Stock Analysis

- Qatar

- /

- Capital Markets

- /

- DSM:DBIS

Dlala Brokerage and Investment Holding Company Q.P.S.C (DSM:DBIS) hikes 10% this week, taking one-year gains to 69%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Dlala Brokerage and Investment Holding Company Q.P.S.C. (DSM:DBIS) share price is 69% higher than it was a year ago, much better than the market decline of around 1.8% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! On the other hand, longer term shareholders have had a tougher run, with the stock falling 45% in three years.

Since the stock has added ر.ق25m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Dlala Brokerage and Investment Holding Company Q.P.S.C

While Dlala Brokerage and Investment Holding Company Q.P.S.C made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Dlala Brokerage and Investment Holding Company Q.P.S.C actually shrunk its revenue over the last year, with a reduction of 13%. Despite the lack of revenue growth, the stock has returned a solid 69% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

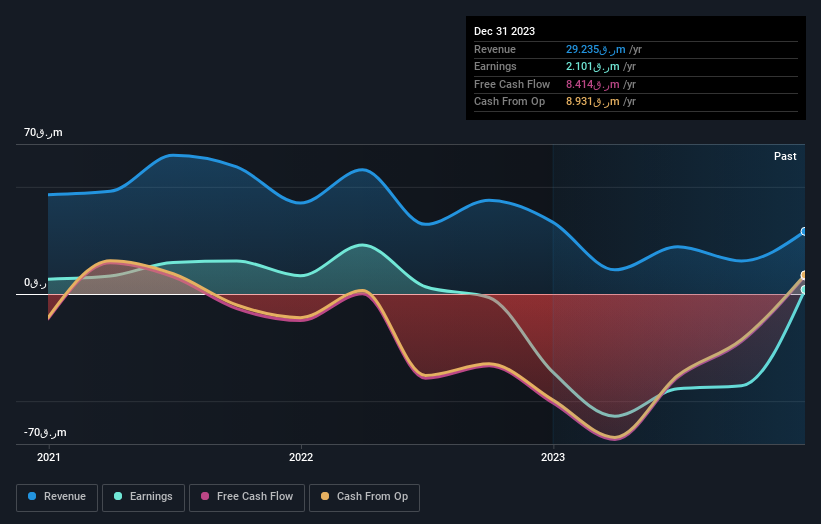

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Dlala Brokerage and Investment Holding Company Q.P.S.C's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Dlala Brokerage and Investment Holding Company Q.P.S.C shareholders have received a total shareholder return of 69% over one year. Notably the five-year annualised TSR loss of 0.5% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Dlala Brokerage and Investment Holding Company Q.P.S.C you should be aware of.

Of course Dlala Brokerage and Investment Holding Company Q.P.S.C may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Dlala Brokerage and Investment Holding Company Q.P.S.C is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:DBIS

Dlala Brokerage and Investment Holding Company Q.P.S.C

Dlala Brokerage and Investment Holding Company Q.P.S.C., together with its subsidiaries, engages in the brokerage activities at the Qatar Stock Exchange.

Flawless balance sheet with questionable track record.