- Portugal

- /

- Food and Staples Retail

- /

- ENXTLS:JMT

If You Like EPS Growth Then Check Out Jerónimo Martins SGPS (ELI:JMT) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Jerónimo Martins SGPS (ELI:JMT). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Jerónimo Martins SGPS

How Quickly Is Jerónimo Martins SGPS Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Jerónimo Martins SGPS managed to grow EPS by 4.9% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

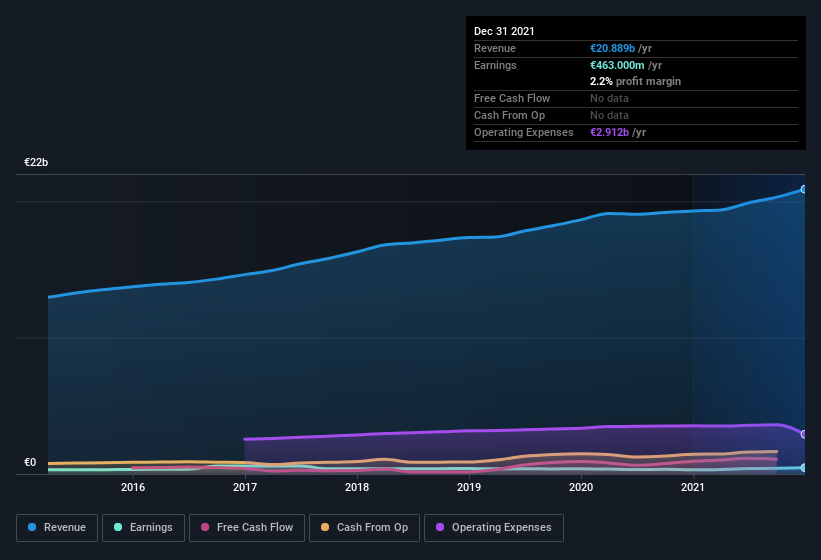

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Jerónimo Martins SGPS's EBIT margins were flat over the last year, revenue grew by a solid 8.3% to €21b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Jerónimo Martins SGPS's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Jerónimo Martins SGPS Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like Jerónimo Martins SGPS, with market caps over €7.3b, is about €3.5m.

The Jerónimo Martins SGPS CEO received total compensation of just €1.2m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Jerónimo Martins SGPS To Your Watchlist?

One important encouraging feature of Jerónimo Martins SGPS is that it is growing profits. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all I think it's worth at least considering for your watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Jerónimo Martins SGPS you should know about.

Although Jerónimo Martins SGPS certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:JMT

Jerónimo Martins SGPS

Operates in the food distribution and specialized retail sectors in Portugal, Poland, and Colombia.

Reasonable growth potential with adequate balance sheet and pays a dividend.