- Poland

- /

- Telecom Services and Carriers

- /

- WSE:AIT

Is Aiton Caldwell SA's (WSE:AIT) Stock On A Downtrend As A Result Of Its Poor Financials?

With its stock down 20% over the past month, it is easy to disregard Aiton Caldwell (WSE:AIT). Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. In this article, we decided to focus on Aiton Caldwell's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Aiton Caldwell

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Aiton Caldwell is:

6.1% = zł505k ÷ zł8.2m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each PLN1 of shareholders' capital it has, the company made PLN0.06 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Aiton Caldwell's Earnings Growth And 6.1% ROE

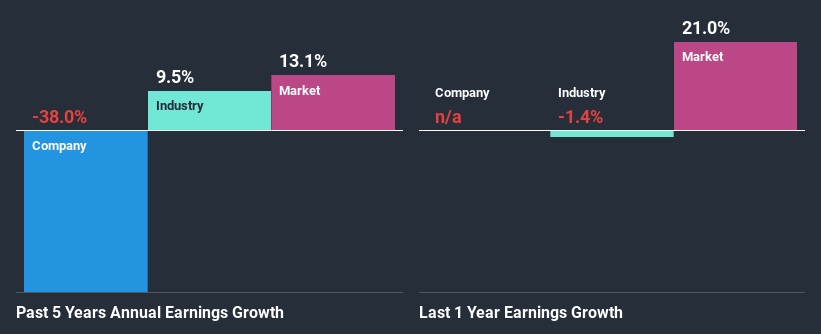

On the face of it, Aiton Caldwell's ROE is not much to talk about. However, its ROE is similar to the industry average of 6.1%, so we won't completely dismiss the company. But Aiton Caldwell saw a five year net income decline of 38% over the past five years. Bear in mind, the company does have a slightly low ROE. Hence, this goes some way in explaining the shrinking earnings.

So, as a next step, we compared Aiton Caldwell's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 9.5% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Aiton Caldwell is trading on a high P/E or a low P/E, relative to its industry.

Is Aiton Caldwell Using Its Retained Earnings Effectively?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Summary

In total, we would have a hard think before deciding on any investment action concerning Aiton Caldwell. As a result of its low ROE and lack of mich reinvestment into the business, the company has seen a disappointing earnings growth rate. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Aiton Caldwell's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade Aiton Caldwell, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:AIT

Aiton Caldwell

Provides VoIP telephony and telecommunications systems for small and medium-sized enterprises and corporate customers in Poland.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives