Stock Analysis

- Qatar

- /

- Capital Markets

- /

- DSM:QOIS

Investors who have held Qatar Oman Investment Company Q.S.C (DSM:QOIS) over the last year have watched its earnings decline along with their investment

Qatar Oman Investment Company Q.S.C. (DSM:QOIS) shareholders should be happy to see the share price up 14% in the last month. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 28% in one year, under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Qatar Oman Investment Company Q.S.C

Given that Qatar Oman Investment Company Q.S.C only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Qatar Oman Investment Company Q.S.C's revenue didn't grow at all in the last year. In fact, it fell 40%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 28% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

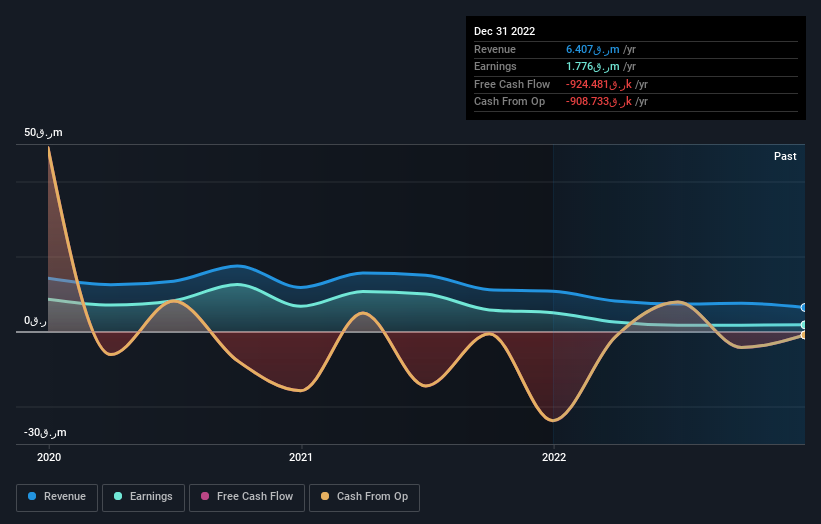

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Qatar Oman Investment Company Q.S.C's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 18% in the twelve months, Qatar Oman Investment Company Q.S.C shareholders did even worse, losing 28%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 0.3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Qatar Oman Investment Company Q.S.C better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Qatar Oman Investment Company Q.S.C (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Qatar Oman Investment Company Q.S.C is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QOIS

Qatar Oman Investment Company Q.S.C

Qatar Oman Investment Company Q.S.C. is a private equity firm specializing in investments in acquisitions.

Excellent balance sheet with weak fundamentals.