- Poland

- /

- Aerospace & Defense

- /

- WSE:LBW

Lubawa (WSE:LBW) soars 13% this week, taking five-year gains to 276%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Lubawa S.A. (WSE:LBW) which saw its share price drive 276% higher over five years. Better yet, the share price has risen 13% in the last week.

Since the stock has added zł40m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Lubawa

We don't think that Lubawa's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Lubawa saw its revenue grow at 5.4% per year. Put simply, that growth rate fails to impress. In comparison, the share price rise of 30% per year over the last half a decade is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It may be that the market is pretty optimistic about Lubawa.

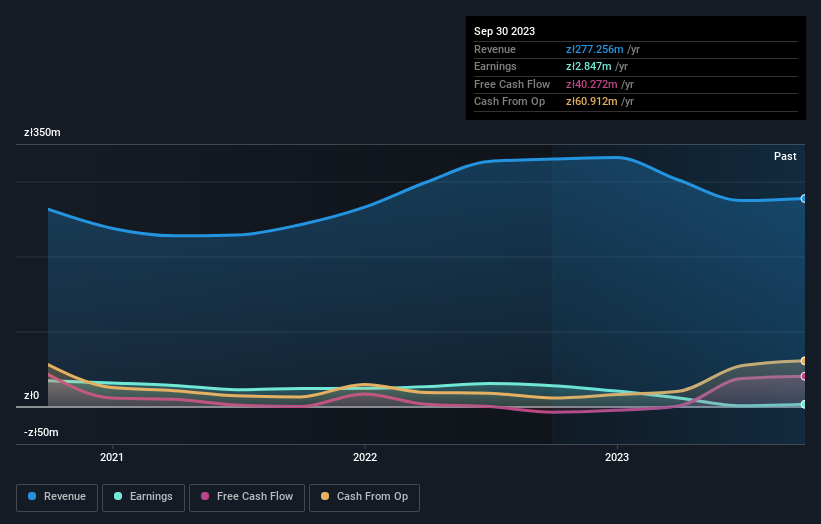

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Lubawa's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Lubawa shareholders are up 5.3% for the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 30% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Lubawa that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:LBW

Lubawa

Manufactures and sells army, police, municipal police, border patrol, fire brigade, and special force products in Poland and internationally.

Flawless balance sheet with solid track record.