- Portugal

- /

- Oil and Gas

- /

- ENXTLS:GALP

Is Now The Time To Put Galp Energia SGPS (ELI:GALP) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Galp Energia SGPS (ELI:GALP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Galp Energia SGPS with the means to add long-term value to shareholders.

View our latest analysis for Galp Energia SGPS

Galp Energia SGPS' Improving Profits

In the last three years Galp Energia SGPS' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Galp Energia SGPS boosted its trailing twelve month EPS from €1.38 to €1.67, in the last year. That's a 21% gain; respectable growth in the broader scheme of things.

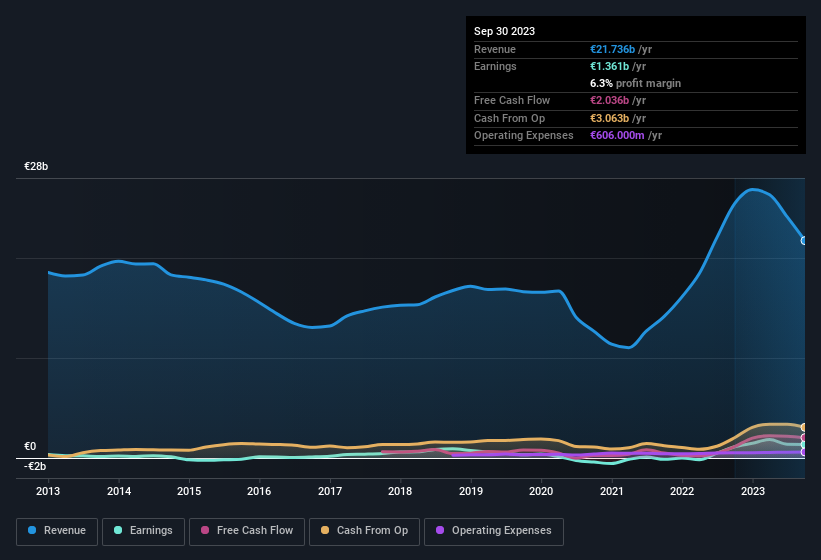

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, Galp Energia SGPS' revenue dropped 15% last year, but the silver lining is that EBIT margins improved from 10% to 16%. That's not a good look.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Galp Energia SGPS' future profits.

Are Galp Energia SGPS Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations over €7.4b, like Galp Energia SGPS, the median CEO pay is around €3.8m.

Galp Energia SGPS' CEO took home a total compensation package of €683k in the year prior to December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Galp Energia SGPS Worth Keeping An Eye On?

One positive for Galp Energia SGPS is that it is growing EPS. That's nice to see. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So all in all Galp Energia SGPS is worthy at least considering for your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Galp Energia SGPS you should be aware of, and 1 of them is a bit concerning.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:GALP

Galp Energia SGPS

Operates as an integrated energy operator in Portugal and internationally.

Excellent balance sheet average dividend payer.