In the wake of recent market developments, where U.S. stocks have rallied to record highs amid expectations of accelerated economic growth and regulatory changes, small-cap stocks like those in the Russell 2000 Index have shown significant movement, although they remain just shy of breaking past previous records. These shifts highlight the potential for discovering undervalued opportunities within smaller companies that may benefit from favorable economic policies and market conditions. Identifying promising stocks often involves assessing their potential for growth in dynamic environments such as these, where strategic positioning can lead to substantial gains over time.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Jasmine International (SET:JAS)

Simply Wall St Value Rating: ★★★★★☆

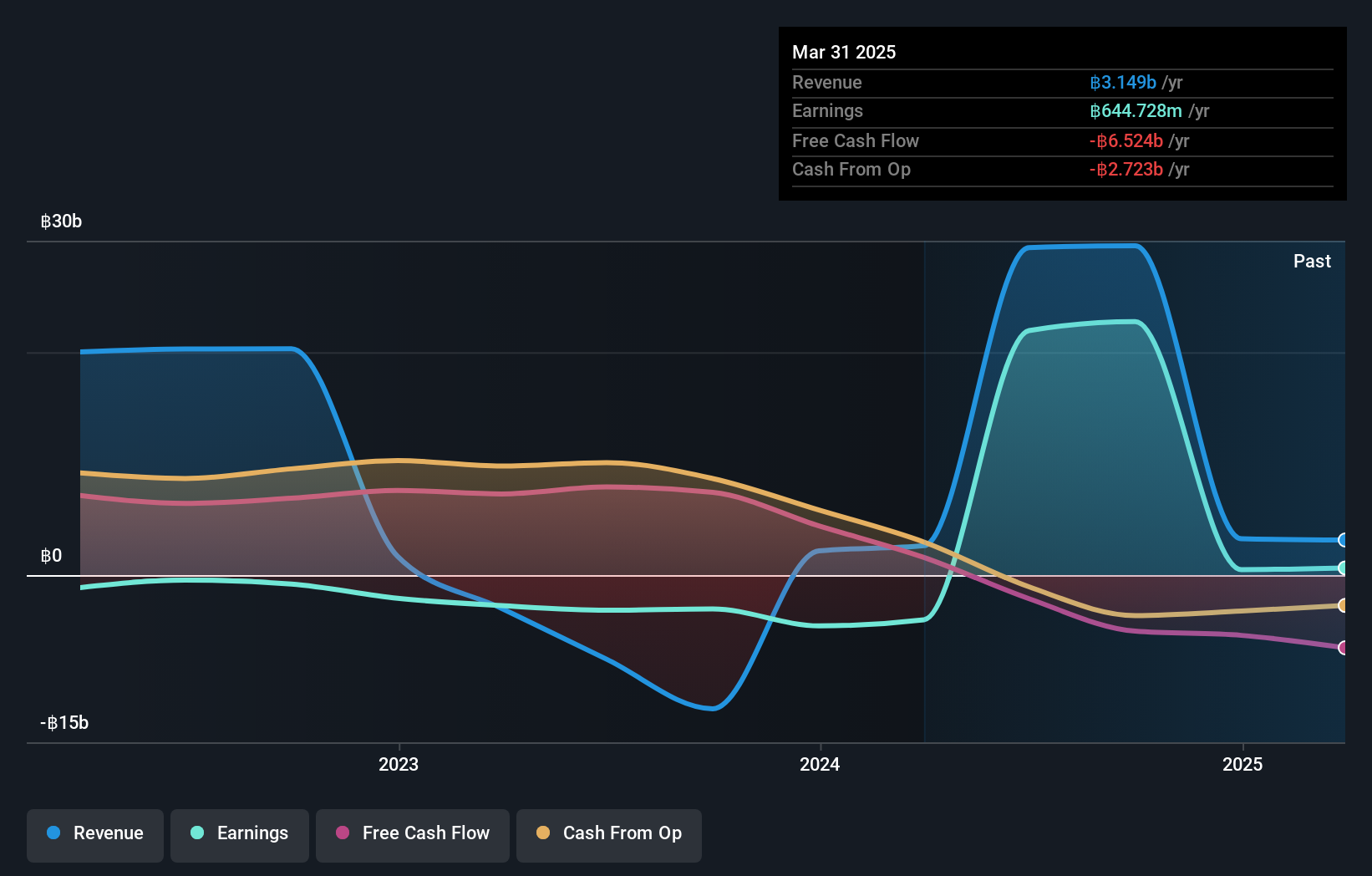

Overview: Jasmine International Public Company Limited operates in the telecommunications sector in Thailand and has a market capitalization of THB20.23 billion.

Operations: Jasmine International generates revenue primarily from its Digital Asset & Technology Solution Business, amounting to THB2.50 billion.

Jasmine International, a relatively small player in the telecom sector, has recently turned profitable with net income of THB 77.03 million for Q2 2024, compared to a loss of THB 794.16 million the previous year. This turnaround is bolstered by its impressive debt management; the debt-to-equity ratio dropped from 41.2% to just 6.4% over five years. Despite high volatility in share price lately, JAS's interest payments are well-covered by EBIT at an impressive ratio of 187x, reflecting strong financial health and operational efficiency within its industry context.

- Click here to discover the nuances of Jasmine International with our detailed analytical health report.

Gain insights into Jasmine International's past trends and performance with our Past report.

Shijiazhuang Kelin Electric (SHSE:603050)

Simply Wall St Value Rating: ★★★★★☆

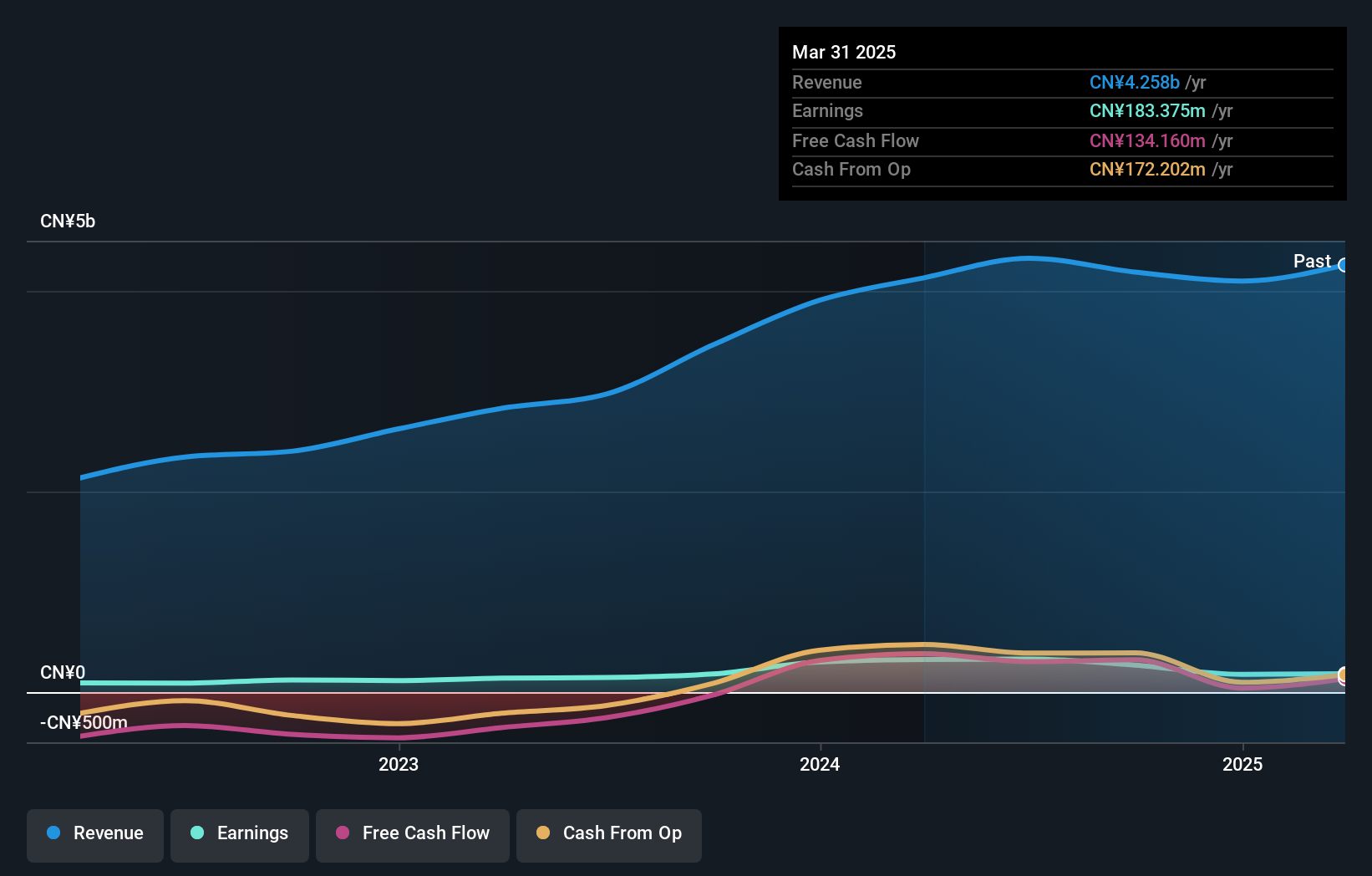

Overview: Shijiazhuang Kelin Electric Co., Ltd. designs, manufactures, and sells electrical power distribution and metering products in China, with a market cap of CN¥6.51 billion.

Operations: Kelin Electric generates revenue primarily from its electrical equipment manufacturing segment, amounting to CN¥4.19 billion. The company's financial data indicates a focus on this core segment as the main source of income.

Shijiazhuang Kelin Electric, a smaller player in the electrical industry, has shown impressive earnings growth of 48.7% over the past year, surpassing the industry average of 0.8%. Despite this growth, net income for the nine months ended September 2024 was CNY 148.96 million, down from CNY 179.62 million a year earlier. The company's net debt to equity ratio stands at a satisfactory level of 28.4%, although it has increased from 24.8% to 65% over five years. Trading at about 83% below its estimated fair value suggests potential undervaluation in market perception despite high-quality earnings and well-covered interest payments with an EBIT coverage of 8.8x.

Cyber_Folks (WSE:CBF)

Simply Wall St Value Rating: ★★★★☆☆

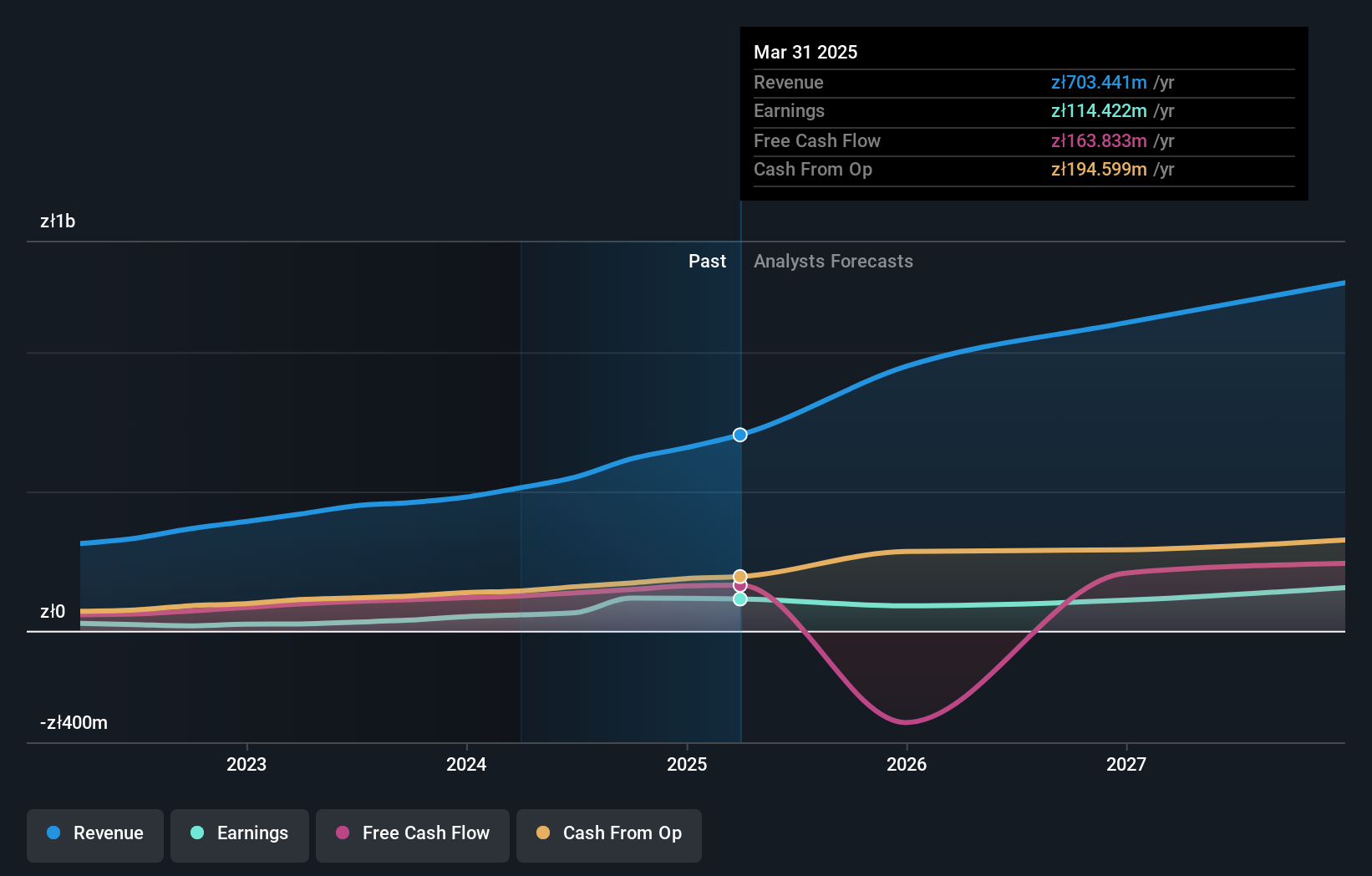

Overview: Cyber_Folks S.A. is a technology company focused on business digitization and enterprise support in Poland and internationally, with a market capitalization of PLN1.70 billion.

Operations: Cyber_Folks generates revenue primarily from its VERCOM segment, contributing PLN401.28 million, followed by Cyber Folks at PLN146.65 million. The SaaS and Corporate segments add smaller amounts of PLN2.44 million and PLN2.24 million, respectively, with exclusions reducing the total slightly by PLN1.49 million.

Cyber_Folks, a dynamic player in the telecom space, has shown impressive growth with earnings surging by 108% last year, surpassing industry norms. Trading at 60.3% below its estimated fair value, it offers a compelling investment opportunity. The company's net debt to equity ratio stands at a satisfactory 37.3%, reflecting prudent financial management over time as this metric improved from 82.7% to 50.6%. Recently added to the S&P Global BMI Index, Cyber_Folks reported Q2 sales of PLN 154 million and net income of PLN 17 million, highlighting robust performance and potential for continued success in the market landscape.

- Unlock comprehensive insights into our analysis of Cyber_Folks stock in this health report.

Review our historical performance report to gain insights into Cyber_Folks''s past performance.

Make It Happen

- Click through to start exploring the rest of the 4645 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:JAS

Jasmine International

Through its subsidiaries, engages in telecommunications, media, and technology businesses in Thailand.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives