In the current global market landscape, marked by fluctuating indices and policy uncertainties, investors are keenly observing sectors that might benefit from potential regulatory changes under the new administration. Amidst these developments, companies with strong growth trajectories and significant insider ownership often attract attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 31% | 29.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Admicom Oyj provides ERP cloud-based solutions in Finland and has a market capitalization of €243.84 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generates €34.78 million.

Insider Ownership: 21.9%

Earnings Growth Forecast: 20.5% p.a.

Admicom Oyj is positioned for significant growth, with earnings projected to increase by 20.53% annually, outpacing the Finnish market's 14.4%. Although revenue growth is slower at 8.7%, it still exceeds the market average of 2.6%. The company's Return on Equity is expected to reach a high of 24.1% in three years, and its stock trades at a considerable discount to estimated fair value, despite large one-off items affecting results recently.

- Click here and access our complete growth analysis report to understand the dynamics of Admicom Oyj.

- Our expertly prepared valuation report Admicom Oyj implies its share price may be too high.

Runben Biotechnology (SHSE:603193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd. focuses on the research, production, and sale of mosquito repellent products, baby care products, and essential oil products with a market cap of CN¥9.79 billion.

Operations: The company's revenue primarily comes from its personal products segment, totaling CN¥1.25 billion.

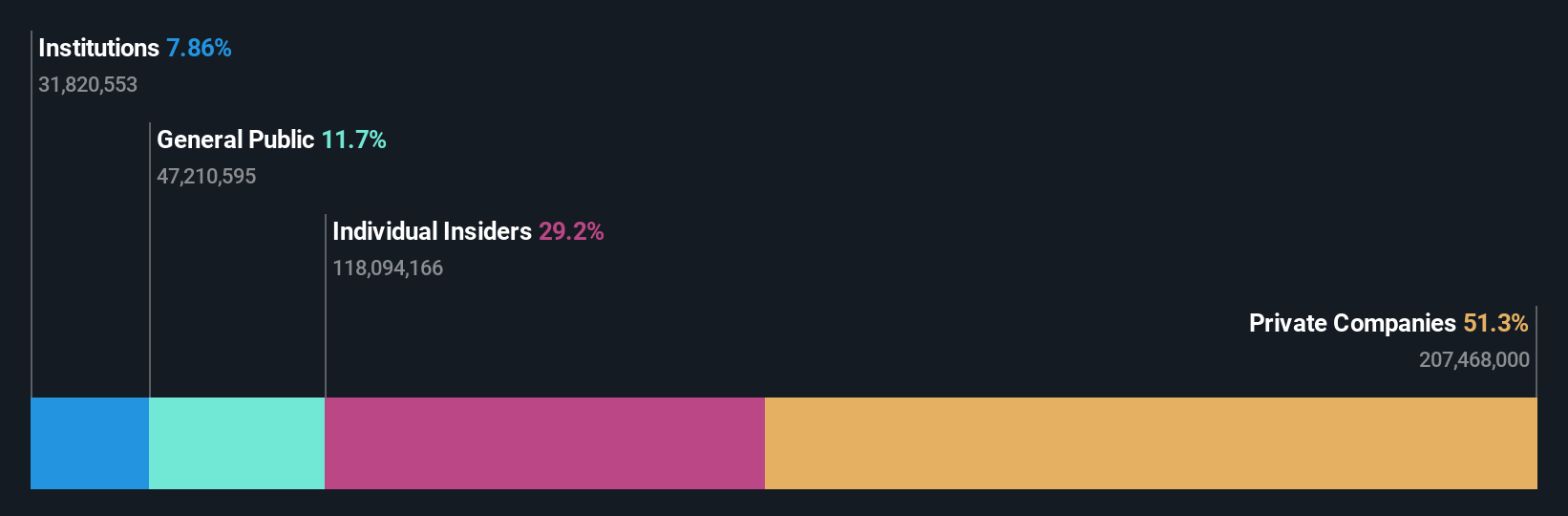

Insider Ownership: 33.1%

Earnings Growth Forecast: 22.7% p.a.

Runben Biotechnology is poised for robust growth, with revenue forecasted to expand by 24.8% annually, surpassing the Chinese market's average of 13.9%. Earnings are expected to grow significantly at 22.68% per year, although slightly below the market's 26.1%. Recent earnings show a strong performance with sales reaching CNY 1.04 billion and net income rising to CNY 260.88 million over nine months. The stock trades below the market P/E ratio at 32x, indicating potential value.

- Dive into the specifics of Runben Biotechnology here with our thorough growth forecast report.

- Our expertly prepared valuation report Runben Biotechnology implies its share price may be lower than expected.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.62 billion.

Operations: Vercom's revenue segments (in millions of PLN) are not specified in the provided text.

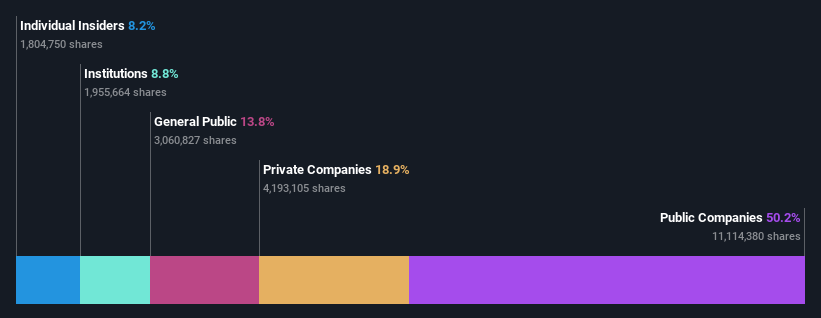

Insider Ownership: 12.7%

Earnings Growth Forecast: 16.3% p.a.

Vercom's recent earnings report highlights strong growth, with third-quarter sales rising to PLN 145.11 million and net income reaching PLN 19.4 million. Earnings per share increased to PLN 0.88 from PLN 0.59 a year ago. The company is forecasted to achieve annual profit growth of 17.3%, outpacing the Polish market's average, though below significant levels. Trading slightly below fair value, Vercom shows potential for continued expansion without notable insider trading activity recently observed.

- Navigate through the intricacies of Vercom with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Vercom's current price could be inflated.

Seize The Opportunity

- Investigate our full lineup of 1546 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRC

Outstanding track record with excellent balance sheet.