Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Marvipol Development S.A. (WSE:MVP) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Marvipol Development

What Is Marvipol Development's Net Debt?

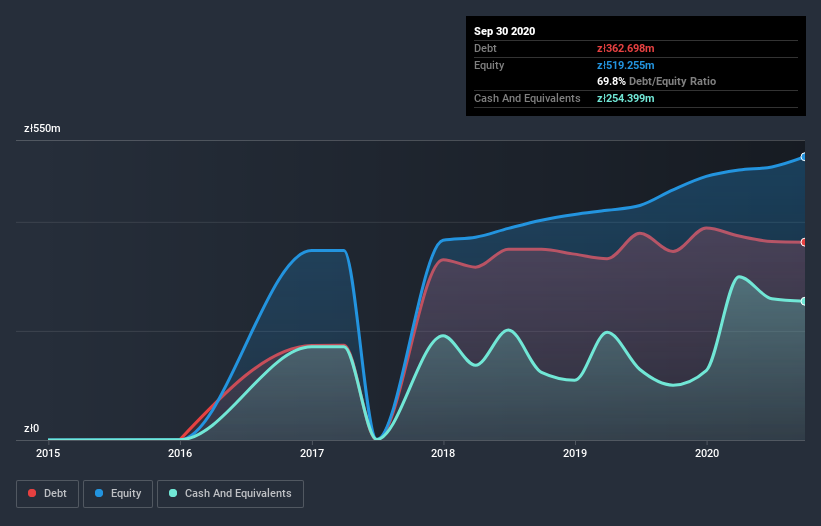

The image below, which you can click on for greater detail, shows that at September 2020 Marvipol Development had debt of zł362.7m, up from zł345.5m in one year. However, because it has a cash reserve of zł254.4m, its net debt is less, at about zł108.3m.

How Strong Is Marvipol Development's Balance Sheet?

According to the last reported balance sheet, Marvipol Development had liabilities of zł742.1m due within 12 months, and liabilities of zł195.5m due beyond 12 months. Offsetting this, it had zł254.4m in cash and zł40.6m in receivables that were due within 12 months. So it has liabilities totalling zł642.6m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the zł249.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Marvipol Development would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Marvipol Development's net debt is 2.7 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 1k times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. Notably, Marvipol Development's EBIT launched higher than Elon Musk, gaining a whopping 209% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Marvipol Development will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Marvipol Development recorded free cash flow of 28% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

While Marvipol Development's level of total liabilities has us nervous. To wit both its interest cover and EBIT growth rate were encouraging signs. Taking the abovementioned factors together we do think Marvipol Development's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Marvipol Development (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Marvipol Development or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:MVP

Marvipol Development

Engages in investing in and developing real estate projects in Poland.

Excellent balance sheet and good value.

Market Insights

Community Narratives