenue segments include Clinics (RON879.25 million), Corporate (RON275.69 million), Hospitals (RON523.05 million), Pharmacies (RON58.89 million), Stomatology (RON121.76 million) and Laboratories (RON241.77 million).

Insider Ownership: 39.2%

Earnings Growth Forecast: 51.2% p.a.

Med Life exhibits strong growth potential with significant insider ownership. Its earnings are forecast to grow significantly at 51.17% per year, outpacing the broader market's 1.7%. Although revenue growth is expected to be slower at 10% annually, it still surpasses the market average of 1.3%. Trading at a substantial discount of 34.1% below its estimated fair value, Med Life's financial position is solid despite large one-off items impacting results and limited recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Med Life.

- The valuation report we've compiled suggests that Med Life's current price could be quite moderate.

Maharah for Human Resources (SASE:1831)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maharah for Human Resources Company offers manpower services to public and private sectors in Saudi Arabia and the United Arab Emirates, with a market cap of SAR3.27 billion.

Operations: The company's revenue segments include Corporate (SAR1.46 billion), Individual (SAR433.68 million), and Facility Management (SAR116.65 million).

Insider Ownership: 26.4%

Earnings Growth Forecast: 15.4% p.a.

Maharah for Human Resources demonstrates robust growth with high insider ownership. Recent earnings showed a significant increase, with net income rising to SAR 51.11 million from SAR 35.1 million year-over-year for Q2 2024, and sales reaching SAR 537.1 million. Forecasts indicate annual revenue growth of 10.9%, outpacing the SA market's average, while earnings are expected to grow by 15.4% per year. Despite a volatile share price and dividends not well-covered by free cash flows, its P/E ratio of 24.9x remains attractive compared to the market average of 25.8x.

- Unlock comprehensive insights into our analysis of Maharah for Human Resources stock in this growth report.

- Our comprehensive valuation report raises the possibility that Maharah for Human Resources is priced higher than what may be justified by its financials.

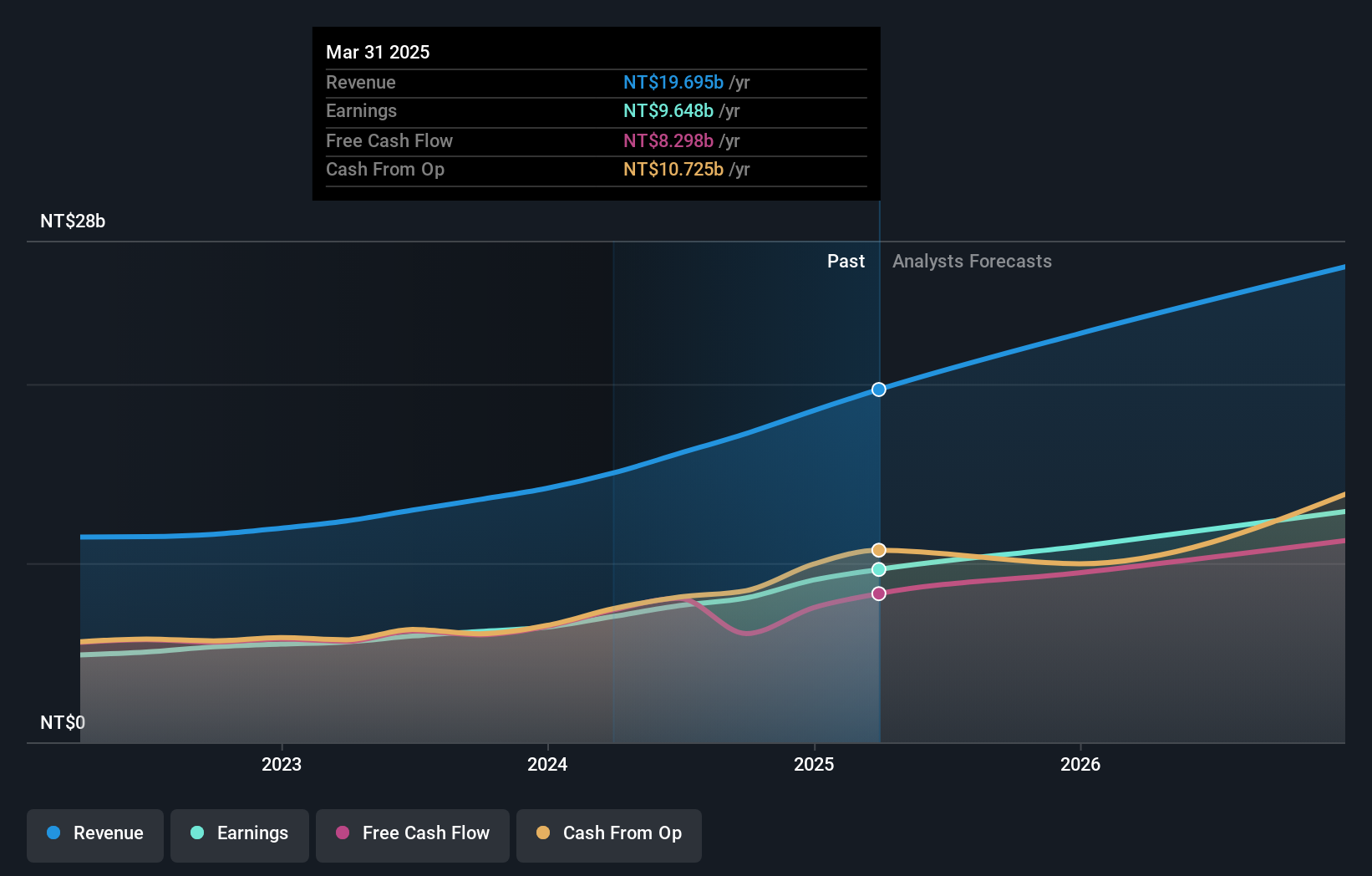

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Games System Co., Ltd. is engaged in planning, designing, researching, developing, manufacturing, marketing, servicing, and licensing arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$231.64 billion.

Operations: The company's revenue segments include NT$8.99 billion from the Online Games Division and NT$7.13 billion from the Business Game Division.

Insider Ownership: 12.5%

Earnings Growth Forecast: 19.4% p.a.

International Games System Ltd. showcases strong growth with high insider ownership. Recent earnings for Q2 2024 reported sales of TWD 4.58 billion, up from TWD 3.48 billion a year ago, and net income increased to TWD 2.28 billion from TWD 1.66 billion. Forecasts suggest revenue growth of 20.6% per year, outpacing the TW market's average, while earnings are expected to grow by 19.35% annually despite recent share price volatility and no significant insider trading activity in the past three months.

- Get an in-depth perspective on International Games SystemLtd's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report International Games SystemLtd implies its share price may be too high.

Key Takeaways

- Investigate our full lineup of 1483 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1831

Maharah for Human Resources

Provides manpower services to public and private sectors in Saudi Arabia and the United Arab Emirates.

Reasonable growth potential with proven track record.