- Taiwan

- /

- Professional Services

- /

- TPEX:6146

3 Asian Dividend Stocks Yielding Up To 9.6%

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with the U.S. labor market showing signs of weakness and China's economy facing a slowdown, investors are increasingly turning their attention to Asia's dividend stocks for potential stability and income. In such an environment, selecting dividend stocks that offer reliable yields can be crucial for maintaining portfolio resilience amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.95% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.66% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.85% | ★★★★★★ |

| NCD (TSE:4783) | 4.38% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| Daicel (TSE:4202) | 4.33% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.67% | ★★★★★★ |

Click here to see the full list of 1009 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

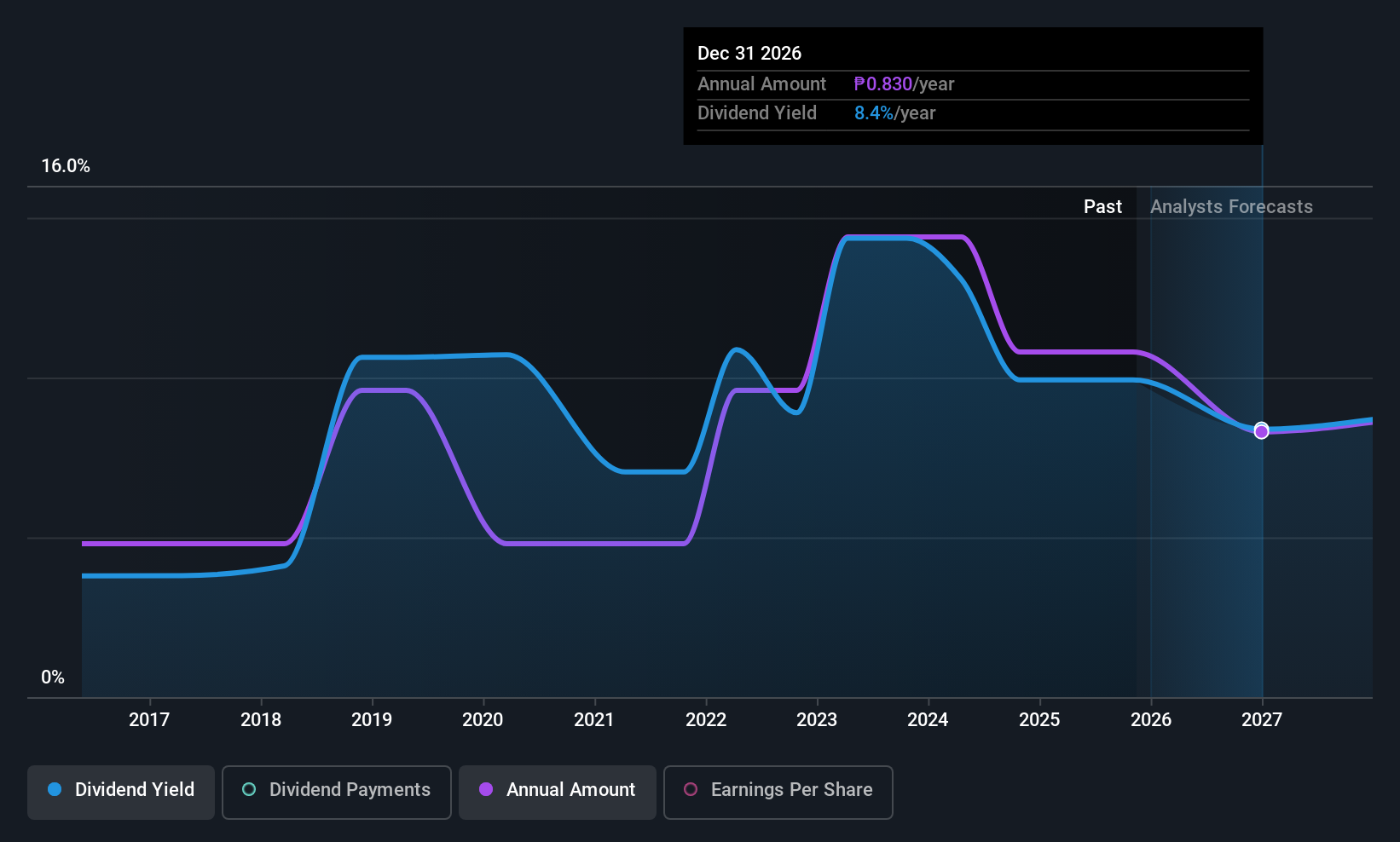

DMCI Holdings (PSE:DMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMCI Holdings, Inc. operates in general construction, coal and nickel mining, power generation, real estate development, water concession, and manufacturing both in the Philippines and internationally with a market cap of ₱148.71 billion.

Operations: DMCI Holdings, Inc. generates revenue from its various segments including DMCI Homes at ₱16.07 billion and Nickel Mining at ₱4.04 billion.

Dividend Yield: 9.6%

DMCI Holdings offers a high dividend yield of 9.64%, ranking in the top 25% of Philippine market dividend payers, with dividends well-covered by earnings and cash flows due to a low payout ratio (27.4%). However, its dividend history is marked by volatility and unreliability over the past decade. Recent expansion in mining operations through Berong Nickel Corporation could enhance future cash flows, potentially stabilizing dividends despite recent earnings declines.

- Unlock comprehensive insights into our analysis of DMCI Holdings stock in this dividend report.

- Our valuation report here indicates DMCI Holdings may be undervalued.

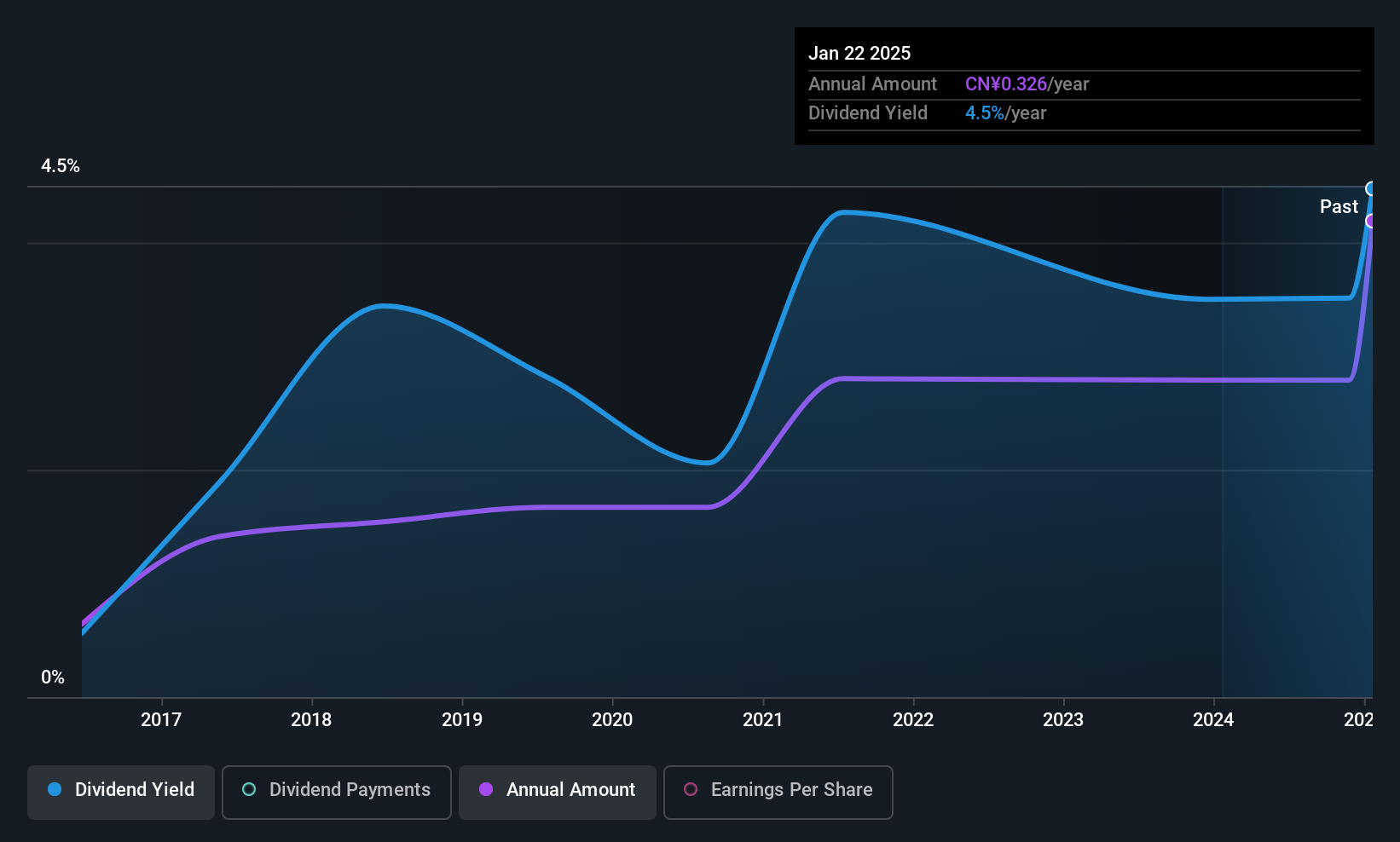

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the mould and plastic manufacturing industry, with a market cap of CN¥9.28 billion.

Operations: Jiangnan Mould & Plastic Technology Co., Ltd. generates its revenue from the mould and plastic manufacturing industry.

Dividend Yield: 4.3%

Jiangnan Mould & Plastic Technology's dividend yield of 4.29% places it in the top 25% of CN market payers, supported by a low payout ratio (35.5%) and covered by cash flows (61.5%). Despite this, its dividend history has been unstable over the past decade with significant annual drops. Recent earnings show a decline, with net income at CNY 293.33 million for H1 2025 compared to CNY 358.22 million last year, impacting future dividend reliability.

- Click here to discover the nuances of Jiangnan Mould & Plastic Technology with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Jiangnan Mould & Plastic Technology shares in the market.

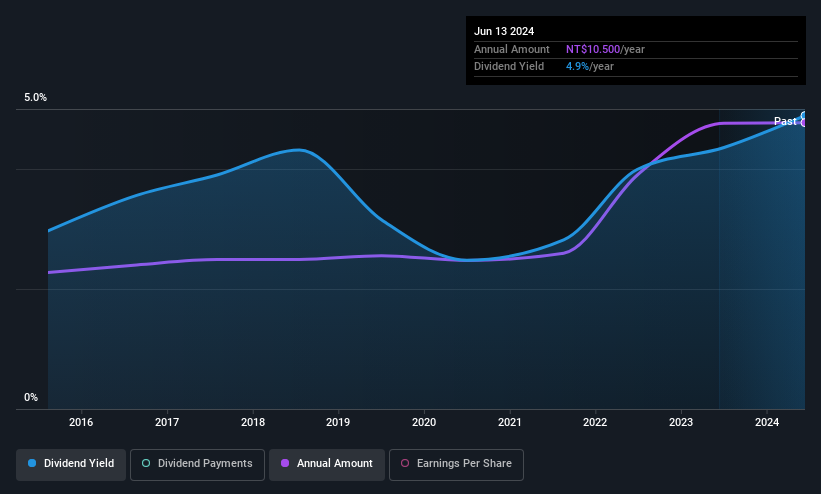

Sporton International (TPEX:6146)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Sporton International Inc. offers product testing and certification services both in Taiwan and internationally, with a market cap of NT$19.35 billion.

Operations: Sporton International Inc. generates revenue primarily from its testing, certification, and verification services segment, which accounts for NT$3.94 billion, and the parts division, contributing NT$547.82 million.

Dividend Yield: 5.3%

Sporton International offers a high dividend yield of 5.32%, ranking in the top 25% within the Taiwan market. Its dividends have been stable and growing over the past decade, supported by an earnings payout ratio of 88.6% and a cash payout ratio of 70.4%. Despite recent declines in net income to TWD 259.48 million for Q2 2025, its dividend payments remain covered by both earnings and cash flows, suggesting ongoing reliability for investors seeking income stability.

- Get an in-depth perspective on Sporton International's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Sporton International's current price could be inflated.

Next Steps

- Delve into our full catalog of 1009 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6146

Sporton International

Provides product testing and certification services in Taiwan and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives