- Poland

- /

- Capital Markets

- /

- WSE:KLE

Optimism for Grupa Klepsydra (WSE:KLE) has grown this past week, despite three-year decline in earnings

For us, stock picking is in large part the hunt for the truly magnificent stocks. Not every pick can be a winner, but when you pick the right stock, you can win big. One such superstar is Grupa Klepsydra S.A. (WSE:KLE), which saw its share price soar 857% in three years. It's also up 47% in about a month. We love happy stories like this one. The company should be really proud of that performance!

The past week has proven to be lucrative for Grupa Klepsydra investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for Grupa Klepsydra

We don't think that Grupa Klepsydra's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years Grupa Klepsydra has grown its revenue at 144% annually. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 112% per year, over the same period. Despite the strong run, top performers like Grupa Klepsydra have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

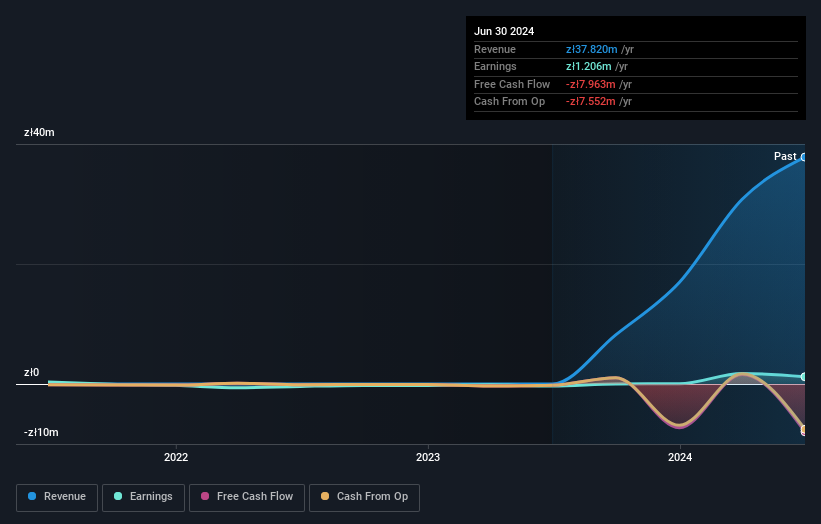

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Grupa Klepsydra's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Grupa Klepsydra shareholders have received a total shareholder return of 44% over one year. However, that falls short of the 56% TSR per annum it has made for shareholders, each year, over five years. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 4 warning signs we've spotted with Grupa Klepsydra .

But note: Grupa Klepsydra may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KLE

Grupa Klepsydra

Engages in the provision of funeral, cemetery, and cremation services in Poland.

Adequate balance sheet slight.