- Japan

- /

- Professional Services

- /

- TSE:9743

Global Market Highlights 3 Noteworthy Dividend Stocks

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and fluctuating trade dynamics, global markets have experienced a volatile week, with U.S. indices reversing early gains due to rising oil prices and renewed Middle East conflicts. In this uncertain environment, dividend stocks can offer investors a measure of stability through regular income streams, making them an attractive option for those seeking reliable returns amidst market turbulence.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.57% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.19% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.47% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 1559 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

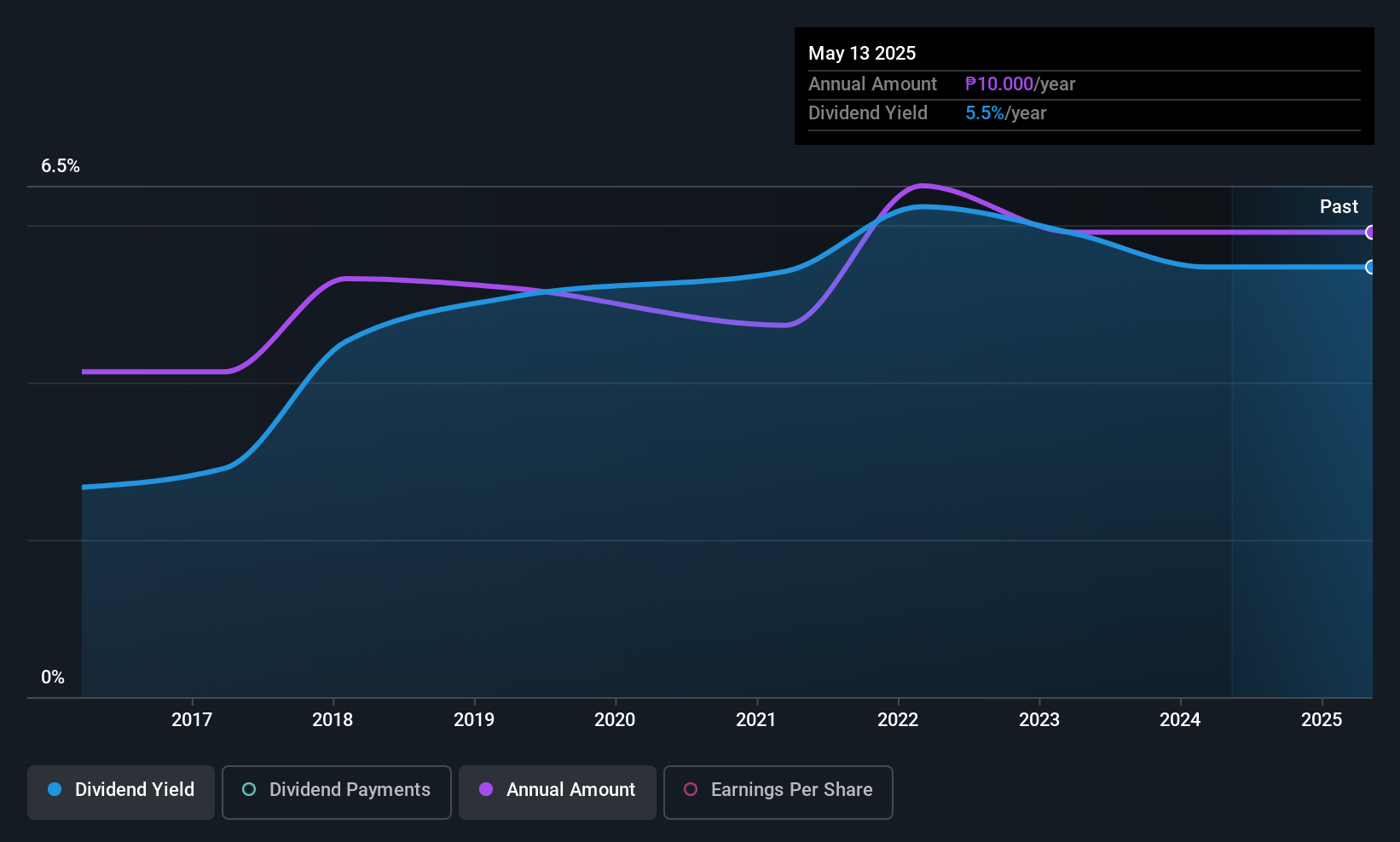

Philippine Stock Exchange (PSE:PSE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Philippine Stock Exchange, Inc., along with its subsidiaries, operates as a stock exchange in the Philippines and has a market cap of ₱16.21 billion.

Operations: The Philippine Stock Exchange, Inc. generates revenue through its operations as a stock exchange in the Philippines.

Dividend Yield: 4.9%

Philippine Stock Exchange's dividend profile is marked by volatility over the past decade, despite an overall increase in payments. The current payout ratio of 55.1% indicates dividends are covered by earnings, while a cash payout ratio of 86% shows coverage by cash flows. However, its 5.08% yield is below the market's top quartile. Recent developments include a PHP 10 per share dividend announcement and a technology partnership with Nasdaq to enhance trading infrastructure capabilities.

- Click here to discover the nuances of Philippine Stock Exchange with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Philippine Stock Exchange's share price might be too optimistic.

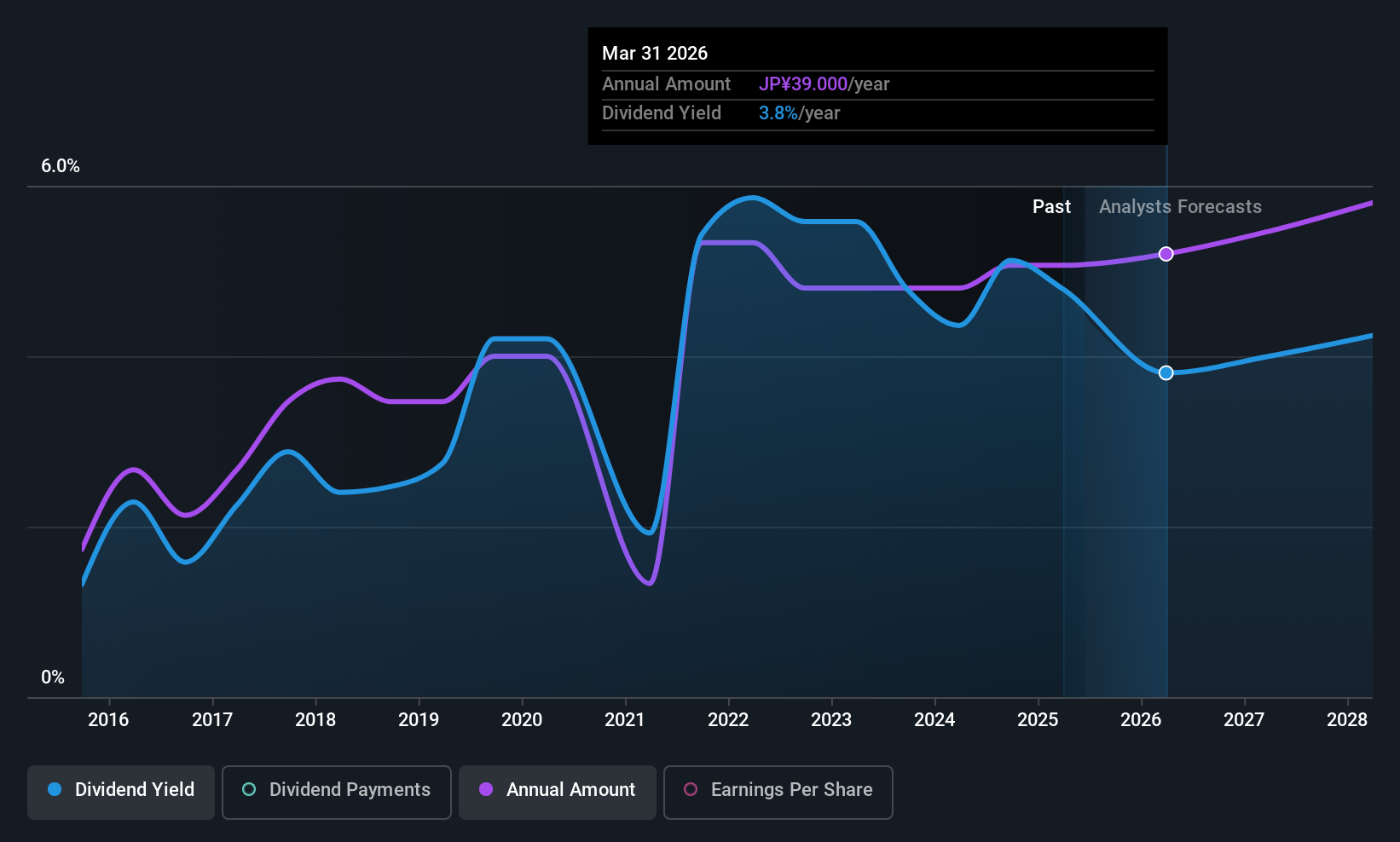

Tokyu Construction (TSE:1720)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyu Construction Co., Ltd. operates in the civil engineering and building construction sectors in Japan, with a market cap of ¥107.33 billion.

Operations: Tokyu Construction Co., Ltd.'s revenue primarily comes from its Construction Business (Civil Engineering) segment at ¥68.49 billion and its Construction - Architecture segment at ¥22 billion, with additional contributions from its Real Estate Business and Other activities totaling ¥4.98 billion.

Dividend Yield: 3.8%

Tokyu Construction's dividend payments have been volatile over the past decade, yet they show an overall increase. The company plans to pay JPY 20 per share for the fiscal year ending March 2026, up from JPY 19 previously. With a payout ratio of 60.6%, dividends are covered by earnings and cash flows, but its yield of 3.82% falls short of Japan's top quartile. Recent guidance projects stable financial performance with net sales expected at ¥338 billion.

- Take a closer look at Tokyu Construction's potential here in our dividend report.

- Our valuation report here indicates Tokyu Construction may be overvalued.

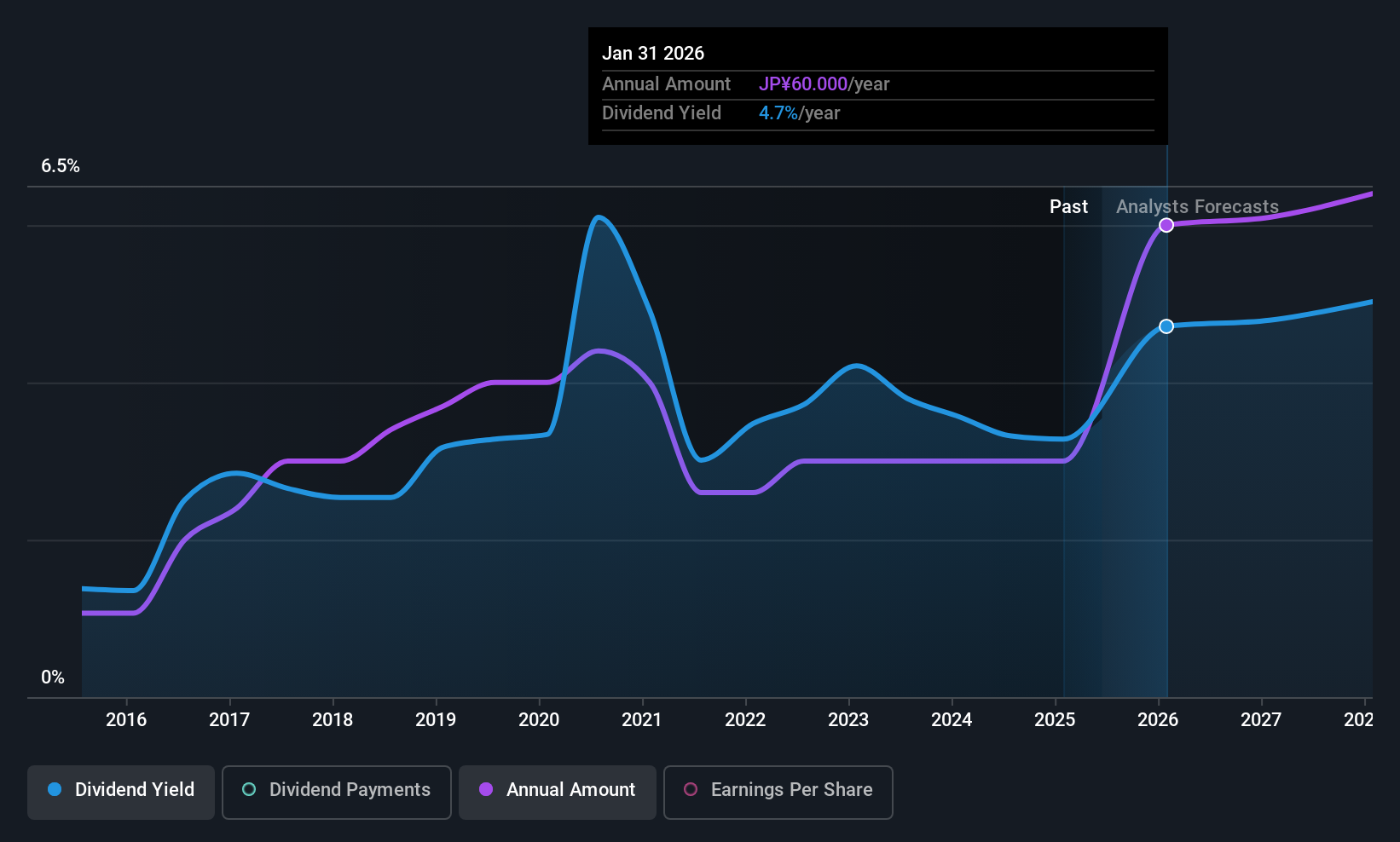

Tanseisha (TSE:9743)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tanseisha Co., Ltd. specializes in the research, planning, design, production, and operation of various commercial and cultural spaces both in Japan and internationally, with a market cap of ¥51.75 billion.

Operations: Tanseisha Co., Ltd.'s revenue is derived from its activities in designing, constructing, and managing spaces across commercial, public, hospitality, event, and cultural sectors both domestically and globally.

Dividend Yield: 4.7%

Tanseisha's dividend payments have increased recently, with a projected JPY 35 per share for the fiscal year ending January 2026. Despite this growth, dividends are not well covered by cash flows, indicated by a high cash payout ratio of 356.2%. The company has revised its earnings guidance upwards for the current fiscal year, suggesting improved financial performance. Although trading at a good value with a P/E ratio of 10.4x, past dividend reliability remains an issue due to volatility.

- Get an in-depth perspective on Tanseisha's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Tanseisha's current price could be quite moderate.

Next Steps

- Click through to start exploring the rest of the 1556 Top Global Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tanseisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9743

Tanseisha

Engages in the research, planning, design, layout, production, construction, and operation of commercial, public, hospitality, event, and business and cultural spaces in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives