- Poland

- /

- Interactive Media and Services

- /

- WSE:WPL

3 European Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As European markets experience a pullback, with concerns about overvaluation in artificial intelligence-related stocks affecting sentiment, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. In this environment, identifying undervalued stocks often involves looking at companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Witted Megacorp Oyj (HLSE:WITTED) | €1.36 | €2.67 | 49% |

| Vinext (BIT:VNXT) | €3.38 | €6.57 | 48.5% |

| Rusta (OM:RUSTA) | SEK64.50 | SEK126.76 | 49.1% |

| Roche Bobois (ENXTPA:RBO) | €35.40 | €69.69 | 49.2% |

| NEUCA (WSE:NEU) | PLN790.00 | PLN1553.92 | 49.2% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.403 | €0.78 | 48.5% |

| Eleving Group (DB:OT8) | €1.64 | €3.20 | 48.7% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 48.9% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

| Allcore (BIT:CORE) | €1.34 | €2.66 | 49.7% |

Let's review some notable picks from our screened stocks.

AKVA group (OB:AKVA)

Overview: AKVA group ASA is involved in designing, manufacturing, and selling technology products and offering services for the aquaculture industry, with a market cap of NOK3.35 billion.

Operations: AKVA group ASA generates revenue through the design, purchase, manufacture, assembly, sale, and installation of technology products as well as providing rental and consulting services within the aquaculture sector.

Estimated Discount To Fair Value: 43.2%

AKVA group appears undervalued based on cash flows, trading at NOK 92, significantly below its estimated fair value of NOK 161.85. Despite interest payments not being well covered by earnings and the impact of large one-off items on financial results, the company's earnings are forecast to grow significantly at over 20% annually. Recent developments include a RAS contract worth NOK 220 million and a share buyback program for up to NOK 9 million, potentially enhancing shareholder value.

- Our earnings growth report unveils the potential for significant increases in AKVA group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of AKVA group.

Wirtualna Polska Holding (WSE:WPL)

Overview: Wirtualna Polska Holding S.A. operates in the media, advertising, and e-commerce sectors in Poland with a market capitalization of PLN1.64 billion.

Operations: The company generates revenue from various segments, including Travel (PLN769.29 million), Consumer Finance (PLN214.38 million), and Advertising and Subscriptions (PLN729.90 million).

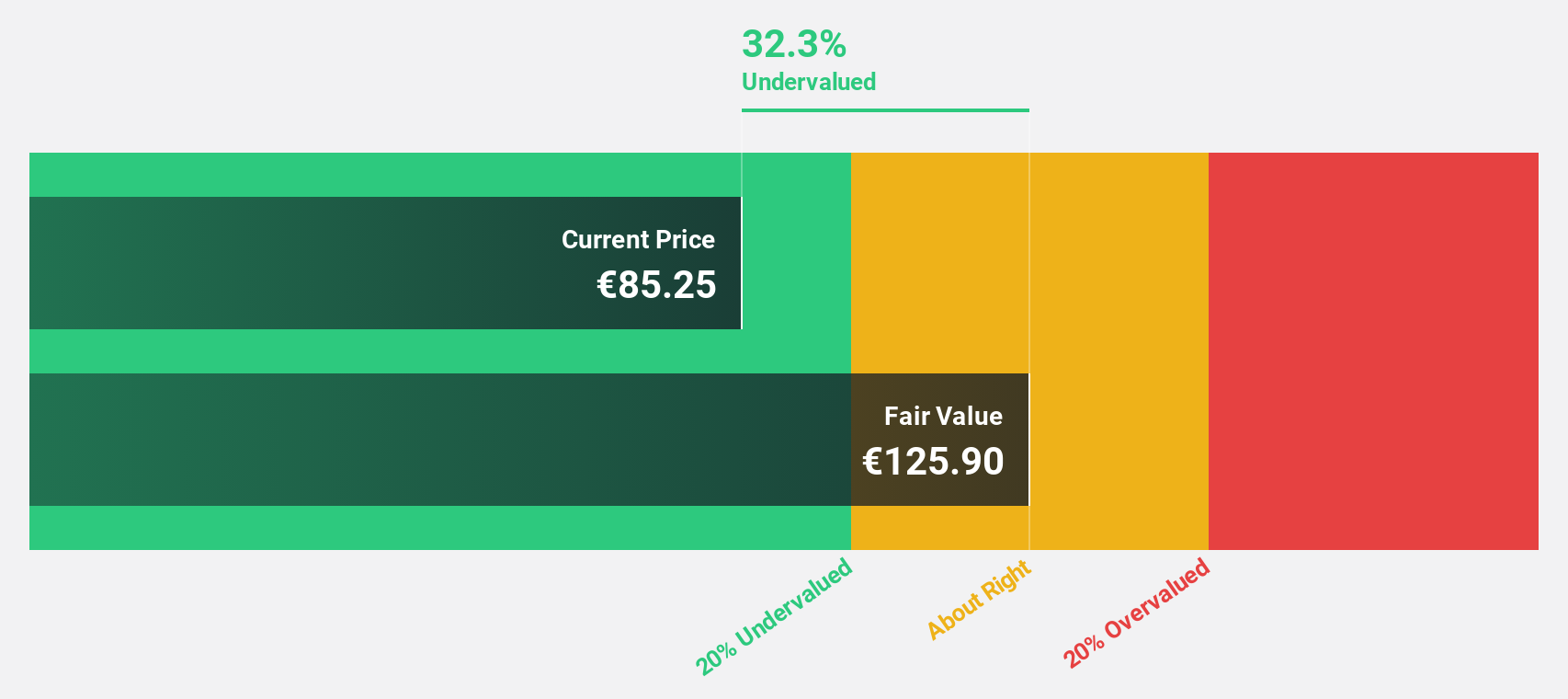

Estimated Discount To Fair Value: 45.6%

Wirtualna Polska Holding is trading at PLN 55.2, significantly below its estimated fair value of PLN 101.44, indicating strong undervaluation based on cash flows. Despite a recent net loss and high debt levels, earnings are forecast to grow significantly at over 20% annually, outpacing the Polish market. The company's addition to the S&P Global BMI Index highlights its potential for broader investor interest despite an unstable dividend track record and large one-off items impacting results.

- The growth report we've compiled suggests that Wirtualna Polska Holding's future prospects could be on the up.

- Get an in-depth perspective on Wirtualna Polska Holding's balance sheet by reading our health report here.

Hensoldt (XTRA:HAG)

Overview: Hensoldt AG, along with its subsidiaries, offers sensor solutions for defense and security applications globally and has a market cap of €10.97 billion.

Operations: The company's revenue is primarily derived from its Sensors segment, which generates €2.02 billion, and its Optronics segment, contributing €398 million.

Estimated Discount To Fair Value: 31.9%

Hensoldt AG is trading at €95, well below its estimated fair value of €139.42, suggesting undervaluation based on cash flows. Despite a net loss decrease to €30 million for the nine months ending September 2025 and lowered revenue guidance of €2.5 billion, earnings are forecast to grow significantly at 31.5% annually, outpacing the German market's growth rate. The company's addition to the FTSE All-World Index underscores its growing prominence despite concerns about interest coverage by earnings.

- The analysis detailed in our Hensoldt growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Hensoldt stock in this financial health report.

Key Takeaways

- Investigate our full lineup of 191 Undervalued European Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wirtualna Polska Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:WPL

Wirtualna Polska Holding

Through its subsidiaries, engages in the media, advertising, and e-commerce businesses in Poland.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives