- Poland

- /

- Trade Distributors

- /

- WSE:PTN

Poltronic S.A.'s (WSE:PTN) 27% Dip In Price Shows Sentiment Is Matching Earnings

The Poltronic S.A. (WSE:PTN) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

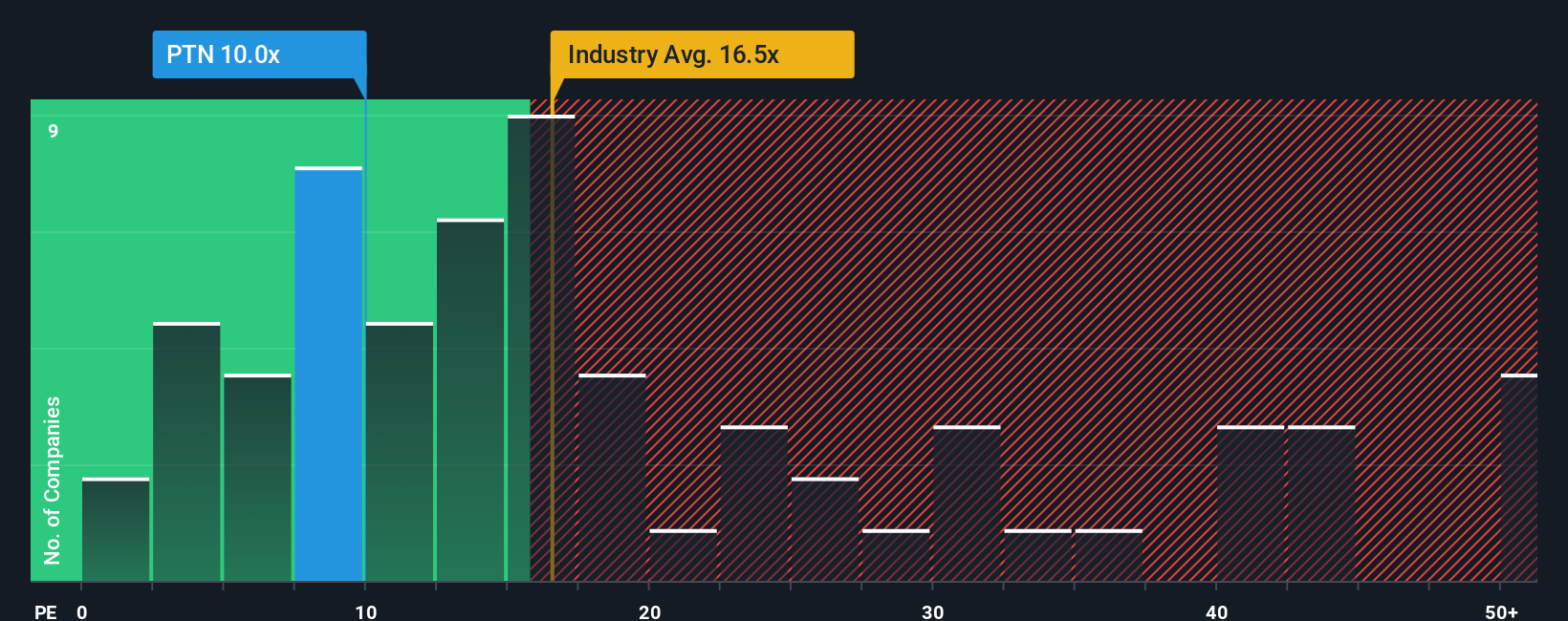

Although its price has dipped substantially, Poltronic may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10x, since almost half of all companies in Poland have P/E ratios greater than 14x and even P/E's higher than 28x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen firmly for Poltronic recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Poltronic

Is There Any Growth For Poltronic?

The only time you'd be truly comfortable seeing a P/E as low as Poltronic's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 60% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's an unpleasant look.

In light of this, it's understandable that Poltronic's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

The softening of Poltronic's shares means its P/E is now sitting at a pretty low level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Poltronic maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 6 warning signs for Poltronic (3 are a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Poltronic, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PTN

Poltronic

Imports and distributes electrical products in Poland and other European countries.

Medium-low risk with adequate balance sheet.

Market Insights

Community Narratives