In recent weeks, European markets have experienced a pullback amid concerns over the valuation of artificial intelligence-related stocks, with major indices such as the STOXX Europe 600 Index ending lower. Despite this cautious sentiment, growth companies with high insider ownership can offer unique advantages in uncertain times, as strong insider stakes often indicate confidence in a company's long-term potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 87% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

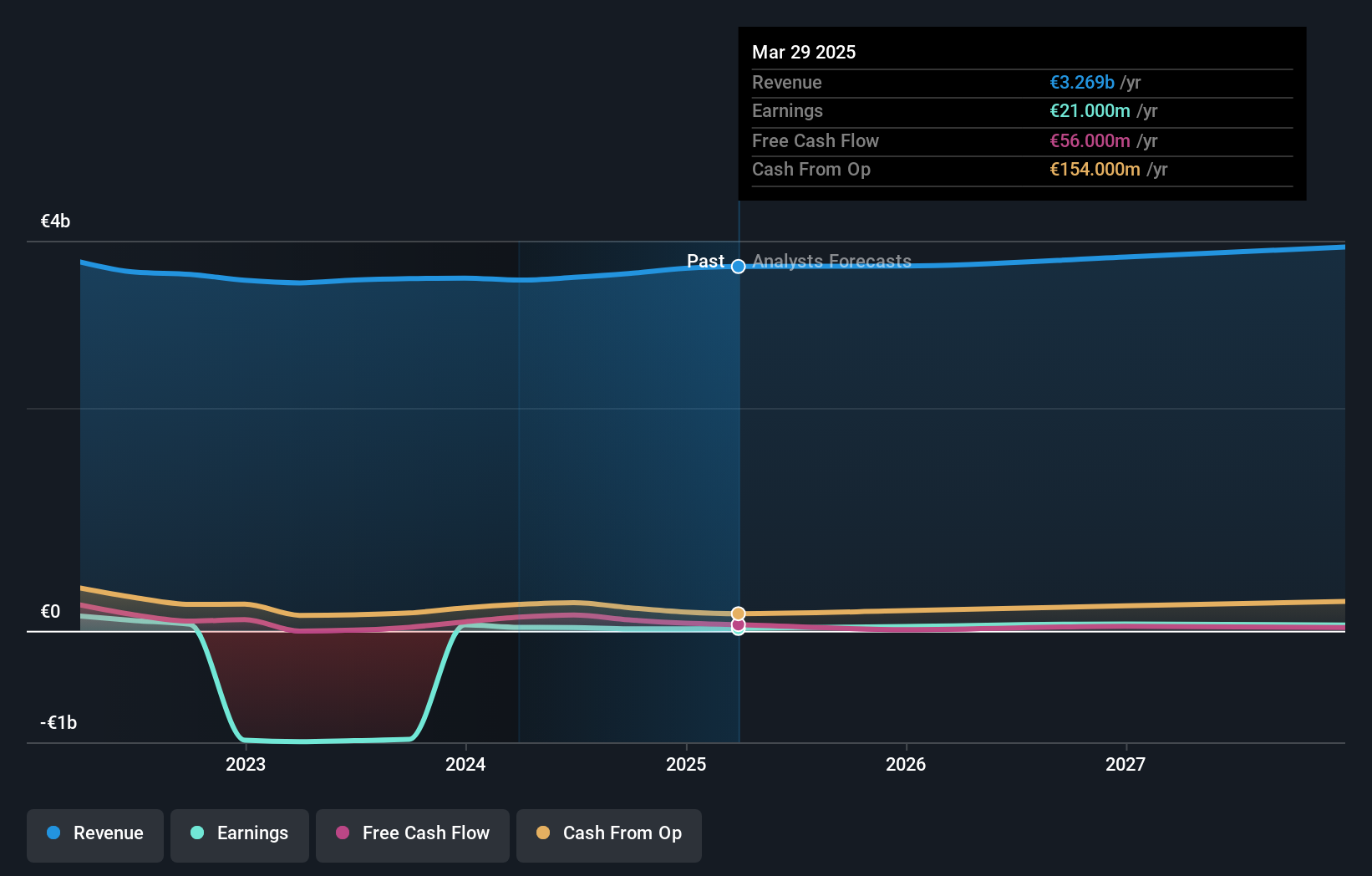

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. is a company that offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €490.37 million.

Operations: The company's revenue segments include Parcels at €2.41 billion and Mail in The Netherlands at €1.32 billion.

Insider Ownership: 35.1%

Earnings Growth Forecast: 58.1% p.a.

PostNL is trading at a substantial discount to its estimated fair value, suggesting potential undervaluation. Despite an expected annual profit growth that surpasses the market average, revenue growth remains modest and below the Dutch market rate. The company's financial position shows challenges with interest coverage and a dividend not fully supported by earnings. Recent results indicate widening losses, yet insider activity over the past three months shows no substantial buying or selling trends.

- Dive into the specifics of PostNL here with our thorough growth forecast report.

- Our valuation report unveils the possibility PostNL's shares may be trading at a discount.

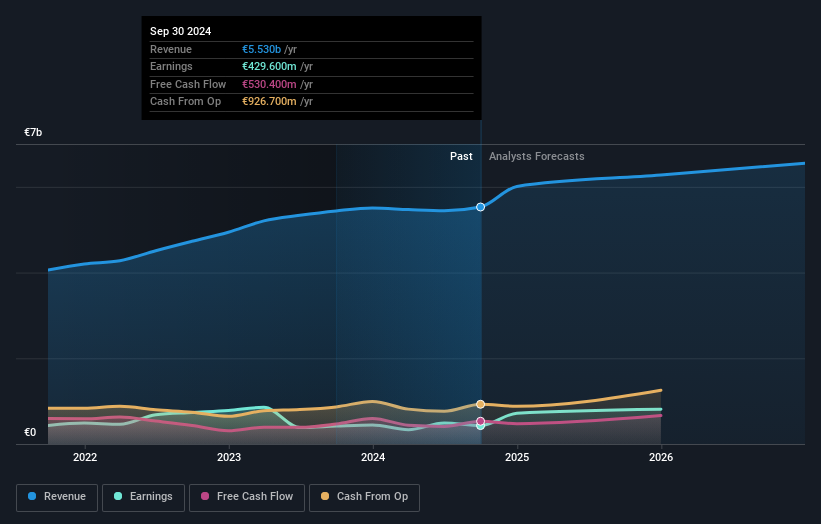

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that produces and sells Atlantic salmon products globally, with a market cap of NOK118.75 billion.

Operations: The company generates revenue through several segments, including Feed (€1.06 billion), Farming (€3.48 billion), Sales & Marketing - Markets (€4.05 billion), and Sales and Marketing - Consumer Products (€3.74 billion).

Insider Ownership: 14.7%

Earnings Growth Forecast: 35.9% p.a.

Mowi's high insider ownership aligns with its strong growth prospects, as earnings are forecast to grow significantly faster than the Norwegian market. Despite a high level of debt, Mowi is trading well below its estimated fair value. The company recently reported an increase in net income for Q3 2025 and raised its harvest volume guidance for 2025 and 2026, indicating robust operational performance. Mowi was also added to the Euronext 150 Index.

- Click here to discover the nuances of Mowi with our detailed analytical future growth report.

- Our expertly prepared valuation report Mowi implies its share price may be lower than expected.

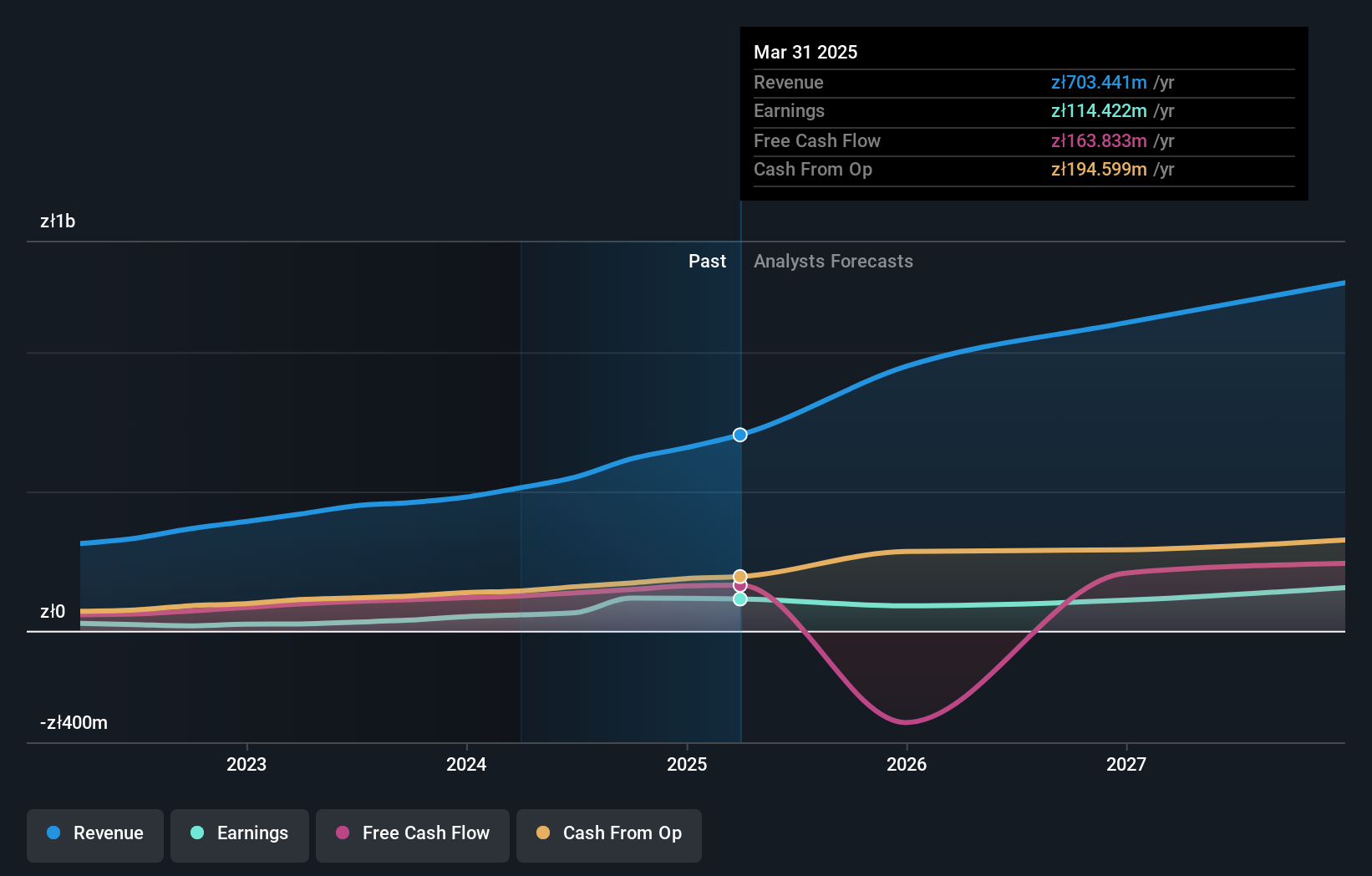

Cyber_Folks (WSE:CBF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cyber_Folks S.A. is a global technology company with a market cap of PLN2.76 billion.

Operations: Cyber_Folks S.A. operates globally as a technology company with various revenue segments, excluding "Other," "Unallocated," or "Inter-Segment" amounts.

Insider Ownership: 22.6%

Earnings Growth Forecast: 39% p.a.

Cyber_Folks demonstrates strong growth potential with substantial insider ownership, as its earnings are forecast to grow significantly faster than the Polish market. Despite a high level of debt and recent declines in profit margins, the company is trading well below its estimated fair value. Recent Q3 2025 results showed revenue growth to PLN 215.92 million, although net income decreased considerably from last year due to large one-off items impacting financial results.

- Get an in-depth perspective on Cyber_Folks' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Cyber_Folks implies its share price may be too high.

Where To Now?

- Embark on your investment journey to our 188 Fast Growing European Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives