- Portugal

- /

- Electric Utilities

- /

- ENXTLS:EDP

EDP (ENXTLS:EDP) Valuation Insights Following Q3 Earnings: Rising Sales but Softer Profits Shape Outlook

Reviewed by Simply Wall St

EDP (ENXTLS:EDP) has just published its third quarter and nine-month earnings. Investor focus is on the results as sales climbed compared to last year, though net income saw a decline over both periods.

See our latest analysis for EDP.

EDP’s share price has shown strong momentum this year, with a year-to-date gain of almost 23%. This comes despite a recent pullback following the earnings update, where revenue growth contrasted with softer profits. Over the past year, the total shareholder return sits near 21%, reflecting meaningful long-term progress.

With energy companies shifting the landscape, this could be an ideal moment to broaden your investment scope and discover fast growing stocks with high insider ownership.

With EDP’s growth in revenues offset by slimmer profits and the share price not far below analyst targets, the key question is whether this presents a genuine buying opportunity or if the market already anticipates future gains.

Most Popular Narrative: 15.1% Undervalued

EDP is trading at €3.89, while the most-followed narrative points to a fair value estimate of €4.58. This suggests that the current market price remains meaningfully below what analysts believe the shares are worth, increasing investor interest in the company's growth story.

EDP anticipates significant investment growth in electricity networks, driven by increasing electrification, infrastructure modernization, digitalization, and integration of renewable generation. This could boost future revenue through expanded regulated asset bases and improved demand.

Curious what makes this premium price target tick? The narrative hangs on ambitious profit margin gains and a bold transformation of the revenue model. Which crucial assumptions must actually come true for this valuation to hold water? The underlying numbers and market moves might surprise you. Explore the full breakdown to uncover the financial logic analysts are betting on.

Result: Fair Value of $4.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty in Iberia or currency swings in Brazil could quickly challenge the more optimistic views on EDP’s future performance.

Find out about the key risks to this EDP narrative.

Another View: Price Ratios Tell a Different Story

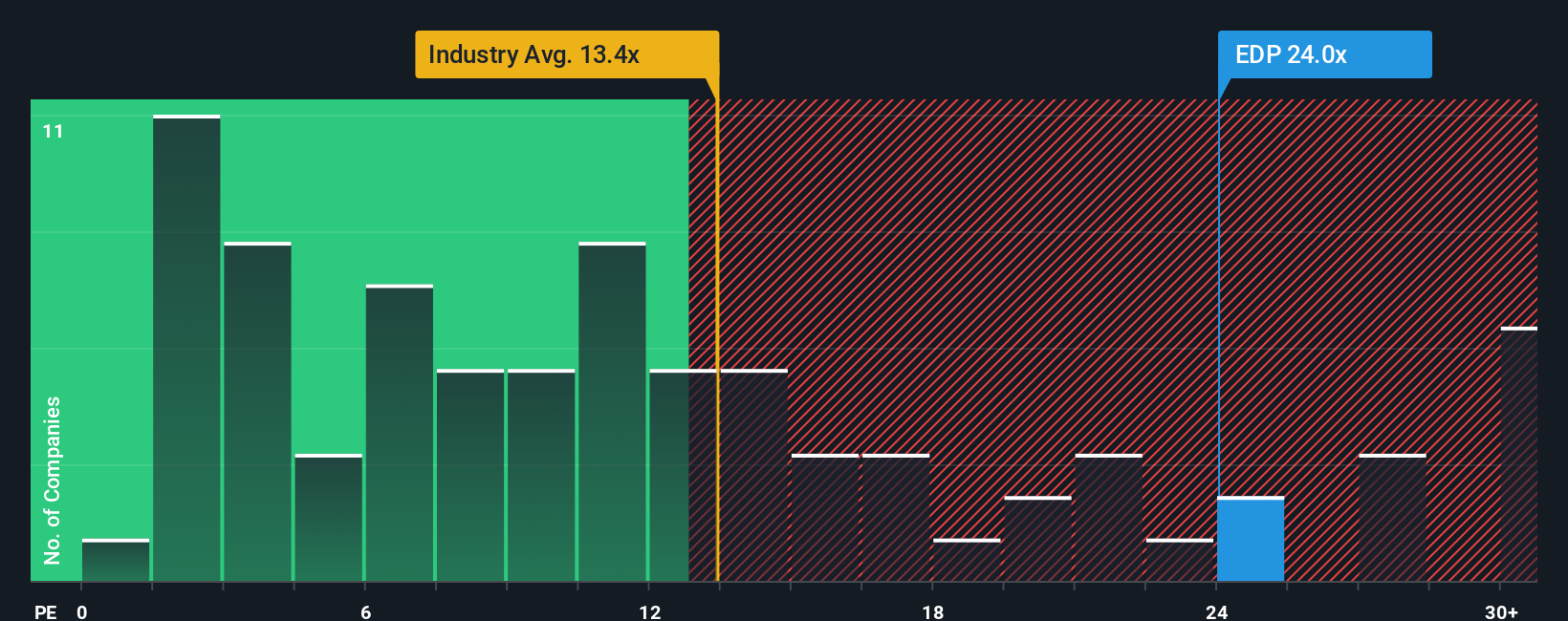

Looking at common price ratios, EDP currently trades at a price-to-earnings of 24 times, which is notably above both the European industry average of 13.4x and its own fair ratio of 23.2x. This makes the stock look relatively expensive and raises questions about valuation risk for investors. Should you trust the growth outlook, or is the market already pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EDP Narrative

If you see the numbers differently or want to dive into the details yourself, you can shape your own perspective on EDP in just a few minutes, and Do it your way.

A great starting point for your EDP research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their watchlist fresh. Don’t let standout opportunities slip by. Make your next move among the stocks most likely to outperform, right now.

- Boost your potential returns by scanning these 874 undervalued stocks based on cash flows hidden gems with strong financials primed for a comeback.

- Tap into powerful income opportunities through these 16 dividend stocks with yields > 3% offering robust yields above 3% and reliable cash flows.

- Catch the next tech wave with these 25 AI penny stocks shaping tomorrow’s markets with groundbreaking artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:EDP

EDP

Engages in the generation, transmission, distribution, and supply of electricity in Portugal, Spain, France, Poland, Romania, Italy, Belgium, the United Kingdom, Greece, Colombia, Brazil, North America, and internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives