- Portugal

- /

- Electric Utilities

- /

- ENXTLS:EDP

Can EDP (ENXTLS:EDP) Balance Aggressive Renewables Investment With Declining Profitability?

Reviewed by Sasha Jovanovic

- Earlier this month, EDP announced third-quarter and nine-month 2025 results with sales rising year-on-year but net income falling to €243 million and €952 million, respectively, alongside unveiling a €12 billion investment plan focused on renewables and electricity networks.

- This dual update emphasized EDP’s long-term commitment to the energy transition but raised questions among observers about whether lower recent profits and a greater reliance on asset rotations could challenge the company’s ability to deliver consistent growth.

- We’ll examine what EDP’s recent earnings miss and ambitious renewable investment plan mean for its medium-term investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

EDP Investment Narrative Recap

For EDP shareholders, the key belief is that large-scale investment in renewables and electricity grids will drive long-term value, despite short-term profit pressure. The latest results, higher sales but lower net income, underscore the challenge of balancing growth ambitions with earnings stability. Right now, the most important catalyst remains project execution in core markets, while the biggest risk is the company’s ongoing reliance on asset rotation gains; the recent update did little to change that risk meaningfully.

EDP’s plan to invest €12 billion in renewables and networks from 2026 to 2028 is especially relevant in light of these earnings. This move aims to reinforce EDP’s energy transition strategy while addressing investor concerns around future growth and revenue sources by targeting core areas like wind, solar, and electricity infrastructure.

But investors should be aware: despite EDP’s ambitious growth plan, the pressure from reduced asset rotation gains remains a potential headwind...

Read the full narrative on EDP (it's free!)

EDP's narrative projects €15.0 billion revenue and €1.3 billion earnings by 2028. This requires a 0.9% yearly revenue decline and a €552 million increase in earnings from €747.7 million today.

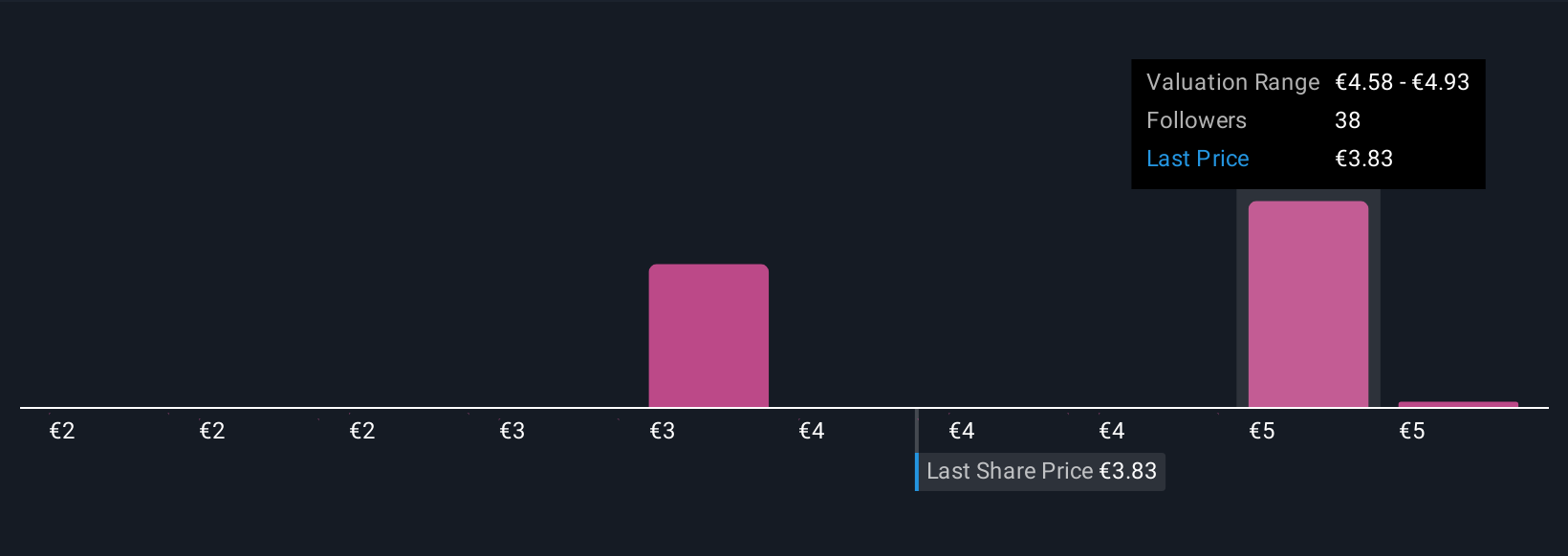

Uncover how EDP's forecasts yield a €4.58 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from eight Simply Wall St Community members span €1.78 to €5.28 per share. With profit growth forecasts facing challenges from reliance on asset sales for earnings, now is a good time to examine contrasting outlooks.

Explore 8 other fair value estimates on EDP - why the stock might be worth less than half the current price!

Build Your Own EDP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EDP research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free EDP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EDP's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:EDP

EDP

Engages in the generation, transmission, distribution, and supply of electricity in Portugal, Spain, France, Poland, Romania, Italy, Belgium, the United Kingdom, Greece, Colombia, Brazil, North America, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives