Stock Analysis

IMC (WSE:IMC shareholders incur further losses as stock declines 10% this week, taking three-year losses to 61%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term IMC S.A. (WSE:IMC) shareholders. Regrettably, they have had to cope with a 66% drop in the share price over that period. And over the last year the share price fell 52%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 20% in a month.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for IMC

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

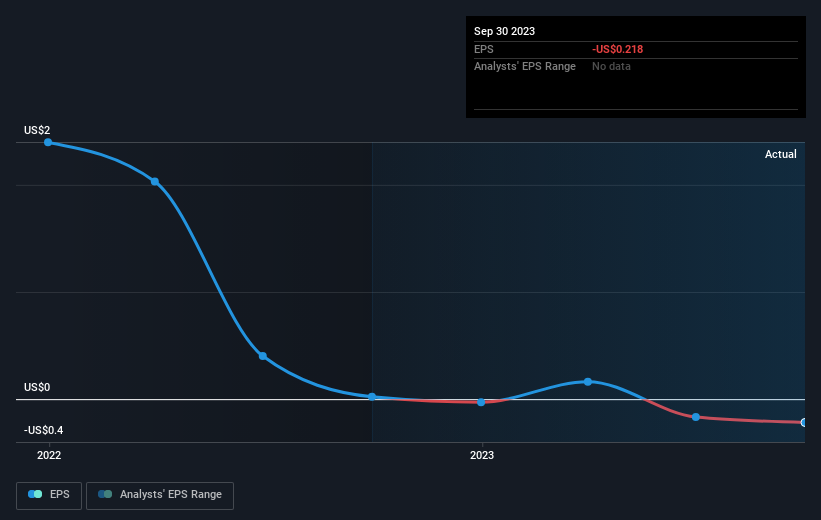

Over the three years that the share price declined, IMC's earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. In some ways, TSR is a better measure of how well an investment has performed. IMC's TSR over the last 3 years is -61%; better than its share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

Investors in IMC had a tough year, with a total loss of 52%, against a market gain of about 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for IMC you should be aware of, and 1 of them shouldn't be ignored.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether IMC is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:IMC

IMC

IMC S.A., together with its subsidiaries, operates as an integrated agricultural company in Ukraine and internationally.

Excellent balance sheet and slightly overvalued.