- Romania

- /

- Food and Staples Retail

- /

- BVB:RPH

European Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

European markets have recently faced challenges, with the pan-European STOXX Europe 600 Index ending lower amid concerns about overvaluation in AI-related stocks. Despite the broader market pullback, opportunities still exist for investors willing to explore smaller companies that might offer untapped potential. Penny stocks, although a somewhat outdated term, continue to represent a niche investment area where those backed by strong financials can present intriguing growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.712 | €1.28B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.06 | €15.75M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €2.02 | €27.91M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.58 | €404.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.959 | €77.39M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €4.04 | €79.03M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.01 | €277.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.876 | €29.34M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 282 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Renovalo (BIT:RNV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Renovalo S.p.A. operates in the construction industry in Italy with a market cap of €15.96 million.

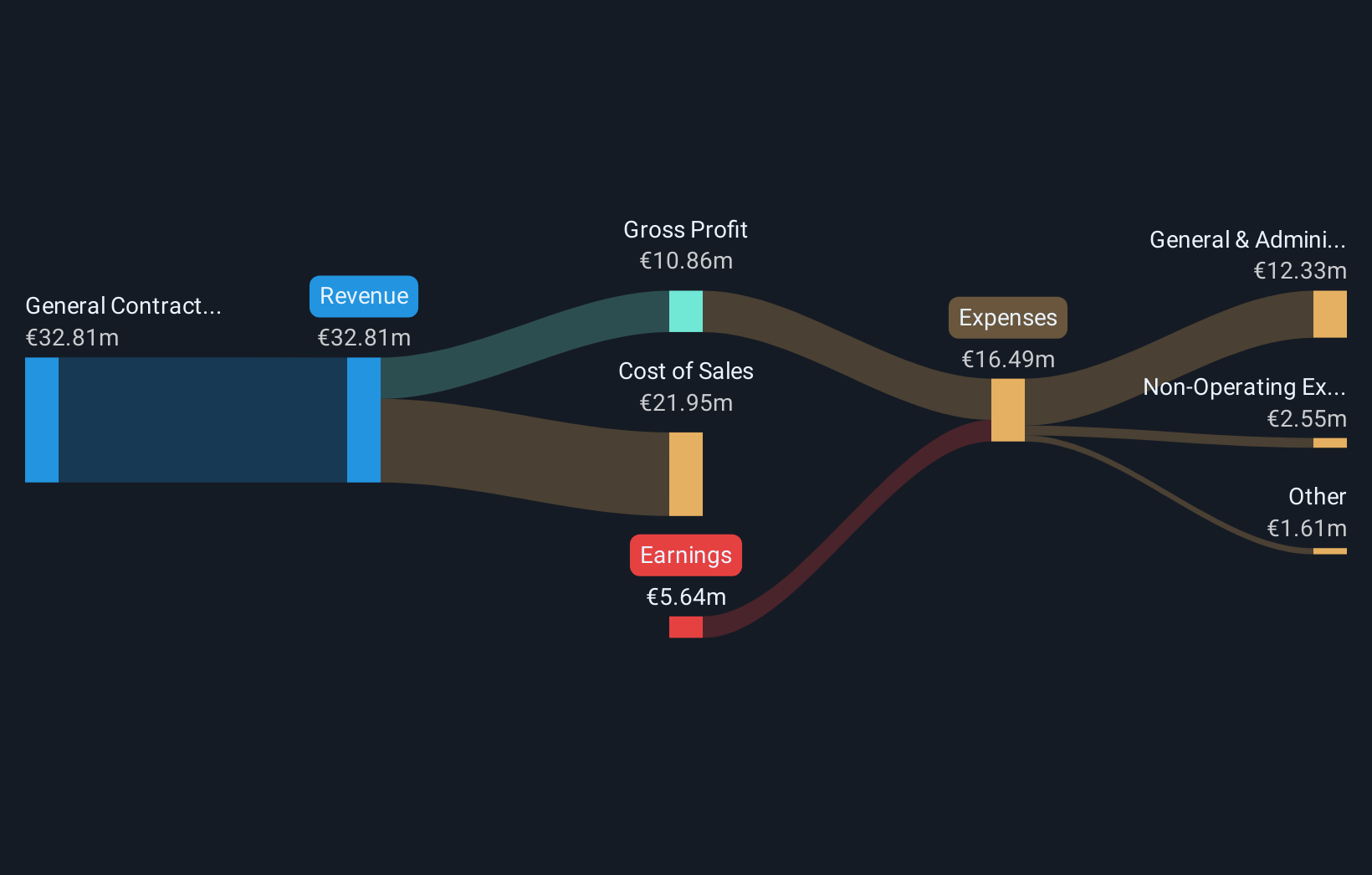

Operations: Renovalo S.p.A. generates its revenue primarily from its General Contractors segment, amounting to €32.81 million.

Market Cap: €15.96M

Renovalo S.p.A., with a market cap of €15.96 million, operates in Italy's construction sector and reported half-year revenue of €17.08 million, up from €12.44 million the previous year. Despite this growth, the company remains unprofitable with a net loss of €4.33 million for the same period. Its short-term assets (€48.3M) comfortably cover both its short-term (€18.4M) and long-term liabilities (€11.1M). However, Renovalo’s stock has experienced high volatility recently and its earnings have declined significantly over five years by 35.5% annually, indicating challenges in achieving profitability amidst fluctuating market conditions.

- Get an in-depth perspective on Renovalo's performance by reading our balance sheet health report here.

- Gain insights into Renovalo's outlook and expected performance with our report on the company's earnings estimates.

S.C. Ropharma (BVB:RPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.C. Ropharma S.A. operates a chain of pharmacies in Romania and has a market cap of RON84.87 million.

Operations: Revenue segments for this company are not reported.

Market Cap: RON84.87M

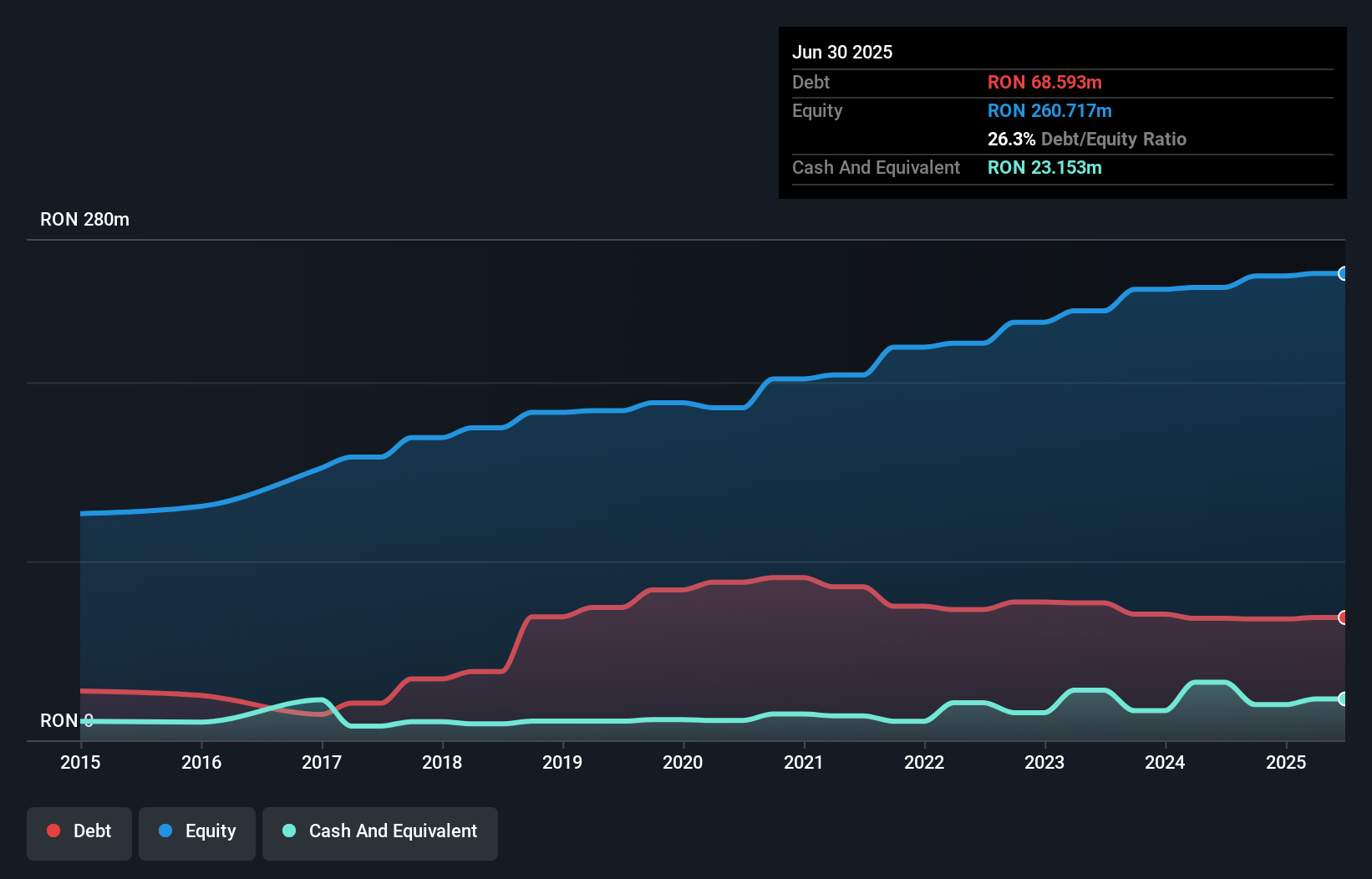

S.C. Ropharma S.A., with a market cap of RON84.87 million, reported half-year sales of RON657.36 million, up from RON558.71 million the previous year, while reducing its net loss to RON1.21 million from RON3.21 million. The company’s debt management is satisfactory with a net debt to equity ratio of 17.4%, and its short-term assets (RON623.4M) exceed both short-term (RON594.5M) and long-term liabilities (RON120.4M). Despite low return on equity at 3%, recent earnings growth has been substantial compared to industry averages, supported by an experienced management team and stable volatility levels over the past year.

- Take a closer look at S.C. Ropharma's potential here in our financial health report.

- Evaluate S.C. Ropharma's historical performance by accessing our past performance report.

Orthex Oyj (HLSE:ORTHEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orthex Oyj is a houseware company that designs, produces, markets, and sells household products in the Nordics, Europe, and internationally with a market cap of €83.29 million.

Operations: The company's revenue is primarily generated from the Nordics (€67.65 million), followed by the Rest of Europe (€19.75 million) and the Rest of The World (€0.94 million).

Market Cap: €83.29M

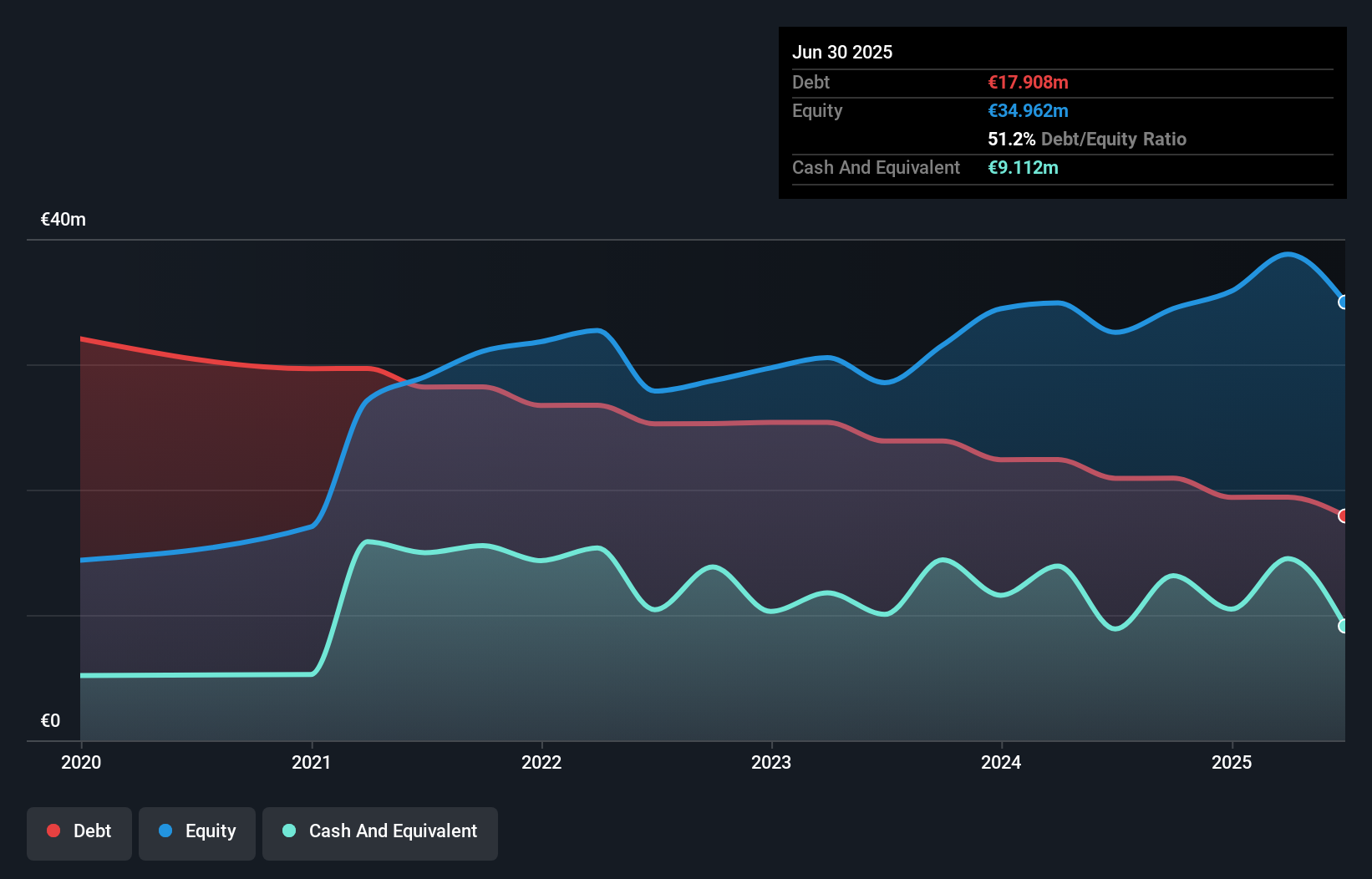

Orthex Oyj, with a market cap of €83.29 million, primarily generates revenue from the Nordics. Despite a decline in earnings over the past year and five years, its debt to equity ratio has significantly improved from 196.7% to 51.2%. The company's interest payments are well covered by EBIT (6.5x), and its operating cash flow covers debt effectively (66.9%). Recent management changes include Aurélien Chabannier's appointment as Sales Director for Europe and International Markets, which might influence future growth strategies. Orthex trades at good value compared to peers but faces challenges with declining profit margins and negative earnings growth recently.

- Dive into the specifics of Orthex Oyj here with our thorough balance sheet health report.

- Gain insights into Orthex Oyj's future direction by reviewing our growth report.

Where To Now?

- Gain an insight into the universe of 282 European Penny Stocks by clicking here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:RPH

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives