Stock Analysis

- Qatar

- /

- Real Estate

- /

- DSM:UDCD

As United Development Company Q.P.S.C (DSM:UDCD) grows 5.1% this past week, investors may now be noticing the company's one-year earnings growth

It's understandable if you feel frustrated when a stock you own sees a lower share price. But often it is not a reflection of the fundamental business performance. The United Development Company Q.P.S.C. (DSM:UDCD) is down 18% over a year, but the total shareholder return is -14% once you include the dividend. That's better than the market which declined 16% over the last year. However, the longer term returns haven't been so bad, with the stock down 2.2% in the last three years. On the other hand the share price has bounced 5.1% over the last week. The buoyant market could have helped drive the share price pop, since stocks are up 4.6% in the same period.

On a more encouraging note the company has added ر.ق205m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for United Development Company Q.P.S.C

SWOT Analysis for United Development Company Q.P.S.C

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Dividend is low compared to the top 25% of dividend payers in the Real Estate market.

- Current share price is above our estimate of fair value.

- UDCD's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine UDCD's earnings prospects.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the United Development Company Q.P.S.C share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

United Development Company Q.P.S.C's dividend seems healthy to us, so we doubt that the yield is a concern for the market. In fact, it seems more likely that the revenue fall of 4.1% in the last year is the worry. So it seems likely that the weak revenue is making the market more cautious about the stock.

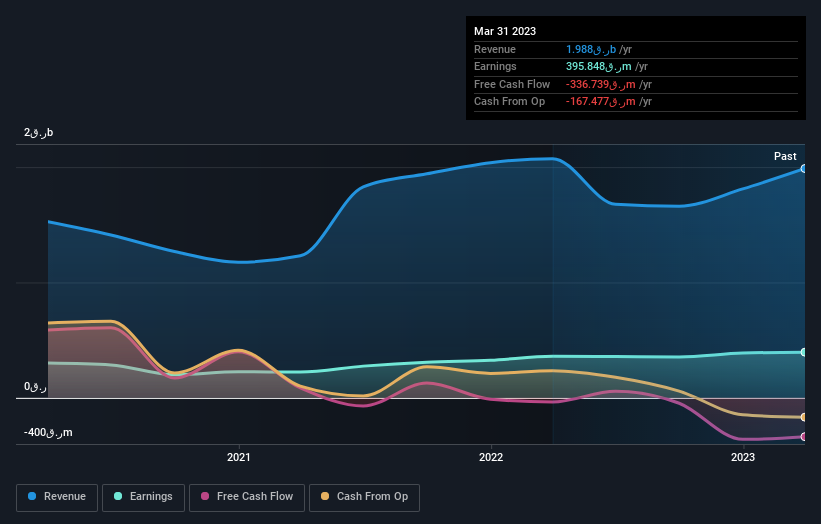

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of United Development Company Q.P.S.C, it has a TSR of -14% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The total return of 14% received by United Development Company Q.P.S.C shareholders over the last year isn't far from the market return of -16%. The silver lining is that longer term investors would have made a total return of 1.6% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for United Development Company Q.P.S.C (1 is potentially serious!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether United Development Company Q.P.S.C is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:UDCD

United Development Company Q.P.S.C

United Development Company Q.P.S.C., together with its subsidiaries, contributes and invests in infrastructure and utilities in the State of Qatar.

Mediocre balance sheet and slightly overvalued.