Brokers Are Upgrading Their Views On Santander Bank Polska S.A. (WSE:SPL) With These New Forecasts

Celebrations may be in order for Santander Bank Polska S.A. (WSE:SPL) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

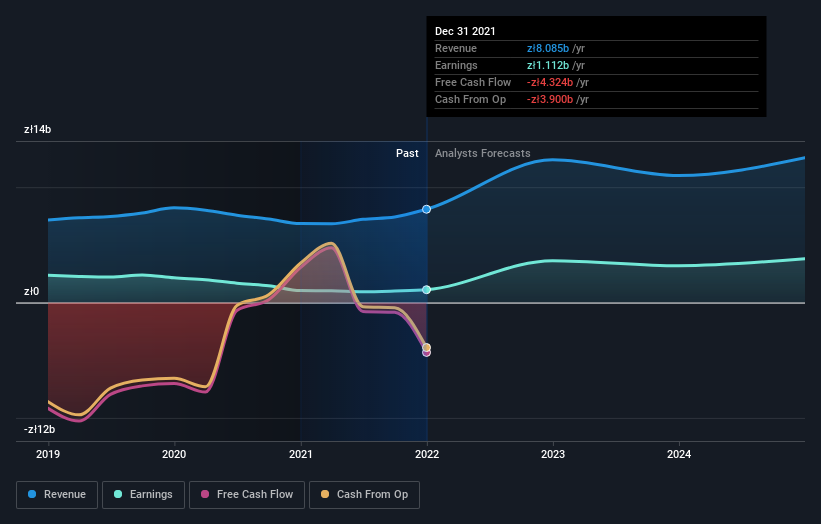

After this upgrade, Santander Bank Polska's nine analysts are now forecasting revenues of zł12b in 2022. This would be a sizeable 53% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to surge 227% to zł35.61. Before this latest update, the analysts had been forecasting revenues of zł10b and earnings per share (EPS) of zł23.25 in 2022. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out our latest analysis for Santander Bank Polska

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of zł394, suggesting that the forecast performance does not have a long term impact on the company's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Santander Bank Polska analyst has a price target of zł470 per share, while the most pessimistic values it at zł324. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Santander Bank Polska's past performance and to peers in the same industry. The analysts are definitely expecting Santander Bank Polska's growth to accelerate, with the forecast 53% annualised growth to the end of 2022 ranking favourably alongside historical growth of 2.0% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 12% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Santander Bank Polska is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Santander Bank Polska could be a good candidate for more research.

Better yet, our automated discounted cash flow calculation (DCF) suggests Santander Bank Polska could be moderately undervalued. You can learn more about our valuation methodology on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:SPL

Santander Bank Polska

Provides various banking products and services for individuals, small or medium-sized enterprises, corporate clients, and public sector institutions.

Undervalued established dividend payer.