- Thailand

- /

- Industrials

- /

- SET:TTA

Axelum Resources And 2 Other Penny Stocks With Promising Growth Potential

Reviewed by Simply Wall St

With U.S. stock indexes climbing toward record highs and inflation data fueling expectations for continued restrictive monetary policy, investors are navigating a complex market landscape. In such conditions, identifying stocks with strong financial health becomes crucial, particularly in the niche realm of penny stocks. Although the term 'penny stock' may seem outdated, these smaller or newer companies can still offer growth potential when supported by robust balance sheets. Let's explore three examples of penny stocks that combine financial strength with promising long-term prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.66B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$45.35B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$142.2M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

Click here to see the full list of 5,671 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Axelum Resources (PSE:AXLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Axelum Resources Corp. is involved in the manufacture and distribution of coconut products across the Philippines, the United States, and Australia, with a market cap of ₱7.60 billion.

Operations: The company's revenue primarily comes from the sale of coconut-based products, amounting to ₱6.52 billion.

Market Cap: ₱7.6B

Axelum Resources Corp., with a market cap of ₱7.60 billion, generates revenue primarily from coconut-based products, totaling ₱6.52 billion. Despite being unprofitable with a negative return on equity of -0.5%, its interest payments are well covered by EBIT at 75.1x coverage, indicating strong financial management in this area. The company’s short-term assets significantly exceed both its short and long-term liabilities, and it holds more cash than total debt, suggesting robust liquidity. However, earnings have declined by 33.4% annually over the past five years, and the share price has been highly volatile recently.

- Click here to discover the nuances of Axelum Resources with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Axelum Resources' track record.

Kinetix Systems Holdings (SEHK:8606)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kinetix Systems Holdings Limited is an investment holding company that offers IT services across Hong Kong, Macau, Singapore, the People’s Republic of China, and the United Kingdom with a market cap of HK$143.14 million.

Operations: The company generates revenue from IT Maintenance and Support Services amounting to HK$43.63 million, alongside IT Solutions Services which include IT Development Solutions Services at HK$131.21 million and IT Infrastructure Solutions Services at HK$177.42 million.

Market Cap: HK$143.14M

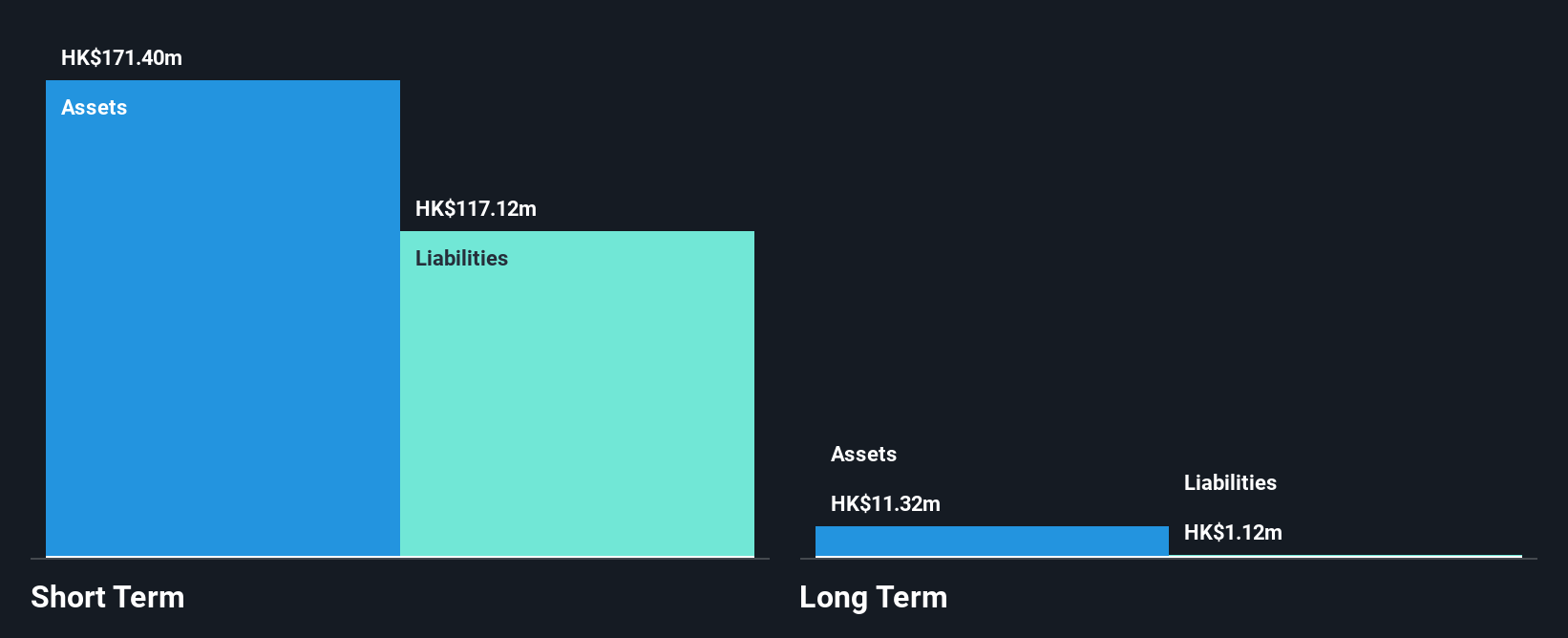

Kinetix Systems Holdings, with a market cap of HK$143.14 million, is unprofitable and has seen earnings decline by 49.1% annually over the past five years. Despite this, it trades at 76.1% below its estimated fair value and maintains a positive free cash flow with a runway exceeding three years. The company's short-term assets cover both short and long-term liabilities comfortably, indicating solid liquidity. While its debt level remains low compared to cash holdings, share price volatility persists. Management's seasoned experience offers stability amidst financial challenges in IT services across multiple regions.

- Click to explore a detailed breakdown of our findings in Kinetix Systems Holdings' financial health report.

- Gain insights into Kinetix Systems Holdings' historical outcomes by reviewing our past performance report.

Thoresen Thai Agencies (SET:TTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thoresen Thai Agencies Public Company Limited is an investment holding company that provides shipping services in Thailand and internationally, with a market cap of THB7.62 billion.

Operations: Thoresen Thai Agencies generates revenue through various segments, including Shipping (THB7.03 billion), Agrochemical (THB4.03 billion), Offshore Service (THB17.18 billion), Food and Beverage (THB2.33 billion), and Investment excluding Food and Beverage (THB1.17 billion).

Market Cap: THB7.62B

Thoresen Thai Agencies, with a market cap of THB7.62 billion, has faced challenges with declining net profit margins from 4.2% last year to 1.5% currently and negative earnings growth of -54.9%. Despite this, the company maintains a satisfactory net debt to equity ratio of 8.2%, and its short-term assets exceed both short and long-term liabilities, indicating strong liquidity. Recent corporate actions include capital restructuring through rights offerings and fixed-income offerings totaling THB800 million in debentures, reflecting strategic moves to bolster financial stability amidst fluctuating returns on equity at 2.3%.

- Unlock comprehensive insights into our analysis of Thoresen Thai Agencies stock in this financial health report.

- Review our growth performance report to gain insights into Thoresen Thai Agencies' future.

Summing It All Up

- Investigate our full lineup of 5,671 Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thoresen Thai Agencies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:TTA

Thoresen Thai Agencies

Operates as a shipping company in Asia, Africa, the United States, Europe, and Oceania.

Flawless balance sheet and good value.

Market Insights

Community Narratives